OECD alert on tax revenue crisis

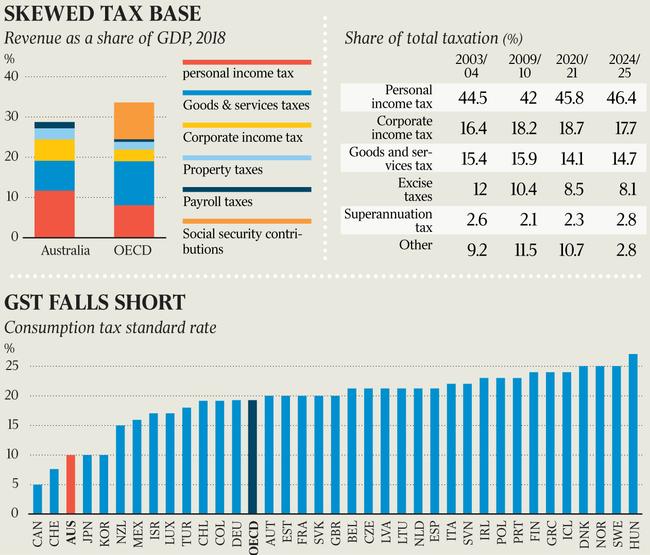

Australia is too reliant on income tax revenue and major reforms must be implemented to respond to the ageing population, the OECD has warned.

Major tax reforms must be implemented by federal and state governments to respond to Australia’s ageing population, as the Organisation for Economic Co-operation and Development warns the nation has become too reliant on income tax revenue.

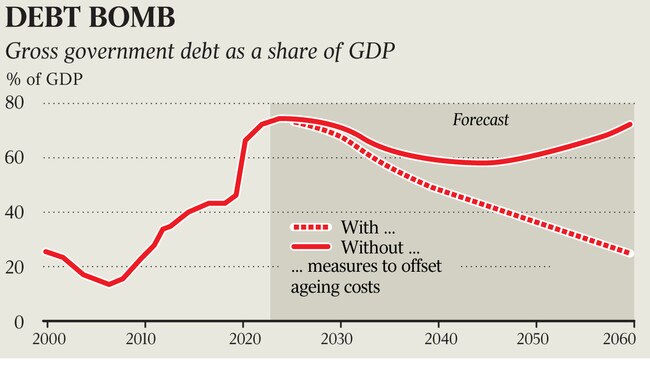

The Paris-based economic organisation will release a report on Wednesday urging the Morrison government to outline its medium-term fiscal strategy in response to ageing-related costs, which under current policy settings will lead to rising public debt out to 2060.

The Australia 2021 economic survey, the first OECD snapshot of the country in almost three years, forecasts economic growth of 4 per cent this year and 3.3 per cent in 2022 but warns that “risks and uncertainties remain large”.

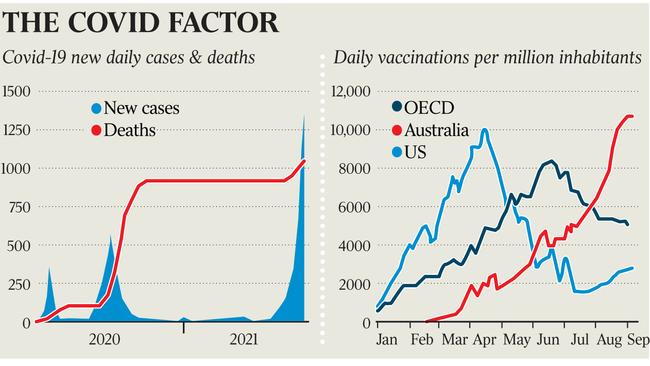

“The economy is expected to contract in the third quarter of 2021, before state-based restrictions can begin to be eased as higher vaccination rates are achieved. The ensuing recovery may be more gradual than in previous episodes, given it will occur in an environment of higher community transmission of Covid-19,” the survey warns.

The OECD survey states that a faster vaccine rollout could help unlock strict Covid-19 restrictions and drive economic growth if household consumption rapidly picks up due to “excess savings”.

“In contrast, significant new Covid-19 outbreaks may deepen the economic shock. Furthermore, problems with the vaccine rollout or vaccine hesitancy could delay reopening.

“A ratcheting up of diplomatic tensions with China could also further weaken trade activity.”

Josh Frydenberg said that with more than 43 per cent of Australians aged over 16 fully vaccinated, “the progress towards our nationally agreed targets of 70 to 80 per cent is accelerating”.

“As the survey notes, once we reach these targets, ‘the reopening of international borders will support the economic recovery through enabling foreign student arrivals, bilateral tourism and population growth stemming from net immigration’,” the federal Treasurer said.

The OECD, led by Australia’s longest-serving finance minister Mathias Cormann, recommends either increasing the GST or broadening its base, offsetting “any regressive effects through additional personal income tax cuts (especially for low-and-middle-income workers)”.

The survey states that compared with other OECD countries, Australia’s consumption tax rate is “relatively low” and raises a relatively small share of its revenues from the GST.

“Over the past decade, revenues from the GST have been falling as a share of total taxes and will continue to do so if recent changes to the pattern of household consumption persist,” it states.

“Authorities should aim to increase the overall contribution of GST revenues to its tax mix once the economic recovery is firmly entrenched. However, careful consideration should be given to the distributional effects.”

Other tax reform measures floated by the OECD include lowering the capital gains tax discount, and reducing concessions for the taxation of private pensions, particularly those favouring high-income earners.

“For example, the annual concessional contributions cap could be lowered, and private pension earnings in retirement (untaxed for balances below $1.6m) taxed at the same rate as private pension earnings before retirement.”

The OECD report recommends that state governments should “replace stamp duty with a well-designed recurrent land tax”.

Mr Frydenberg said the report highlighted that “bracket creep, if unaddressed, will result in increasing average taxes over time”.

“This further underlines the importance of the structural reform implemented through the government’s stage three tax cuts which will remove an entire tax bracket and ensure that 95 per cent of taxpayers face a marginal tax rate of no more than 30c in the dollar,” the Treasurer said.

The OECD warns that even with the legislated tax cuts, “bracket creep is likely to result in the average personal tax rate of many workers rising over the period to 2030, especially those in the low to middle part of the income distribution”.

“An increase in revenues from the goods and services tax could be accompanied by further lightening the taxation of personal incomes for such workers.”

With Anthony Albanese flagging he will target stagnant productivity in the lead-up to the next election, the OECD stated: “The economy was exhibiting signs of structural headwinds when the pandemic hit.”

Red tape was highlighted as a drag on productivity, with governments urged to simplify land use, licensing and permit systems.

“Regulatory procedures are relatively complex and the licensing and permit system is cumbersome compared with other OECD countries,” it states. “As well as harmonising and simplifying the land-zoning system at the state level, giving local authorities more fiscal autonomy can encourage them to allow the entry of new businesses or households.”

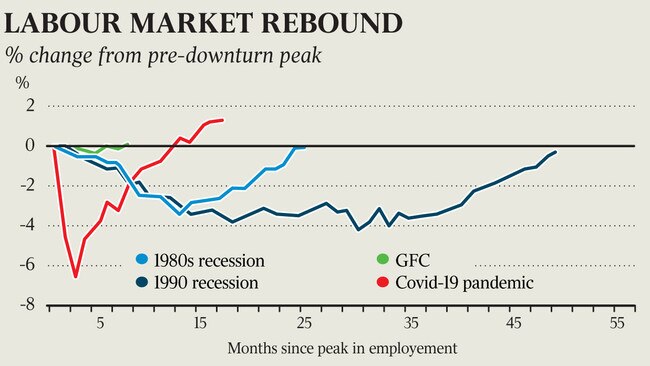

Mr Frydenberg said the OECD survey acknowledged the government’s “macroeconomic policy support was delivered swiftly and with appropriate force”.

“The ‘core component’ of the fiscal response was JobKeeper, which the OECD acknowledges ‘saved at least 700,000 jobs’,” the Treasurer said.

In response to the OECD’s recommendations, Mr Frydenberg said “fiscal policy continues to be responsive to developments in economic conditions”, with more than $6.6bn in Covid-19 disaster payments flowing to two million Australians.

“The OECD also recognises the importance of the government’s legislated automatic mutual recognition reforms and encourages remaining jurisdictions to follow the commonwealth’s lead to support Australian workers and boost productivity growth,” he said.

“Importantly, as highlighted by the OECD, to further support the recovery, the government will continue to pursue reforms to ensure small and emerging businesses have access to a range of funding sources, including streamlining lending laws, expanding open banking and via the Australian business growth fund.”

The OECD report states that company tax rates should be reviewed because the two-rate system of 25 per cent for SMEs and 30 per cent for larger companies risks “distorting how firms are structured and how they behave, especially around the threshold between the two rates”.

“It can also raise the cost of tax compliance as firms move between the two rates. To the extent that SME support is required, it may be better channelled to particular SME segments where market failures are rife, such as young businesses in innovative sectors.”

The OECD report warns the ageing population will result in lower tax revenue, with the tax base “increasingly reliant on personal income taxation – meaning the declining share of people in the labour market … will have significant implications for receipts”.

Opposition Treasury spokesman Jim Chalmers said the report highlighted the fact “Australia’s economic weaknesses predated the pandemic, and that the recovery is hostage to the government’s failures on vaccines”.

“Our economy would be much stronger if it wasn’t shedding billions of dollars a week as a consequence of the government’s inability to get the vaccines and quarantine right,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout