Record debt ‘is price of saving jobs, economy’, says Mathias Cormann

Mathias Cormann has said the COVID-19 crisis meant there was no choice but to blow out Australia’s debt and deficits to post-war highs

Finance Minister Mathias Cormann has said a legacy of massive debt that could take decades to pay back is the necessary cost of saving 700,000 jobs and the economy tens of billions of dollars through the COVID-19 crisis.

Thursday’s Economic and Fiscal Update confirmed that commonwealth debt would surge from $540bn as at June 2019 to a postwar record of $852bn — or 45 per cent of GDP — by the middle of next year.

Following the update, modelling from PwC suggested the budget would not be balanced until 2040, and net debt would not be reduced to zero until 2060.

Senator Cormann batted away repeated questions around how long it would take to pay down the debt accrued to pay for COVID-related deficits.

“In the circumstances, what was the alternative?” he said. “Are you suggesting that we shouldn’t have provided the support we did to boost our health system, to protect jobs, to protect livelihoods?”

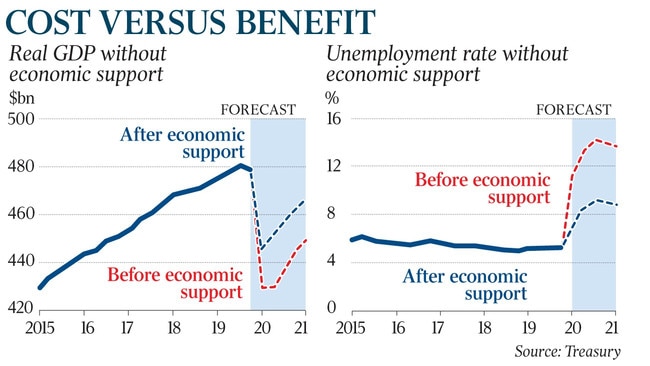

Treasury estimates that the government’s economic support measures in response to the health crisis — including $164bn in direct stimulus spending — has lifted the level of real GDP by about 0.75 per cent in 2019-20, and will add another 4.5 per cent in 2020-21.

Its analysis suggests that without this support the economy would have contracted by 7 per cent in this financial year, versus the forecast 2.5 per cent decline.

Moreover, the December peak in unemployment of 9.25 per cent would have been around five percentage points higher, or above 14 per cent.

Josh Frydenberg on Thursday said the government’s historic intervention in the labour market via such measures as the JobKeeper wage subsidy would save 700,000 jobs.

Treasury’s new fiscal projections show net debt will nearly double from $374bn in June 2019 to $677bn two years later, and from 19 per cent of GDP to 36 per cent.

Despite the massive boost to debt and deficits, global ratings agencies Moody’s and Standard & Poor’s quickly reaffirmed Australia’s AAA credit rating.

Moody’s lead country analyst Martin Petch said he expected the country’s coveted top rating to be “resilient”.

“In particular, we expect the process of fiscal repair will begin in 2021 as the economy recovers and financing costs remain low,” Mr Petch said.

Before the health crisis, the Morrison government in its December mid-year budget update had projected net debt to have dwindled to almost zero by 2030.

That time frame will be significantly extended in line with the increase in net debt through this and the past financial years.

The task of paying down debt will likely be further complicated by an uncertain post-COVID recovery in coming years.

“Clearly now with what we’ve had to decide, the decisions we had to make, it will take somewhat longer” to drive net debt levels to zero, Senator Cormann said, as he flagged more details would be available in the October budget’s medium-term forecasts.

“The way to get on top of this debt is by growing the economy more strongly and creating more opportunity for Australians to get ahead, get into jobs — better-paying jobs — and get ahead.

“Stronger growth leads to more revenue and lower welfare payments.”

The Treasurer said the cost of servicing the debt had not increased proportionally with the additional level of borrowing due to record low interest rates.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout