Red tape strangles projects and jobs

More than 30 mining projects valued at almost $13bn remain stuck in the NSW planning process, amid a rise in proposals for non-coal mines.

More than 30 mining projects valued at almost $13bn remain stuck in the NSW planning process, amid a rise in proposals for non-coal mines including gold, silver, nickel, cobalt and scandium.

Despite coal remaining the state’s top export – worth about $16bn this year – planning for non-coal mine projects has reached its highest level in more than a decade.

NSW Minerals Council data, analysing the potential economic benefits of all major mining projects in the planning system, reveals metals projects would deliver $7bn in investment and more than 6000 new jobs in NSW’s central west and far west.

Demand for NSW coal has remained strong through the pandemic, with established markets Japan, South Korea, Taiwan, and emerging markets in India, Vietnam and The Philippines helping plug the gap after China effectively banned Australian coal.

With coal exports expected to remain strong for at least another 20 years and commodity prices at high levels, there has been a renewed push to expand existing operations with $5.5bn of planned investment in the pipeline.

The number of coal projects decreased from 21 to 19 this year after the withdrawal of some projects and the refusal of the Dendrobium project by the NSW Independent Planning Commission.

NSW Minerals Council chief executive Stephen Galilee said the 32 mining projects were “shovel-ready” and should be backed to help drive the post-pandemic economic recovery.

“There is growing demand for our high-quality metals and rare earths. Technological advances in industries such as telecommunications, medicine, defence, renewables, and energy storage are driving demand for critical metals and minerals,” he said.

“As NSW continues to be gripped by the effects of Covid-19, and we look to rebuild the economy, there has never been a more critical time to maximise the opportunities this pipeline of job-generating projects represents.”

The council’s research indicated the projects would help create or maintain more than 17,500 direct construction and operations jobs, along with “tens of thousands more jobs in businesses that support the mine”.

Royalties from 23 of the 32 projects would deliver more than $4bn in royalties.

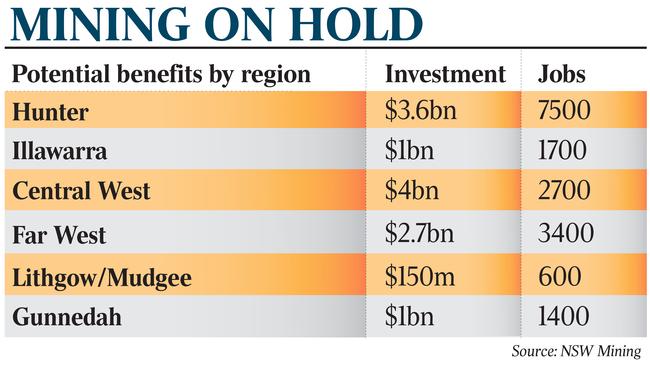

A snapshot of regional benefits showed more than $3.6bn in capital investment and 7500 jobs in the Hunter region, more than $4bn and 2700 jobs in the central west and in excess of $2.7bn and almost 3400 jobs in the central west.

The biggest mining proposals include the Dubbo zirconia, Wallarah 2 coal, Hume coal and Hawsons iron ore projects.

The minerals council research said “if these projects obtain their necessary planning approvals and are able to proceed, they will collectively deliver significant capital investment and create or maintain thousands of jobs across NSW over the next 20 years or more”.

“The number of metals projects increased to 13 in 2021, up from 11 in 2020.

This is a further increase on the findings of the previous report and underscores the strong interest in further investment in metals in NSW,” the Resources for Recovery report said.

“Coal projects currently in the pipeline continue to represent a significant economic opportunity for NSW both now and into the future.

“[They will] potentially contribute over $5.5bn in capital investment and almost 11,000 jobs over the next 20 years or more.”

A spokeswoman for the NSW Department of Planning claimed “there are no mining applications stuck in the system”.

“Seventy-five per cent of mining applications are currently with the applicants for further action. There are 12 mining projects where the Department is still waiting for an application to be lodged. On average, the Department has been waiting for more than two years for these applications,” the spokeswoman said.

“There are also five mining projects that have been approved and have not yet been built. The planning system is helping keep the economy going and we’ve made a number of reforms to speed it up, without weakening our rigorous assessment requirements.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout