We’ll soon learn if she’s also prepared to wield a big stick and whack borrowers with higher repayment costs to win that war.

As Jim Chalmers says, at 5.4 per cent, and falling, consumer “inflation is still too high”.

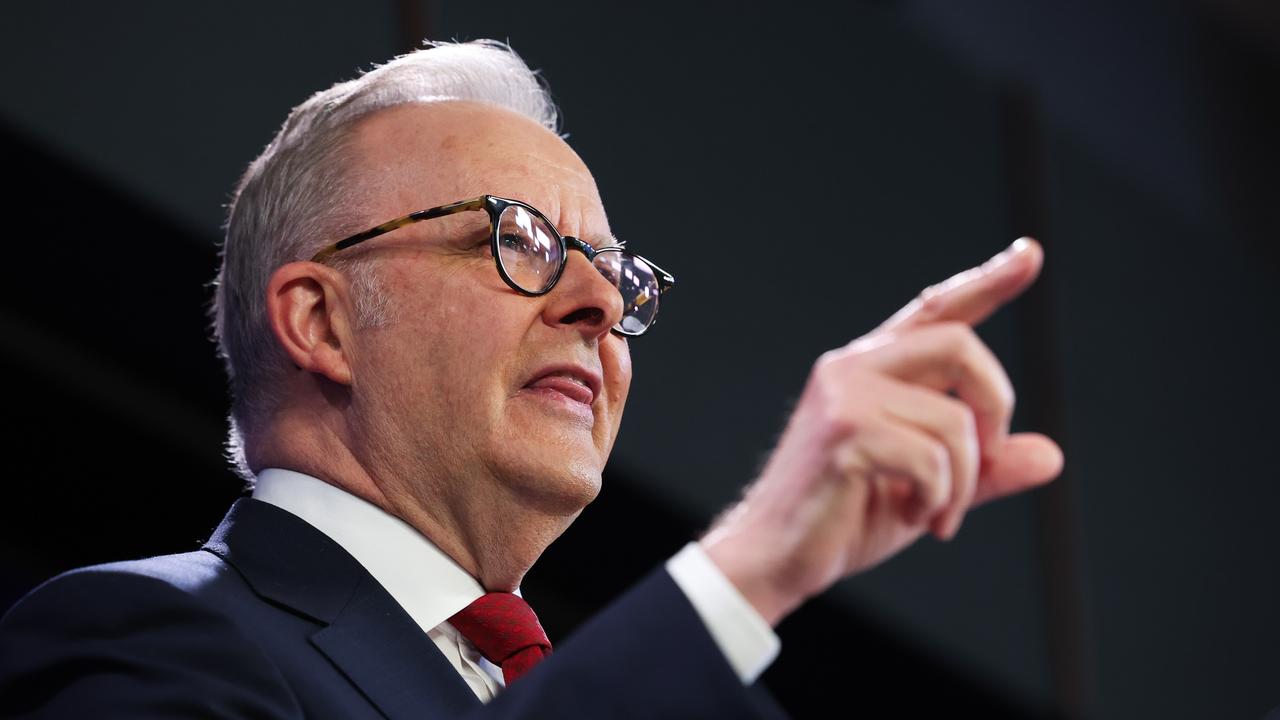

The Albanese government has been feeling the ire of voters due to higher petrol prices, rents, energy costs, insurance premiums and childcare fees.

Some of the cost-of-living relief in Labor’s two budgets, worth $23bn on the Treasurer’s figuring, has shaved half a percentage point off headline inflation.

Yet after stripping out volatile items in the consumer price index, like food and fuel, as the Reserve Bank does in its monetary policy considerations, core inflation is running at 5.2 per cent.

After the latest inflation news, economists believe the RBA is now more likely than not to raise its cash rate target to 4.35 per cent at its next board meeting.

The RBA governor, whose job is to keep inflation in a 2-3 per cent band (on average over time) is worried about a slower return to target, which would alter inflationary expectations.

Right now, officials believe expectations are “well-anchored”, meaning the community believes prices growth will return to target in coming years.

But in a speech on Tuesday, Bullock said: “The board will not hesitate to raise the cash rate further if there is a material upward revision to the outlook for inflation.”

What constitutes a “material” change to forecasts?

That’s anyone’s guess, and has quickly become the arena for punditry and push-back.

The Commonwealth Bank’s Gareth Aird reckons the lift in core inflation in the September quarter is “sufficiently strong for the RBA to act on their hiking bias at the upcoming board meeting”.

Aird says the 4.3 per cent “six month annualised” pace of core inflation is enough “to cause the board some discomfort, given the RBA has recently upped its rhetoric on the importance of keeping inflation expectations anchored”.

Chalmers argues the CPI result “is consistent with our expectations” in the budget.

“It doesn’t materially change the inflation outlook going forward,” he said on Wednesday.

Got that?

No hike is warranted. And besides, in the past 12 months, Chalmers said financial markets have “been wrong on a couple of occasions from memory”.

“The decision will be taken independently by the RBA board,” he told reporters in Canberra.

“I will do my job, they will go about their job in a diligent way under governor Bullock as well.”

Treasury officials say a flow of strong data on wages growth and input costs above current forecasts would likely constitute a material change to the outlook.

Treasury secretary Steven Kennedy, who sits on the central bank’s board, told Senate estimates on Wednesday that while wages were rising, “there are no signs of a wage-price spiral”.

“We still expect inflation to steadily fall towards the target band although its descent towards the target band may be slower than initially expected due to higher petrol prices,” he said.

The Treasury chief noted the so-called “narrow path” to a soft landing globally was “widening”, especially for the US, and it was also “a little wider” for Australia,

“I’m becoming more confident about our ability in Australia to maintain low unemployment rates and see inflation fall back within the band in a reasonable period,” Kennedy said.

That’s despite the emergence of a new risk to the global outlook from a softening Chinese economy, Treasury’s head noted.

Officials told the estimates hearing that high petrol prices at the pump could depress economic activity, which would then ease price pressures elsewhere.

Burning the village to save the village.

As the shocks keep coming early on her watch, Bullock goes to Canberra on Thursday for her first parliamentary appearance as governor.

There is a lot of uncertainty about the effect a dozen interest-rate hikes are having on the economy, because of what she calls “long lags in the transmission of monetary policy”, as well as doubts about how long the supply squeeze from the major oil producers will last.

Then there are the wars in the Middle East and Ukraine.

The RBA governor may speak more softly to senators on this occasion about these turbulent times, but that big stick remains solidly in play for a November 7 rate strike.

Michele Bullock has been talking tough about fighting inflation.