Outbreaks of inflation from housing boom and supply shortages

Rising fuel, rents, food and household energy costs will push up headline inflation but wage rises are still a long way off

Reports of its death have been greatly exaggerated. Inflation is fighting back, as the property boom, supply shortages and cost of living pressures spark outbreaks in the economy.

Internal Commonwealth Bank data shows average rents paid rose sharply in the March quarter, by an estimated 2 per cent, almost unthinkable with the collapse in the number of temporary migrants such as students and skilled workers.

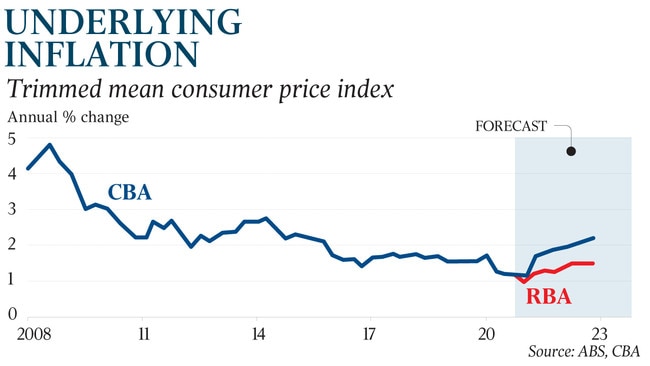

“We forecast a strong lift in rents that may not be expected by the street,” CBA economists said, adding underlying inflation would continue to rise this year.

Near-zero official interest rates and government grants to boost the housing industry are pushing up building costs and leading to fierce competition for labour and materials.

The latest National Australia Bank business survey showed 11 per cent of companies reported materials were a “significant constraint”, the highest since the survey began in 1989, and one-quarter of firms responded in the same way about labour.

As The Australian reported last month, bricklayers in Perth were receiving as little as 80c per laid brick a year ago but some are now charging as much as $2.50.

CoreLogic’s national home value index rose by 2.8 per cent last month, the fastest rate of appreciation since October 1988, although there are signs the market is losing steam.

A recovery in global oil markets has resulted in a jump in prices at the pump, with forecasters noting a 9.5 per cent rise in vehicle fuel costs in the first quarter of the year.

As well, higher household energy, food and education prices, and the end of pandemic discounting, are feeding kitchen-table inflation. Opinion polling by JWS Research shows cost of living is top of mind for adults aged under 35. At home, the price of cattle is hitting record highs as farmers rebuild herds. The Eastern Young Cattle Indicator broke through 900c/kg last week and continues to climb.

The missing part of the inflation story is wages. With almost 780,000 unemployed last month before the end of JobKeeper, the labour market has significant slack and will not be able to generate the “material” pay gains the Reserve Bank is hoping to stoke.

On Wednesday, the Australian Bureau of Statistics will issue the March quarter CPI, with bank economists expecting an increase of 0.9 per cent, taking the annual inflation rate from 0.9 per cent in December to 1.4 per cent.

ANZ Bank senior economist Catherine Birch is tipping a 0.9 per cent quarterly rise, led by large price rises in fuel, pharmaceuticals, electricity and construction costs for housing.

ANZ expects the annual rate of so-called “trimmed mean inflation”, which smooths out data bumps, to be unchanged at 1.2 per cent, and well below the RBA’s 2-3 per cent target band.

“Reports of capacity constraints are mounting, however, as Australian and global demand growth outpaces expectations,” Ms Birch wrote in a note to clients on Friday.

“Some factors behind these constraints are temporary and unlikely to generate the ‘sustainable’ wage growth and inflation that the RBA is looking for, but it is possible that some will have a longer-term impact.

“If they translate into a stronger, earlier pick-up in general cost pressures, wage growth and CPI, more specifically, it will have implications for the timing and speed of RBA policy changes, particularly around the timing of any cash rate hikes and, in the near term, the decisions to extend Quantitative Easing and/or Yield Curve Control.”

Major government infrastructure projects and home building could lead to further capacity constraints in construction. Ms Birch notes “the synchronised upswing across Australia and internationally is set to heighten competition for skilled labour, materials and equipment, pushing up prices”.

Commonwealth Bank analysts are at the top end of CPI market previews with a forecast of 1.1 per cent for the March quarter, due largely to a 1.8 per cent rise in housing costs, which was driven by a rebound in rents, utilities and the cost of home building. The housing component makes up 24 per cent of the CPI.

Although expecting a 0.9 per cent quarterly CPI rise, NAB economists also see “risks tilted to the upside with the possibility of higher-than-expected rental inflation and uncertainty around the ability of retailers to pass on higher input costs”.

Private economists believe the robust recovery and a policy bias to fire up spending will lead to the headline CPI hitting 3.5 per cent by the middle of the year and a scaling up of official forecasts for employment and inflation by Treasury and the RBA.

But that may be a blip, a quirk in the data after a 1.9 per cent pandemic and policy-induced plunge in the CPI last June, the largest quarterly fall in the index in its 72-year history.

CBA economists, however, think it could be more enduring, with inflation accelerating over the first three months of the year. The consensus view is that “base effects” are going to propel headline inflation comfortably above 3 per cent by the middle of the year.

“The RBA will consider that lift to be transitory. But our view is that not all of the lift in inflation will be fleeting,” they write.

“Our expectation is that underlying inflation will be on a sustained upward trend over 2021. And we expect core inflation to sit within the RBA’s target band by mid-2022.”

The RBA’s forward guidance is the cash rate of 0.1 per cent will remain unchanged until 2024.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout