MYEFO: smaller surpluses to limit stimulus

Business leaders back government’s economic agenda, calling on Treasurer Josh Frydenberg to approach further stimulus cautiously.

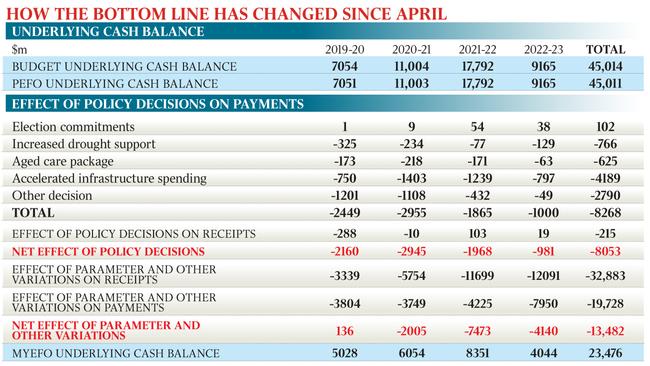

Scott Morrison’s future surpluses have been downgraded by $21.6bn over the next four years and wound back by $2.1bn this financial year, putting pressure on the government’s ability to inject extra stimulus into the economy before the May budget.

On Monday, business leaders and economists called on Josh Frydenberg to approach further stimulus cautiously and avoid drastic intervention, including further tax cuts, as the government prioritised new spending on aged care, infrastructure and drought.

The government resisted pressure to ease fiscal policy in the budget update, as it held the line on delivering the first budget surplus in 12 years.

Business Council of Australia chief executive Jennifer Westacott said the “surplus is good news for Australians and should not be compromised”.

“The government has done the hard work and we’re on track for a surplus after a decade of deficits,” Ms Westacott said. “Now our focus should be on driving the economy harder, and the private economy will need to do the heavy lifting. The forecast for new, job-creating business investment growth has been downgraded to just 1.5 per cent in 2019-20.”

Investors were betting on Monday that downgrades in the mid-year economic review would force the Reserve Bank to reduce interest rates as early as February. Amid a softening in US trade policy towards China, the benchmark S&P/ASX 200 share index had its third-best day this year, rising 110 points or 1.6 per cent to 6849.7 on broad-based gains.

The Treasurer was confident on Monday that the cumulative surpluses of $23.5bn over the forward estimates could be larger than forecast, noting Treasury’s conservative approach to iron ore prices. Mr Frydenberg said the government had kept the iron ore price assumption at a conservative “$US55 per tonne by the end of the June quarter 2020” despite the current spot price being around $US85 a tonne.

To ensure its “pathway to surplus” was “steady and consistent and not relying on overly optimistic commodity forecasts”, Mr Frydenberg said metallurgical and thermal coal price assumptions were also reduced to $134 and $64 respectively to reflect “recent price movements”.

“If you look at the last three final budget outcomes, they have been cumulatively $37bn better off than what was originally forecast. So the government’s story is that we under-promise and we over-deliver,” he told Sky News.

Our responsible & considered economic plan will see the Budget return to surplus for the 1st time in 12 yrs.

— Josh Frydenberg (@JoshFrydenberg) December 16, 2019

Getting the budget under control means we can pay down Labor’s debt & continue to invest record amounts in infrastructure & the essential services people need & rely on. pic.twitter.com/R6IY9OcLER

Deloitte Access Economics partner Chris Richardson said it was “debatable” whether the government should do more to bolster growth because it would have “less ammunition down the track if there was a recession”.

“But if it did, it makes more sense to spend on infrastructure or lifting Newstart, where you know the money is going to be spent, than bringing forward tax cuts,” Mr Richardson said.

He said the second phase of tax cuts, due to start in 2022-23, cost about $6bn a year. Mr Richardson argued that the revisions to the economic outlook made it more likely the Reserve Bank would cut interest rates in the new year.

In addition to surplus and revenue updates, forecasts for wages and economic growth were downgraded while unemployment was revised up from 5 per cent to 5.25 per cent for 2019-20 and 2020-21.

PwC chief economist Jeremy Thorpe said the downward revision of surplus and revenue forecasts left “little room for error for the government to deliver on the promise of future surpluses while also rebooting the economy”.

The downgrades came amid a significant revenue writedown of $32.6bn over the forward estimates, fuelled by lower projected income from the GST, superannuation funds and individual and company tax takes.

Commonwealth Bank chief economist Michael Blythe said policymakers at the RBA would be disappointed that fiscal policy was not eased because it was harder for it to achieve full employment and hit the bank’s 2-3 per cent inflation target band.

Westpac chief economist Bill Evans said the “downbeat” forecasts in the fiscal outlook emphasised the need for some extra stimulus for the economy.

There is hope in government ranks that greater international economic stability, including certainty around Brexit and the US-China trade clash, could spark a global rebound.

Watch my interview with @tomwconnell from @SkyNewsAust about today’s mid-year Budget update. #auspol #ausecon pic.twitter.com/acRt3armQQ

— Jim Chalmers MP (@JEChalmers) December 16, 2019

Mr Frydenberg, who recommitted the Coalition to paying down debt after medium-term forecasts showed it would fall short on its pledge to eliminate debt by 2029-30, said the economy’s “remarkable” resilience had occurred in the face of strong global and domestic headwinds.

The mid-year budget update showed the nation’s net debt bill was estimated to hit $392.3bn in the current financial year, with gross debt reaching $576bn by the end of the forward estimates. “With gross debt having peaked in 2017-18 and net debt falling over the forward estimates, the nation’s interest bill on its debt burden falls from $19bn last year to $14.5bn in 2022-23,” Mr Frydenberg said.

Economic growth will reach 2.25 per cent in 2019-20, down from an estimated 2.75 per cent in April, but is expected to reach 2.75 per cent in 2020-21.

Wages forecasts have been downgraded since April to 2.5 per cent across the next two financial years. The pre-election economic and fiscal outlook released ahead of the May 18 election had estimated wages would increase 2.75 per cent this financial year and 3.25 per cent next financial year.

The Australian understands that despite increasing pressure on the budget, the Coalition will not touch the Future Fund.

Labor Treasury spokesman Jim Chalmers said the budget update was a “humiliating admission” the economy had deteriorated under the Coalition, with “significant and overdue” downgrades to key economic forecasts.

ADDITIONAL REPORTING: ADAM CREIGHTON

LATEST KEY FEDERAL BUDGET AND ECONOMIC FORECASTS

BUDGET FORECASTS

* 2019/20 surplus $5 billion vs $7.1 billion at the April budget.

* 2020/21 surplus $6.1 billion vs $11.0 billion.

ECONOMIC FORECASTS

GDP

* 2019/20 2.25 per cent vs 2.75 per cent.

* 2020/21 2.75 per cent vs 2.75 per cent.

UNEMPLOYMENT

* 2019/20 5.25 per cent vs 5.0 per cent.

* 2020/21 5.25 per cent vs 5.0 per cent.

WAGE GROWTH

* 2019/20 2.5 per cent vs 2.75 per cent.

* 2020/21 2.5 per cent vs 3.25 per cent.

KEY SPENDING SINCE THE PRE-ELECTION UPDATE

* Extra $4.2 billion on road and rail projects.

* $1 billion water infrastructure package.

* $540 million Australian Business Growth Fund.

* First home loan deposit scheme to start January 1.

* Drought support includes additional $1.3 billion since election.

* $624 million over four years for aged care in response to royal commission.

* $34 million extra for veterans’ support.

* $1 billion Grid Reliability Fund for new power generation, storage and transmission projects.

* $300 million for Papua New Guinea “economic reform”.

* $40 million over 10 years to test new ways of providing foreign aid.

* $2 billion Australian Infrastructure Financing Facility.

KEY SAVINGS SINCE THE PRE-ELECTION UPDATE

* $196.4 million over four years through combating illegal phoenix activity.

* Interest payments to drop as surplus.

* Public service efficiency dividend to save $1.5 billion over four years to 2022/23.

Source: MYEFO

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout