Queensland public servants’ super at risk of deficit

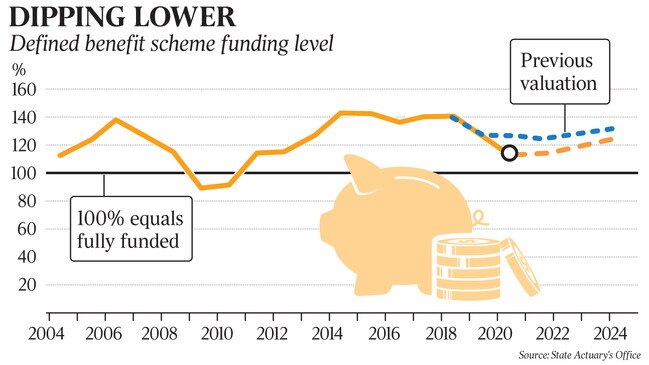

Queensland’s public service superannuation fund hit hard by COVID-19 and Treasurer’s debt-reduction scheme.

Queensland’s public service superannuation fund has been hit hard by COVID-19 and Treasurer Cameron Dick’s debt-reduction scheme, and has a near-50 per cent chance of plunging into deficit any year in the next four.

The state has the only fully funded bureaucrat super fund in the country, but an investigation reveals the fund’s surplus has dived from $7.3bn in mid-2019 to $3.6bn at June 30 this year.

On some measures — including the accounting basis that the government uses in its budget papers — the fund has an accrued deficit of $2.8bn and an actuarial deficit of $6bn.

State Actuary Wayne Cannon said the Queensland fund’s position still “compares extremely favourably with other governments in Australia” and any risk of the fund falling into deficit would be borne by the state government, rather than public servants.

“It is important to note that the risk of fund deficiency falls upon the state, with the legislative guarantee protecting member entitlements and so the effects of a deficit on the security of members’ entitlements are insignificant compared to similar funds in the private sector,” Mr Cannon said in his actuarial investigation report.

If there is a shortfall or deficit, the government will be forced to find extra cash or borrow more to ensure bureaucrats’ retirement payouts are preserved.

Mr Cannon’s report finds that the probability of the fund falling into deficit “in any year of the budget period up to 2024 has been estimated to be 46 per cent, or around one in two”.

He said Mr Dick’s announced transfer of $1bn to the Queensland Future Fund — set up to pay down the state’s debt — meant the super fund’s position had “obviously declined” compared with last year but remained strong.

Mr Dick’s December budget forecast Queensland’s total government debt would reach $130bn by 2023-24, $28bn more than the $102bn by mid-2021 forecast in September.

Ahead of the October 31 state election, the Treasurer announced an extra $4bn in debt would be used to pay for election promises.

The Palaszczuk government has for years “repatriated” part of the surplus of the super fund in an effort to pay down debt.

In his report, Mr Cannon notes that any repatriation will likely eventually have to be countered by the government paying more in employer contributions. “Consequently, employer contributions and surplus repatriations are simply two sides of the same coin, linked by the fact that higher repatriations at any point in time increase the likelihood of greater contributions in future; i.e. there is an effective trade-off between them with the material difference being one of timing,” he said.

He recommends the state meet 96 per cent of defined benefit payments this year (92 per cent last year), with the increase due to poorer investment returns.

Mr Cannon said this year’s surplus was lower in part because the investment returns over the past year were lower and public servant salaries had grown by more than previously forecast.

Mr Dick said the fund’s accrued surplus of $3.6bn at the end of June was a larger balance then when the Queensland Future Fund was originally proposed by his predecessor, Jackie Trad.

“This report also demonstrates, under the Palaszczuk government, Queensland is the only state in Australia with a fully funded defined benefit superannuation liability, as well as having much lower debt than NSW and Victoria, and lower state taxes,” he said.

“In their recent budget, the Berejiklian government delayed their plans to fully fund the NSW superannuation liability by another decade to 2040, at the same time as increasing debt levels well beyond the level of Queensland.”

Delivering the budget, Mr Dick said Queensland’s total debt of $129.7bn by 2023-24 “pales beside” forecasts posted by NSW ($190bn) and Victoria ($192bn).

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout