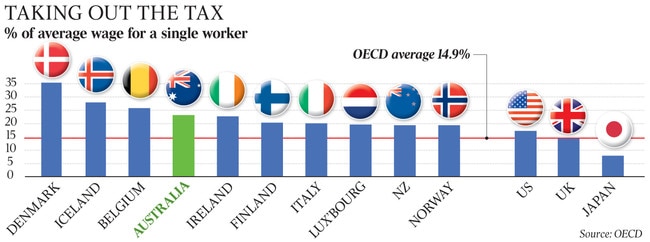

Our tax burden among the highest in the developed world, says OECD report

Australia is the fourth-highest income-taxing country in the developed world, according to the latest annual report from the OECD.

Australia is the fourth-highest income-taxing country in the developed world, according to the latest annual report from the OECD.

The result was one place better than a year earlier, but with a total income tax burden on the average wage earner at 23.2 per cent, Australia remained well above the 14.9 per cent average among 38 OECD nations, and higher than New Zealand’s 19.4 per cent, the US’s 17.2 per cent, Britain’s 14.3 per cent and Japan’s 7.8 per cent.

Only Denmark, Iceland and Belgium imposed a higher income tax burden on their workers, the latest report showed.

ANU tax and transfer policy institute director Bob Breunig said policymakers should be looking at ways to reduce “taxes on effort”.

Professor Breunig said the new and future governments needed to address “the long-term challenge of our inefficient tax system, which everybody knows about: the OECD keeps pointing it out, the IMF keeps pointing it out, as did the Henry review”.

“We have a very inefficient stamp duty regime and a very heavy burden on economic activity through corporate and personal tax. At the same time, we have this growing wealth disparity, which we don’t do anything to tax,” he said. “Taxes that help people to be mobile and encourage people to work are really important. Some of the gains are pretty small, but over 20 years these small gains accumulate a lot.”

During the recent campaign, newly installed Treasurer Jim Chalmers said he would lead a tax reform “conversation” with the states and territories if Labor won, including on “swapping out stamp duty for land taxes and the like”.

The OECD report showed that including additional imposts such as social security contributions made by workers and employers, the picture was much improved, with the total tax burden on an employee at 27.1pc, against the 34.6 per cent OECD average, placing Australia’s total wage tax burden at the 14th-lowest.

Dr Chalmers during the election promised no new taxes under a Labor government, which limits potential reform that could place more of the tax burden on capital and away from income – something most experts believe would improve tax system efficiency.

Professor Breunig said if given one opportunity for tax reform, he would “put in a federal land tax with a very low base”.

“I’d put it in as a Covid repayment measure because I think it has no negative productivity effects. You could say to people, ‘Any land tax you pay, you can deduct from wages and salary’, so it wouldn’t change the tax burden on battlers, but you would be taxing people who have wealth and aren’t working.”

He said the government should spend its first term building a popular case for productivity-enhancing changes to the system.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout