NSW Election: Ignore us at your peril, mining giants tell Dominic Perrottet, Chris Minns

Dominic Perrottet and Chris Minns are warned they face electoral wrath if the booming resources sector continues to be held back.

Dominic Perrottet and Chris Minns have been warned they face the electoral wrath of thousands of miners if the booming resources sector continues to be held back, with data from NSW mining giants revealing they pumped a record $16.7bn into the state’s economy.

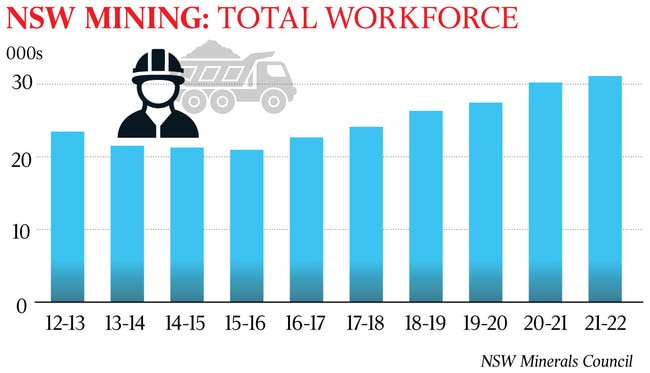

The backlash threat from the NSW mining industry, which employs a record 31,000 full-time workers, comes as the state’s 27 biggest mining companies increased their total spends by $2bn in the last financial year.

Ahead of last year’s NSW-commonwealth market intervention, mining companies, including BHP, Whitehaven, Glencore, Yancoal, Peabody, Idemitsu and Delta, spent $2.9bn on wages and $10.5bn on goods and services purchased from 7000 NSW businesses.

Mining companies, which have warned that investment and jobs could be affected by a one-year $125-a-tonne cap on coal prices, paid about $3.4bn in state taxes and royalties, and $93m in community contributions to local councils.

Whitehaven Coal chief executive Paul Flynn, who operates one of Australia’s largest coal producers, said “contrary to populist political rhetoric, coal is still a pretty big deal in Australia”.

“It’s our most valuable export commodity ($141bn, to be precise), it supplies two-thirds of east coast electricity, it delivers billions in state government royalties and it’s critical to helping power our largest Asian trading partners,” Mr Flynn, writing in The Australian, said.

“The NSW government doesn’t like to acknowledge this and has constrained investment in coal and the supply chains that deliver this energy while quietly pocketing the windfall royalties they generate. Now faced with the consequences of their own mismanagement – tighter supply and rising prices – they’ve hastily diverted coal bound for export markets.

“This is a continuation of the chronic mismanagement that created the mess in the first place and, predictably, it will end up doing more harm than good. Revenues from coal exports will be eroded and our international reputation as a trusted energy exporter will be undermined further.”

NSW Minerals Council chief executive Stephen Galilee, who will release the industry group’s expenditure survey on Monday, warned the Coalition and Labor to not take the resources sector for granted ahead of the March 25 election. “Mining is now making a record contribution to the NSW economy, so whoever wins the approaching NSW election will need to carefully consider how to best ensure this continues,” Mr Galilee told The Australian.

“Many thousands of mining families live in close marginal electorates like Upper Hunter, Dubbo and Barwon, with thousands more working in local mining supplier businesses. Most will at least partially cast votes based on which candidates will best support mining into the future, and these votes could determine the outcome in a tight contest.”

The regional impact of the mining sector’s direct expenditure was equivalent to 30 per cent of gross regional product in the Hunter Region, 36 per cent in far west NSW, 19 per cent in the central west and 8 per cent in Illawarra.

Mr Flynn said governments were not “fixing the underlying problem” by dismantling the architecture of the existing energy system before working out how to replace capacity. “There are plenty of coal reserves in the state, just like there’s plenty of gas. But when the government sold off long-life state-owned generation assets with shorter-dated fuel supply contracts, it all but guaranteed they would be exposed to export prices one day. And so it has come to pass,” he wrote.

He said the “world will consume more than eight billion tonnes of coal this year … (It’s) not because no one cares about climate change but because the global economy demands vast and growing amounts.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout