Mineral exports deliver a $200bn budget turnaround

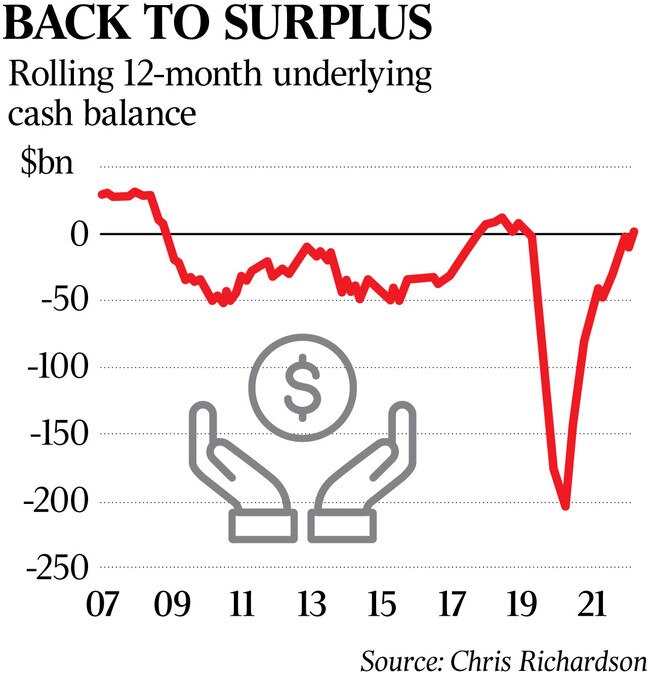

The federal budget has recorded a surplus of $1bn in the year to March, in an extraordinary $200bn turnaround from the depths of the pandemic.

The federal budget has recorded a surplus of $1bn in the year to March, in an extraordinary $200bn turnaround from the depths of the pandemic that will increase pressure on Jim Chalmers to offer more relief to struggling households on May 9.

Monthly financial statements released by the Department of Finance on Friday confirmed that booming commodity prices had pushed the nation’s finances back into the black on a rolling 12-month basis for the first time since before the pandemic.

But days out from Labor’s second budget, experts warned not to expect a shock return to surplus in this financial year, although the cash deficit was likely to be a fraction of the $36.9bn deficit for 2022-23 predicted at the October budget.

Finance Minister Katy Gallagher said the government’s “responsible budget management and spending restraint is delivering a significant improvement to the bottom line”.

“However, as we have made clear, the long-term structural issues facing the budget largely due to the mess that the Liberals left behind, mean there is much more work to do,” he said.

The $200bn turnaround from the depths of the pandemic, driven by the end of Covid-era stimulus measures such as the $89bn JobKeeper wage subsidy, but also thanks to the rapid economic rebound from lockdowns and persistently high prices for key commodity exports such as iron ore, LNG, and coal.

Despite this “stunning” turnaround in the nation’s financial position, Rich Insights founder Chris Richardson said the vastly better-than-anticipated bottom line would not change the Treasurer’s approach to the budget.

“The basic point the government has been making is that the good news is temporary, while the bad news is permanent,” Mr Richardson said.

That “bad news” was related to an underlying structural deficit of about $50bn-60bn, amid ongoing spending pressures in areas such as healthcare, aged care, defence, the NDIS and servicing the country’s much larger debt pile.

For the financial year to date, the official Department of Finance figures revealed an $11.2bn underlying cash deficit, a $23.3bn improvement on the October budget forecast.

Stubbornly high commodity prices helped tax revenues in the financial year to March come in $14.9bn above forecasts, while the resilient economy meant payments over the nine months were $8.4bn lower than anticipated.

Westpac senior economist Andrew Hanlan predicted that the federal underlying cash deficit for 2022-23 would plunge from $32bn in 2021-22, to $6.9bn in 2022-23, or $30bn better than anticipated, and that there would be a $110bn total improvement over the forward estimates period.

Mr Hanlan said the high prices for key exports explained the “persistent or systematic” underestimation of revenue for years. “When you frame a budget you always have a bit of caution built into the forecast, and it’s entirely reasonable that commodity prices would at some point in time move closer to those (much lower) average cost curves,” he said. “What’s unclear is how long they stay higher, and as we’ve seen they can stay above them from a very substantial period.”

Mr Hanlan said at 0.3 per cent of GDP in this financial year and the next (with a forecast $7.6bn deficit in 2023-24), that the budget would be “broadly in balance” for two years.

The Treasurer has said he accepted a recommendation from his department to make its commodity price forecasts in the budget more realistic, although they would remain conservative.

Mr Hanlan said assuming commodity prices would fall over 18 months, rather than three to six months, explained his substantially smaller forecast deficits in this financial year and the next.

But the end of high commodity prices would then see the deficit balloon back to about $29bn in 2024-25 and 2025-26, Mr Hanlan said, underscoring the ongoing challenge of repairing the budget over the longer term.

“The government has said it is trying to balance restraint and relief, and there’s an expectation here they would bank the majority of the windfall,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout