Plibersek homebuyer scare tactic is inflated

Labor’s campaign over investors buying their ‘30th property’ has been vastly overstated.

Tanya Plibersek’s fear campaign suggesting first-home buyers need to be shielded from investors buying their “30th investment property” has been vastly overstated, with 90 per cent of Australians who negatively gear owning no more than two properties.

The deputy Labor leader, who owns four properties, including one in Slovenia, yesterday justified Labor’s housing policy by warning that first-home buyers were subsidising investors who had portfolios of 10, 20 and 30 properties.

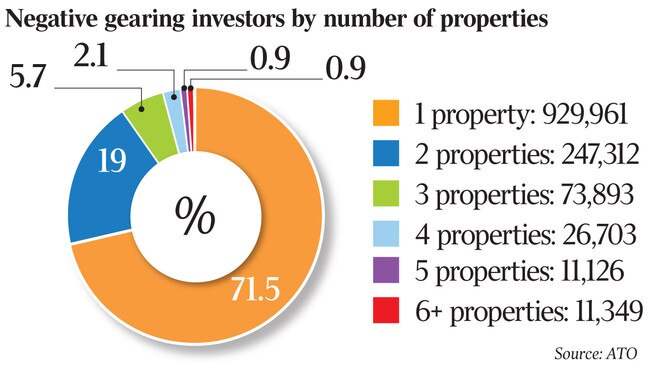

According to the Australian Taxation Office, fewer than 1 per cent of the nation’s 1.3 million negatively geared investors own six properties or more, compared to 71.5 per cent who own just one investment property.

Nineteen per cent of negatively geared investors own two properties, while 5.7 per cent own three and 2.1 per cent own four.

“What we really need to do to help first-home buyers into the housing market is stop subsidising people buying their 10th or 20th investment property to compete with first-home buyers at every auction that they’re attending,” Ms Plibersek said. “Helping people buy their 10th or, you know, 30th investment property is not as important as making sure that first-home buyers have a level playing field.”

Ms Plibersek is among 20 Labor frontbenchers who own investment property that will be still able to be negatively geared if Labor’s crackdown is introduced in January next year, given the policy is grandfathered.

Labor’s biggest property moguls include communications spokeswoman Michelle Rowland, who owns six properties with her husband, including several owned through a family trust; and mental health spokeswoman Deb O’Neill, who lists six properties owned jointly with her husband.

Legal affairs spokesman Mark Dreyfus has a primary residence in the Melbourne suburb of Malvern — outside his electorate — and declares investment properties in South Yarra, Camberwell and Airey’s Inlet, owned by him or his wife.

Ms Plibersek yesterday also contradicted Treasury spokesman Chris Bowen, who played down concerns about homeowners falling into negative equity because they would “only lose money if you sell”.

Ms Plibersek, conversely, said falling into negative equity — when the value of the loan is worth more than the property — was “obviously not a good thing”.

“It’s obviously not desirable and I don’t think anybody would say it’s a good thing,” she said.

“If you hold on to your property and it recovers in value, that’s a different proposition, but obviously it’s not a good thing for anyone to owe more than their property is worth. And you would seek to avoid that.”

Under Labor, only newly built properties could be negatively geared, though existing property investments would be grandfathered, while the capital gains tax discount would also be halved to 25 per cent. Labor has also pledged to match Scott Morrison’s plan to act as guarantor to allow 10,000 first-home buyers to purchase homes with a 5 per cent deposit rather than 20 per cent.

Grattan Institute director Danielle Wood said bringing in both policies would slightly increase the risk of homeowners falling into negative equity.

“It slightly increases the risk but it is pretty small,” Ms Wood said.

“Negative equity is not a good place to be because you are exposed,” Ms Wood said.

“So if you lose your job or you for some reason take a hit to income and you can’t service the loan and you have to sell then you are left with a debt. So clearly it is not a great outcome from the homebuyer’s perspective.”

The Prime Minister yesterday upped his attack over the negative gearing policy by declaring it would undermine values in a softening property market.

“They have made the case for it in times past, when housing prices were growing at double-digit rates. That’s not happening now. The justification for why they put this forward in the past is not there,” Mr Morrison said.

“The risk of Labor’s housing tax is now with the market having softened, to further undermine values does run the risk of a concrete landing in the housing market that would erode consumer confidence and lead to a slowing in the growth of the economy. That’s why it’s just such a bad idea.”

Bill Shorten attacked “vested interests” in the property sector who were waging a “scare campaign” against his policy.

“Our political opponents stand where they always have: against change, against progress and as servants to the same vested interests,” the Opposition Leader said.

“With those real estate agents sponsoring scare campaigns to defend their commissions.”

Housing Industry Association managing director Graham Wolfe said Labor’s negative gearing policy would force homebuyers into negative equity.

“Those who are looking to buy right now would be worried about negative equity because there will be fewer people out there looking to buy because investors are going to get out of the market more so than what they are,” he said.

Master Builders Association chief executive Denita Wawn said Labor’s housing policies would exacerbate the downturn in the property market. “Some of our members are seeing decreases of anywhere between 25 to 30 per cent in sales over the last quarter alone,” Ms Wawn said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout