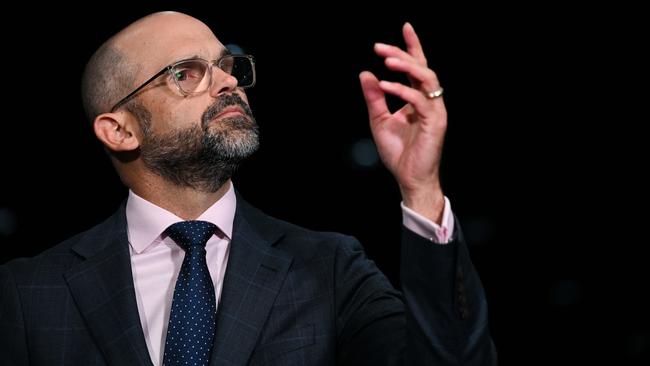

Queensland Premier David Crisafulli recommits to debt reduction pledge

Premier David Crisafulli has promised to reduce Queensland’s escalating debt without cuts while promising a record infrastructure, health and tourism spend.

Queensland Premier David Crisafulli has promised to reduce the state’s escalating debt two weeks before his government delivers its first budget.

The Liberal National government has refused to outline how it will tackle the debt challenge while balancing a promised “record spend” on infrastructure, health and tourism and keeping to its commitment to retain public service jobs.

Queensland's debt figure for the financial year sits at $128.1bn, according to the February mid-year economic and financial review, and is expected to hit $217.8bn by the 2027-28.

Mr Crisafulli has repeatedly said his government would “respect taxpayer money” and deliver value for Queenslanders since last year’s state election, which he reiterated again on Sunday ahead of the June 24 budget.

“Our first budget will do a couple of things,” he said. “One is it will restore service delivery for this state. It will respect taxpayers’ money, and the good news for Queensland is debt will be lower.”

However, with weaker coal prices resulting in lower royalties, a cut in GST and a rising public service wage bill as enterprise bargaining negotiations continue with the 260,000-strong workforce, economists say the government will face significant budget hurdles.

In May, Under-Treasurer Paul Williams sent a letter to directors-general ordering them to stay within their “funding envelopes” and find equivalent savings for any new policies or programs that were pitched.

It followed Treasurer David Janetzki revealing a $45.84bn budget blowout over the next four years in its February MYEFR. At the time, he acknowledged that achieving a surplus would be a “serious challenge” but ruled out cuts to the public service, asset sales or increased taxes.

Independent economist Saul Eslake said he was cautious about the latest figures of the state’s accounts, which may have been inflated to fit a political narrative, echoing ratings agency S&P Global.

Mr Eslake said the Queensland government may have painted itself into a corner when it came to finding savings. “They’re cutting off all of the obvious avenues for doing something about it,” he said.

“I suppose there are three possibilities. One, they’re going to break some of those promises but bearing in mind what happened to Campbell Newman, that’s probably unlikely. No 2 will be that they … say we’re going to grow our way out of this debt without actually doing anything nasty. The third possibility, I suppose, is that they’re actually just not going to do anything and hope the problem goes away.

“I suspect they’re not going to do that. So that leaves you the middle option.

“Unless Janetzki is prepared to do some combination of raising taxes, cutting OpEX (operating expenditure), cutting Capex (capital expenditure), or selling assets, the problem is not going away.”

Former commonwealth Treasury economist and director of Adept Economics Gene Tunny said the obvious money saver for the government would be to defer infrastructure projects and look to establish more public-private partnerships with the business sector, as is occurring with the 2032 Olympic delivery.

“It’s going to be a tough budget,” Mr Tunny said.

“I doubt he (Mr Janetzki) is going to be able to pull a rabbit out of the hat … or find savings sufficient to say we’ll have all of these surpluses. But what they’ll have to do is to show that they’ve got some plan to get the budget back to surplus over a few years and really tell a convincing narrative around that.”

Both economists agreed that the Crisafulli government’s decision to commit to Labor’s 50c public transport fares, which has now been locked in until 2028, will drag on its budget-balancing aspirations.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout