Parliamentary Budget Office warns of surplus tightrope

Planned budget surpluses depend on unprecedented spending restraint, ever rising income tax and ‘above trend’ economic conditions.

The government’s planned budget surpluses depend on unprecedented expenditure restraint, ever rising income tax and “above trend” economic conditions for the next decade, according to parliament’s independent budget watchdog.

Bracket creep will see the federal income tax haul climb by more than any other revenue source over the next decade, rising from 11.5 to 12 per cent of GDP, the highest share in more than a decade, when it will make up 47 per cent of government receipts.

“Even with the (government’s) tax cuts, average tax rates are projected to continue to increase with growth in incomes, particularly for low- to middle-income groups (those with a taxable income in the range of $20,000 to $58,000),” the Parliamentary Budget Office said in its annual projection of taxes and expenses over a decade.

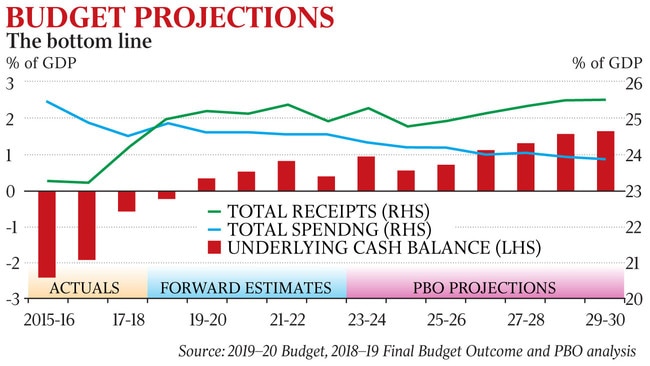

Without further changes to policy, government tax receipts will climb to a record 25.7 per cent of GDP, while total spending is set to fall steadily to 23.9 per cent of GDP, leaving a projected $54bn surplus.

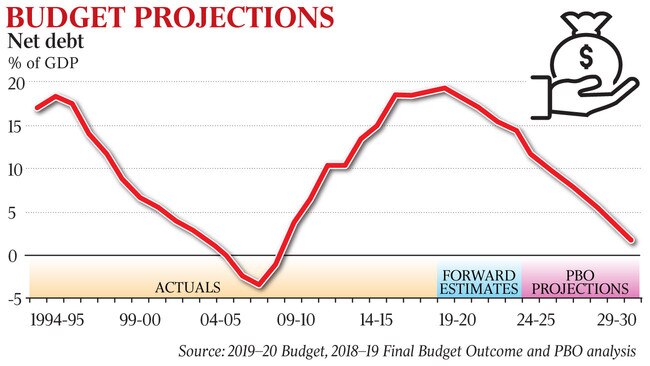

The PBO said “spending restraint” and falling interest payments on government debt explained most of the decline.

“The projected surpluses over the medium term are predicated on above-trend economic growth for much of the period and a return to close-to-trend wages growth by the end of 2022-23,” it said.

The biggest projected contributions to expenditure growth, after stripping out inflation, were defence spending, on track to rise almost 4 per cent a year in real terms for a decade, and the national disability insurance scheme, slated for yearly 7.2 per cent rises. Average annual growth in spending per person, adjusted for inflation, which exceeded 3 per cent a year from 2008 to 2012 and dropped below zero between 2013 and 2018, is projected to remain below 1 per cent until 2030.

“We have worked very hard over the past six years to repair the budget; controlling expenditure growth has demonstrably been a key driver in getting the budget back into balance,” Finance Minister Mathias Cormann told The Australian.

“The spending restraint seen over the past few years may be increasingly difficult to maintain over coming years, given the length of time over which restraint has been applied, the pressures emerging in some spending areas, and the potential need for fiscal stimulus, noting that the projected improvement in the budget balance is mildly contractionary,” the PBO said.

Average personal income tax rates would rise by about four percentage points for taxpayers with earnings between $20,000 and $58,000, the PBO estimated.