Pay rises to go if stage-three tax cut gets the axe

Middle-income Australians would be forced to hand back about 50 per cent of any pay rises earned over the next two years if Labor opts to scrap the stage-three tax cuts.

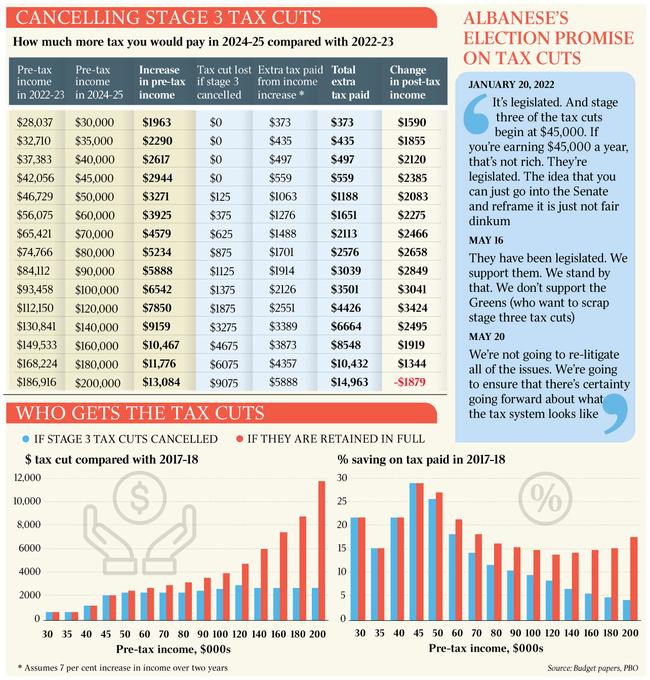

Middle-income Australians would be forced to hand back about 50 per cent of any pay rises earned over the next two years through higher taxes and “incentive killer” bracket creep if Labor opts to scrap the stage-three tax cuts scheduled for 2024-25.

Analysis by The Weekend Australian shows that dumping stage three would see workers on incomes of $90,000 or above lose at least half of their salary increases and bonuses over the next two years, assuming their pay packets increased 7 per cent by the 2024-25 financial year.

Under a scenario where stage three is dropped, a taxpayer who increased their pay from $112,150 to $120,000 by 2024-25 would lose $1875 in income tax cuts and pay an additional $2551 in tax due to the increase in their income. The extra $4426 in tax would claim more than half of the worker’s increased wages.

A worker who increased their income from $149,533 to $160,000 would pay an extra $8548 in tax and lose 80 per cent of their additional earnings compared with the situation if the tax cuts proceeded.

Anthony Albanese and Jim Chalmers said on Friday they had not dumped Labor’s election commitment on tax cuts for middle-to-high income earners but warned that fiscal and monetary policy must be balanced in response to global economic downturns and soaring inflation.

They have repeatedly refused to rule out changes to stage three, which would see the abolition of the 37 per cent tax bracket and shift towards a flat rate of 30 per cent for Australians earning between $45,000 and $200,000 from July 2024. The top 45 per cent bracket would start from $200,000, meaning that about 94 per cent of workers would pay no more than a marginal rate of 30c in the dollar.

In a speech to the Western Sydney Leadership Dialogue on Friday, the Prime Minister said: “We are prepared to make difficult decisions. Right now, advanced economies are seeing the steepest and most synchronised global monetary policy tightening in decades.

“This only reinforces how important it is for fiscal policy to complement monetary policy – so as not to provide an incentive for monetary policy to be even more contractionary.”

Mr Albanese said the fastest and highest tightening of monetary policy in decades was feeding into “budget deliberations”.

Ahead of the October 25 budget, Mr Albanese and Dr Chalmers are understood to be considering options to trim stage three, which would lock in tax relief for low-to-middle income earners but ensure those on higher salaries were still better off.

Dr Chalmers, who is travelling to Washington on Tuesday for a series of high-level meetings including with US Federal Reserve chair Jerome Powell, said he was focused on cost-of-living relief for Australians on low to middle incomes.

“When it comes to the tax cuts, I think we’ve made the obvious point that when it comes to cost-of-living relief it should be targeted to people on low and middle incomes,” Dr Chalmers said.

Business Council of Australia chief executive Jennifer Westacott urged Mr Albanese and Dr Chalmers to “stay the course on reform that will leave Australians better off”.

“We want wages to grow and we want workers to keep more of their own money,” Ms Westacott said. “This is just one piece of a comprehensive, staged reform package that started some years ago with low-and-middle income earners and paves the way to a simpler, progressive system and deals with incentive sapping bracket creep.”

Parliamentary Budget Office analysis warns that if tax rates and thresholds are left unchanged over the coming years, bracket creep would make the tax system less progressive and heap pressure on middle-income earners. Analysis released by PBO director Cameron Chisholm this year warned that the impact of bracket creep would exceed the cost of stage three after four years.

Ms Westacott said bracket creep was “an insidious incentive killer that punishes workers by stealth when inflation goes up or they pick up more hours, get a better job or just for getting ahead”.

“There’s nothing fair about letting people drift into higher income tax brackets and losing more of their pay packet,” she said.

Peter Dutton said Mr Albanese, before the election, “looked the Australian public in the eye and gave them a solemn promise” on stage three tax cuts, which have been estimated to cost the budget $243bn over nine years.

“That is that people on incomes of $45,000 to $200,000 would pay no more than 30c in the dollar,” the Opposition Leader said.

“That is a big win for families who are struggling to pay their power prices, their gas bills, their fuel when they stop at the bowser, when they go to the supermarket, their cost-of-living pressure goes up and up and up every day, and they were relying on this Prime Minister.”

Speaking in Brisbane, Dr Chalmers said the budget’s cost-of-living measures and investment in cheaper childcare, medicines and education must deliver an economic dividend.

“We will put a premium on what’s responsible, what’s affordable, what’s sustainable, and what’s targeted and relevant to the economic conditions that we confront. I think Australians expect that from us,” he said.

Dr Chalmers, who has led the debate over a possible reconsideration of stage three given fiscal and monetary policy settings, said the government’s position on stage three had not changed. But he warned that spending in the budget needed to be “defensible on economic grounds”.

“What I’ve tried to do is to level with the Australian people about the complex combination of challenges that we confront,” he said.

“I think Australians are really smart and they understand that the global economy is in a dangerous place.”

Institute of Public Affairs deputy executive director Daniel Wild warned that a worker on $120,000 would be $1875 worse off each year if stage three was scrapped, which is the equivalent of a typical family’s electricity bill.

“The fastest way to boost wages is to cut taxes, which will spur economic growth through more spending and business investment, delivering benefits to the entire community,” he said.

The Australian on Friday revealed Mr Albanese would likely win support from the Greens, Jacqui Lambie and David Pocock to legislate changes to stage three.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout