Labor warms to $130bn tax cuts

The federal opposition will not repeal the legislated $130 billion final stage of tax cuts for middle- and high-income earners.

Labor is moving closer to supporting Scott Morrison’s $17 billion-a-year stage three tax cuts and will not seek to permanently entrench the Low and Middle Income Tax Offset if it wins the next election.

The Australian can reveal the opposition will not repeal the legislated $130 billion final stage of tax cuts for middle- and high-income earners, with a final policy expected within months.

As Labor seeks to present a smaller, lower-cost election manifesto, the $7.8 billion-a-year temporary LMITO — delivering about 10.2 million Australians tax relief of up to $1080 — is not expected to make the cut in Anthony Albanese’s tax policy.

Mr Albanese’s shadow cabinet, which has been deliberating the design of the party’s tax policy following Josh Frydenberg’s big-spending May 11 budget, is understood to be firming on a decision to support the stage three tax cuts package in full.

Growing support from senior MPs for stage three has been partially driven by the Prime Minister’s post-budget strategy to attack Labor over tax and link the federal ALP to the revenue hikes in the Victorian Labor government’s budget.

The opposition tax policy — requiring support from caucus, which has been divided over stage three — has examined four options: full repeal, suspending the tax cuts, carving out higher incomes and endorsing the package as is. Labor is expected to follow a similar approach to Mr Frydenberg’s in not “indefinitely” extending the LMITO, which was included in the budget as a stimulus measure for a third and final year.

Senior Labor MPs are aware that if they pick winners and losers in carving up stage three, it could trigger a backlash in key seats, such as during the 2019 election campaign when a Gladstone worker bailed up Bill Shorten over tax breaks for higher-income earners. Mr Shorten’s policy at the last election was to restore the deficit levy — and increase taxes — for workers earning more than $180,000-a-year.

Mr Albanese, who last month announced Gladstone mayor Matt Burnett as Labor’s candidate in the central Queensland marginal seat of Flynn, is formulating policies that don’t alienate aspirational Australians and help win back regional and outer-suburban electorates.

The Opposition Leader said in March Labor would wait until after the budget to “enable us to have an assessment across the board as to the state of the economy” before landing on its tax cuts platform.

With the budget revealing $46 billion in additional funding for aged care, disability services and infrastructure, and net debt peaking in June 2025 at $980.6 billion, or 40.9 per cent of GDP, Labor will pursue a fiscal approach to contrast the government’s pandemic spending.

Mr Albanese will not be rushed into announcing his tax policy until consulting all Labor MPs despite post-budget attacks by Mr Frydenberg and Mr Morrison over Labor’s position on stage three tax cuts and Victorian Labor’s high-tax policies.

Senior Labor frontbenchers said there was growing support for waving through the government’s tax package. However, sources said Mr Albanese would need to manage carefully the internal politics because there was support for repealing “at least part of it”.

Deputy Labor leader Richard Marles on the weekend flagged the ALP’s instinct was “we don’t want to stand between anyone and a tax cut”, with senior MPs this week refining the opposition’s messaging around the stage three cuts.

“The concern that we have expressed about the government’s tax agenda is that it seeks to outline a plan of tax cuts going a long way into the future, which in a sense, is a prediction of where the economy is going to be at … way off into the future in a way that no one can reasonably do,” Mr Marles said.

Mr Albanese said on Tuesday Labor would make a decision “based upon our timetable”, as he focused on fewer but higher-quality election policies.

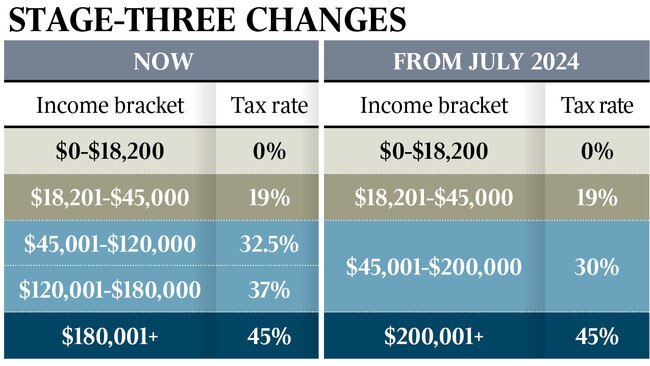

The legislated third stage of the government’s personal income tax plan, due to commence in July 2024, would create a flat 30c-in-the-dollar tax rate on earnings between $45,000 and $200,000.

It would do this by abolishing two tax brackets – the 32.5 per cent rate on income between $45,000 and $120,000, as well as the 37 per cent rate for earnings between $120,000 and $180,000, and applying a 30 cent marginal rate in their place. The 45 per cent top marginal rate would kick in at $200,000, rather than $180,000.

Discussions over Labor’s final policy has focused on whether to trim back the stage three package or pause the tax cuts.

Analysis by The Australian shows that limiting the tax cut for incomes above $120,000 – for example, by reducing the marginal rate from 37.5 cents to 35 cents in the dollar, instead of 30 cents – would save about $3.6 billion of the $17 billion estimated annual cost of stage three.

Keeping the top income threshold at $180,000 would save a further $1.1 billion a year, leaving a “stage three lite” costing about $12.3 billion a year.

At the National Press Club last week, opposition Treasury spokesman Jim Chalmers said Labor’s issue was with the “mismatch between the temporary nature of the low and middle-income tax relief versus the permanent nature of the stage three tax cuts”, committed on an assumption that the budget would be in surplus.

Dr Chalmers said “everyone on incomes below $88,000 will be worse off” under the stage three tax cuts compared with what they were receiving with the LMITO.

Mr Frydenberg, in question time on Wednesday, said the government had legislated tax cuts for 12 million Australians and described Labor as “hopelessly divided and confused” over its tax policy.

“The member for Corio (Mr Marles) seems to be speaking in favour of our stage three tax cuts. The member for Rankin (Dr Chalmers) – always in favour of higher taxes and … is talking it down,” Mr Frydenberg said.

“The Leader of the Opposition does not know if he’s in support of our stage three of the legislated tax policies – policies that are designed to create more jobs, policies that are designed to lower taxes, policies that are designed to encourage aspiration, policies that are designed to reward effort.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout