Market on the march as buyers push property to biggest jump since 1980s

The borrowing binge could lead to new lending restrictions.

The nation’s two biggest cities are on track to post the biggest monthly increases in home values since the 1980s, as low interest rates fuel a borrowing binge that could lead to regulators imposing a fresh round of lending restrictions.

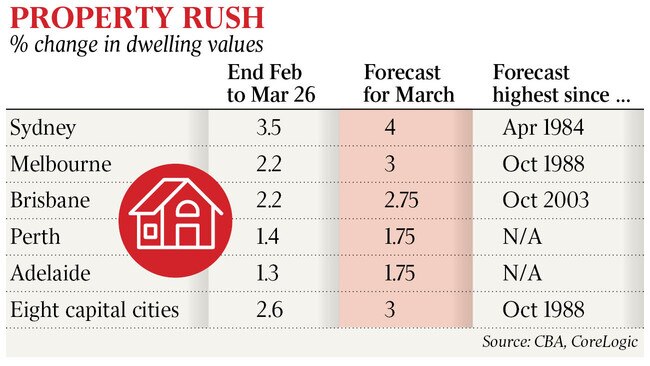

Sydney and Melbourne dwelling prices are set to increase by 4 per cent and 3 per cent respectively in March, according to Commonwealth Bank analysis of CoreLogic daily property price data. They would be the biggest one-month increases since 1984 for Sydney and 1988 for Melbourne.

Commonwealth Bank economist Gareth Aird said the fall in fixed home loan interest rates below 2 per cent for the first time had created a particularly large lift in property prices.

“As the RBA has cut the cash rate right down towards zero, the percentage change in rates has been huge and that is what is underpinning turbocharged price growth we are seeing,” he said.

The federal government’s HomeBuilder subsidy for the purchase of new homes, along with the low rates, has pushed dwelling approvals and lending volumes to a record high in recent months.

“The reverse is also true, which means that any increase in interest rates from here will have a very large bearing on the cost of servicing debt,” Mr Aird said.

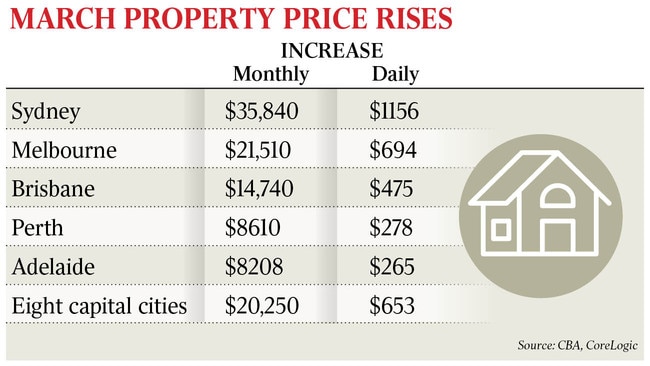

According to the Commonwealth Bank’s analysis, Sydney home prices will have risen an average $35,840 in March — or $1156 a day — while Melbourne values will be up $21,510 this month.

Matthew Conlon, 29, and Jordan Purcell, 25, used the rapid increase in prices to upgrade from their apartment in Mosman, on Sydney’s lower north shore, to a house in Forestville, further north.

“We had hoped to keep the unit as a long-term investment but looking at the current conditions, it would be silly not to take advantage and inject that capital into renovations of our next home,” Mr Conlon said.

The renovated one-bedroom unit was on the market for three weeks, selling prior to auction in mid-March — great timing for the couple, who purchased their new home in December, when the market was only just heating up.

“It’s a good feeling now,” Ms Purcell said.

“Initially it felt like we had paid too much but looking back now, we were lucky to get in.”

Prices in Brisbane are expected to rise 2.75 per cent and 1.75 per cent in Adelaide and Perth after increasing 2.2 per cent and 1.4 per cent this month to March 26, the Commonwealth Bank’s analysis of CoreLogic data shows.

The last time Brisbane property values rose that quickly was in October 2003.

Westpac chief economist Bill Evans said that, despite the rapid price increases in recent months, dwelling prices were still around levels seen in 2017 and the sharp reduction in rates had improved affordability significantly.

“Are these sorts of monthly increases we’re seeing now sustainable?” Mr Evans said.

“No, but we’ll see about 10 per cent increase this year and another 10 per cent next year before price growth starts to flatten out.”

Thomas McGlynn, the head of sales at inner-Sydney real estate agency BresicWhitney, said the sheer depth of buyer demand indicated to him it will be some time before prices slow.

“There are some sectors not performing as well as others,” Mr McGlynn said.

“The inner-city apartment market is still not performing as it had in the 2015 to 2017 boom. But houses in lifestyle locations are doing much better than in the last boom.”

The sharp rise in prices, however, is making some buyers fearful. In Sydney's north, McGrath Lindfield agent James Sutton said two buyers had recently told him they would not come to the auction despite having a loan approved above the home’s price guide because they knew they would be quickly priced out.

“Buyers are more educated and attuned to the market,“ Mr Sutton said. “They want a firm figure rather than a vague guide in order to make a formal offer prior to auction.”

Reserve Bank governor Philip Lowe has previously said he expected the official interest rate to remain at near zero levels until 2024, helping to reduce unemployment and lift wages.

Mr Evans said the prudential regulator would “introduce new lending controls before the Reserve Bank starts to lift rates”.

APRA introduced limits on investor borrowing in late 2017, after which prices in Sydney and Melbourne fell through 2018. “You also had the concerns about Labor’s proposed changes to negative gearing in the lead-up to the 2019 federal election,” he said.

Mr Evans said investors, who typically preferred apartments, had yet to return to the property market in large numbers.

“Once they start coming back into the market you’ll see the gap between houses and apartments that’s opened up start to narrow, and a shortage of apartments will emerge,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout