Recession fears as Covid-19 lockdowns bite bottom line

The Morrison government could face the daunting prospect of pulling the nation out of its second official recession in as many years if the national accounts confirm a contraction.

The Morrison government could face the daunting prospect of pulling the nation out of its second official recession in as many years if Wednesday’s national accounts confirm that the economy contracted in the three months to June.

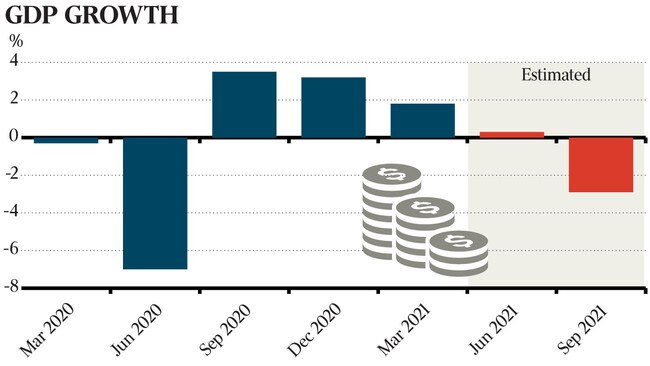

Economists on average estimate growth slowed from 1.8 per cent to 0.3 per cent in the June quarter, according to a survey conducted by The Australian, ahead of a contraction expected to be 10 times as large in the September quarter.

They also warned there remained a risk that GDP may have actually declined in the second quarter, as intermittent lockdowns across the nation restricted activity.

Westpac senior economist Andrew Hanlan downgraded his June quarter growth estimate from 0.5 per cent to 0.1 per cent, after Australian Bureau of Statistics figures showed a fall in export volumes – particularly for key commodities such as iron ore after bad weather and forced maintenance crimped shipments – would subtract a “chunky” one percentage point from real GDP growth.

He also said there was a “clear risk” the economy had contracted over the three months to June.

Josh Frydenberg in parliament on Tuesday flagged a subdued national accounts release, noting there had been lockdowns somewhere in the country in 29 days during the quarter.

“No matter what the result is tomorrow (Wednesday), the exact number, it doesn’t change the fact that today our economy faces some significant challenges,” the Treasurer said.

The anticipated rapid economic deceleration comes despite a surge in jobs growth between March and June that helped drive unemployment down to 4.9 per cent (it fell to 4.6 per cent in July).

CBA head of Australian economics Gareth Aird said “stay at home orders reconcile the difference”. Mr Aird, who forecast the economy expanded by 0.3 per cent in the June quarter before likely collapsing 4.5 per cent in the next, said policymakers would “be desperate to avoid a negative GDP print because it would rubber-stamp that the Australian economy is in recession”.

“The difference, however, between a small positive or small negative growth rate is simply optics,” he said. “The Australian economy is currently in a manufactured recession as we go through another huge negative shock.”

Private sector economists estimate the Delta lockdowns will push GDP down by between 1.5 per cent and 4.5 per cent in the September quarter, although Reserve Bank of Australia forecasts are for a contraction at the lower end of that range.

While real GDP growth is expected to be subdued in the most recent quarter, nominal growth should reach more than 2 per cent, economists said, with strong employment growth and booming commodity prices set to boost government coffers ahead of the anticipated budget blowout as a result of Delta lockdowns.

ABS data on Tuesday showed the country had now produced nine consecutive quarters of current account surpluses, further eclipsing the previous longest stretch of seven quarters between June 1972 and December 1975.

Australia’s current account surplus hit another record high in the June quarter, lifting $1.5bn over the three months to $20.5bn.

Soaring iron ore prices in the quarter drove a record metal ores and minerals export value of $53.3bn, the ABS said.

Public sector spending data, also released on Tuesday, showed the government was likely to add 0.7 percentage points to growth in the June quarter, which Citi chief economist Josh Williamson said would be the largest contribution since 2013.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout