Push to relax foreign investment barriers

New ‘call-in’ powers allowing the Treasurer to review investments should be scrapped for sectors that do not pose a risk to national security, claims MCA.

Australia’s foreign investment regime should be simplified and new “call-in” powers allowing the Treasurer to review investments at any time scrapped for sectors that do not pose a risk to national security, the Minerals Council of Australia has claimed.

In a submission to a parliamentary inquiry into the COVID-19 pandemic, the MCA warns the health crisis has led to an “acceleration of pre-existing trends towards nationalism, protectionism and an unwinding of the multilateral trade rules at a regional and global level”.

It also sounds a warning on barriers to foreign investment, saying they “negatively impact equity and debt markets, undermine job creation and cripple economic recovery.”

“Any reform that constrains foreign investment on national security grounds should be balanced with a simplified, transparent and streamlined foreign investment approvals process that excludes non-sensitive sectors and minimises sovereign risk,” the council argues.

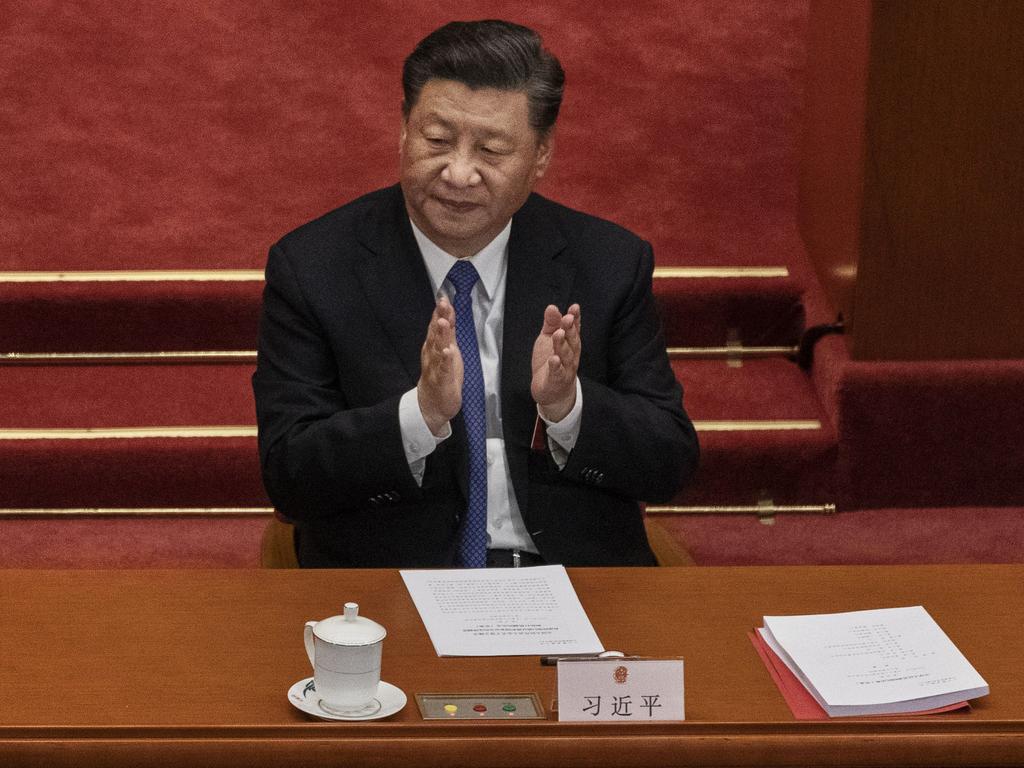

In March, Josh Frydenberg temporarily cut the screening threshold that triggers intervention by the Foreign Investment Review Board from $1.2bn to zero amid fears countries such as China would swoop on companies that were weakened by the COVID-19 lockdowns.

The move means that all asset purchases from overseas interests will require FIRB approval in a bid to crack down on “predatory behaviour” from opportunistic international raiders.

In June, the government went on to announce a major change to the foreign investment framework, including a new national security test for all foreign investors seeking to acquire an interest in a “sensitive national security business”, regardless of the value of the investment.

A new “call-in” power would also enable the Treasurer to review all acquisitions that raised national security risks — before during or after the investment — even if the acquisition did not initially raise national security concerns. Once “called in”, the national security test would then be applied.

MCA chief executive Tania Constable told The Australian the foreign investment regime should “ensure certainty and predictability for investors in sectors that do not present a national security risk, such as minerals”.

“For example, where there is no national security concern, the sovereign risk to potential investors presented by the regime, including by its calling-in power, should be removed, potentially through the provision of an exemption certificate,” she said.

Last year, resources exports totalled $289bn — more than half Australia’s entire export revenue — and the MCA argues that trade liberalisation has, over the past 35 years, increased the income of the average Australian family by about $8448 a year.

It also argues for a range of measures to increase Australia’s attractiveness as a destination for foreign investment, including a reduction in the corporate tax rate, the streamlining of approvals, a lowering of energy costs and a shake-up of the industrial relations system.

The MCA stresses it is vital the nation can access foreign capital to develop its industries.