Miners paid 40pc of big companies’ tax bill in 2018-19: ATO

Australia‘s corporate tax take has become increasingly dependent on the resources sector, new figures from the Taxation Office show.

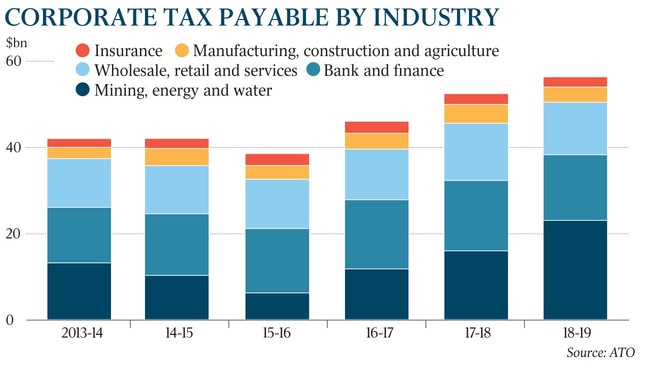

Australia’s corporate tax take has become increasingly dependent on the resources sector, as new figures from the Australian Taxation Office reveal mining companies accounted for $4 in every $10 in tax paid by big business in 2018-19.

The country’s 2311 largest companies paid income tax of $56.1bn in the 2018-19 financial year, according to the ATO’s corporate tax transparency report, or 60 per cent of all income tax paid.

That was up $3.8bn from the previous financial year, with mining and energy companies accounting for all of that increase as income and tax paid by every other sector declined.

Tax paid by resources businesses surged by 42 per cent to $22.9bn in 2018-19, or 41 per cent of the total — 10 percentage points higher than the year before and the most since the reports began six years ago — as taxable income in the sector jumped 60 per cent against the previous 12-month period.

ATO deputy commissioner Rebecca Saint said increases in commodity prices, in particular iron ore, explained the rise in mining earnings. The figures emphasise “how sensitive our tax take is to commodity prices”, she said.

Adding in tax from the country’s banking and finance sector, the two segments made up two-thirds of tax paid by large companies in 2018-19.

Heavy reliance on the volatile resources sector may have become even greater in the 2019-20 financial year, when the economy suffered the pandemic-induced collapse in activity during the June quarter, even as iron ore prices climbed to multi-year highs.

“Mining has performed very strongly and I would expect them to have quite a positive year (in 2019-20),” Ms Saint said.

Tax paid and taxable income in all other segments declined in 2018-19, led by a 19 per cent drop in the insurance sector. Banking and finance firms paid 8 per cent less tax, manufacturing, construction and agriculture companies 12 per cent less, while wholesale, retail and services businesses paid 6 per cent less — all on lower taxable earnings over the year.

The ATO report also shows the proportion of big companies — which included public and foreign-owned businesses with total income of $100m or more, and private firms with income of at least $200m — that paid no tax was steady at 32 per cent, and down from 36 per cent since the first report was issued for the 2013-14 year.

Implementation of the Multinational Anti-Avoidance Law in 2017 led to 44 companies restructuring to recognise sales in Australia, and by 2018-19 they had collectively booked more $8bn in additional sales in this country, and paid an extra $100m each year in tax versus 2015-16.