NT budget: National recovery boosts coffers as ALP spends up

The NT Labor government will claim credit for fiscal improvements delivered by Australia’s better-than-expected economic recovery and higher inflation.

The Northern Territory Labor government will claim credit for fiscal improvements delivered by Australia’s better-than-expected economic recovery and higher inflation.

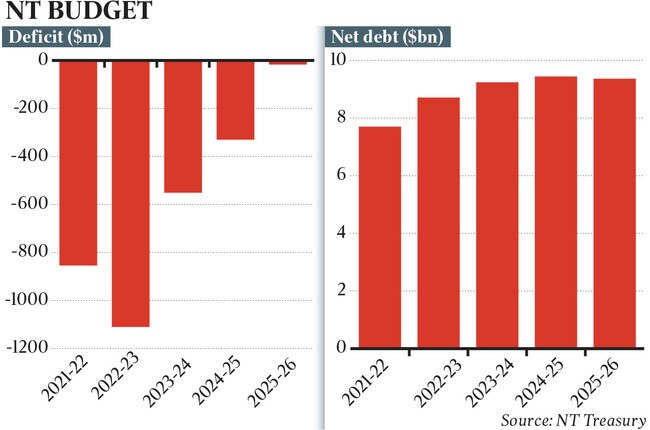

The government on Tuesday handed down its 2022-23 budget forecasting an $854m deficit for 2021-22, down from $1.36bn forecast in the previous budget, and a $1.1bn deficit next financial year, down from $1.2bn also forecast previously.

The improvements were mandated by a significant uplift in the national GST pool “attributable to improved economic expectations and the effect of national inflation”.

Labor’s policy changes since the 2021-22 budget added $321m to this year’s deficit and between $155m and $185m per year over the forward estimates. But the government’s projections were bailed out by an average uplift in GST revenue of 14.9 per cent per year over the forecasting period.

Chief minister and treasurer Michael Gunner said the 2022-23 budget put the Territory on a “solid” path back to surplus. “We can now forecast a government net operating surplus in 2024. This would be the first operating surplus in nearly a decade,” he said.

“As well as the strict fiscal discipline measures delivered by our government in the last few years, the budget is benefiting from a better-than-expected economic recovery, both in the Territory and throughout Australia.”

Opposition Leader Lia Finocchiaro said the budget “lacks vision or a plan for winding down debt and growing the Territory’s economy”. “This is a quitter’s budget,” she said.

Net debt will continue to grow from $7.7bn this financial year to $8.7bn in 2022-23 and over $9bn in subsequent years because, although achieving an operating surplus in 2024 would mean no longer borrowing to pay everyday expenses, the government will still be borrowing to fund infrastructure comments.

“While our spending stays under control, the strong economic recovery is boosting the Territory’s own taxation revenues, as well as our GST revenue,” Mr Gunner said.

Credit rating agency Moody’s welcomed a revenue recovery that “exceeded our initial expectations”. “The Territory will also benefit from the improved financial performance of government-owned corporations … although it remains exposed to a downturn in the broader Australian economy and a correction in commodity prices,” the agency said.

“We forecast that rising inflationary pressures, and hence, interest rates, as well as likely more volatile global economic growth amid elevated geopolitical risk, will … make the budgeted expenditure levels challenging to achieve.”

The Territory’s largest revenue source is commonwealth grants and GST payments; its biggest expense is public sector wages. Territory-funded expenses were projected to decline by 2.8 per cent to 2025-26 compared to a 9.3 per cent forecast increase in own-source revenue. But the success of that restraint depends on individual agencies sticking to a wages freeze to 2024-25, followed by a 2 per cent cap on future growth.

Mr Gunner, who announced his resignation as leader after delivering his budget speech, identified failing to deliver a budget surplus promised in 2016 as a major regret.

“The revenue improvements in this budget are better than previously forecast. If we can lock these in, and continue to make gains in future budgets, then hopefully the current wages policy is something that could be revisited,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout