Labor risks new row with miners over coal, gas tax

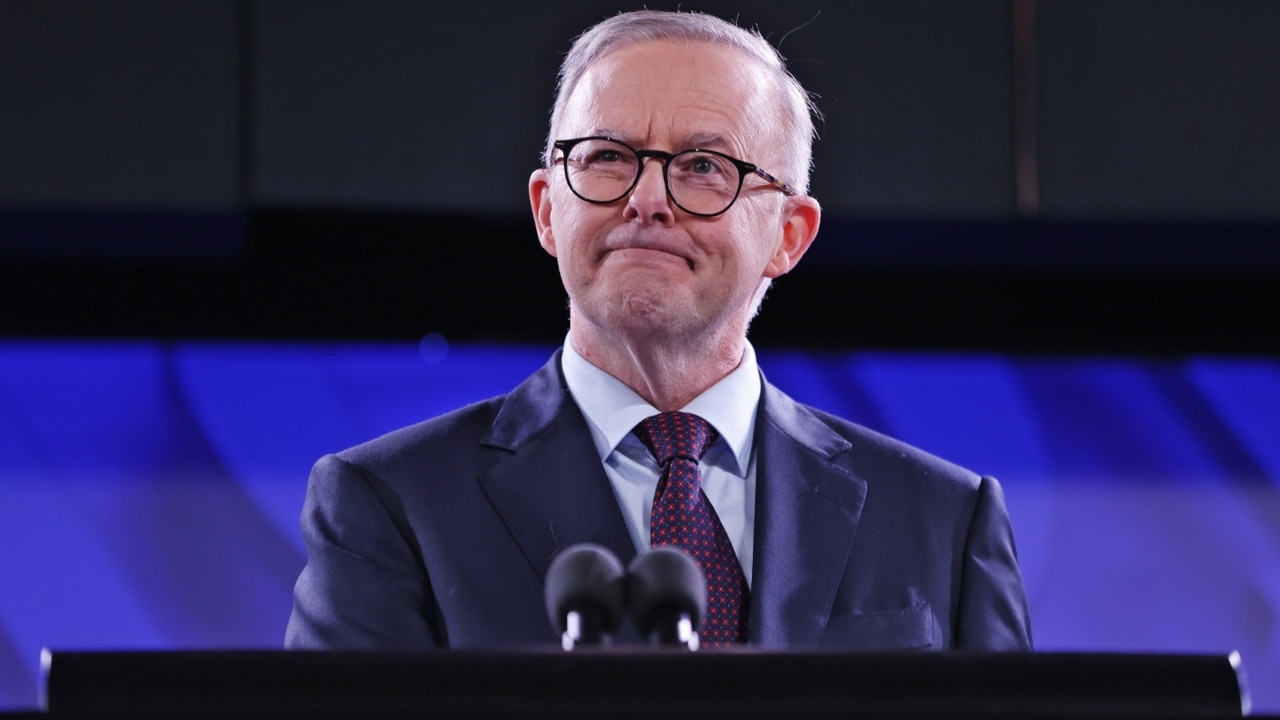

Anthony Albanese says a new tax on gas and coal is not ‘our preference’ but ‘we’re working through the issues constructively’.

Anthony Albanese has not ruled out a new tax on gas and coal to help ease energy prices for households and businesses and said the Government is “working through the issue”.

The Prime Minister said a new tax on gas and coal, reported exclusively in The Australian, was not “our preference” but said: “we’re working through the issues constructively”.

“We’re working that through with departments, we’re working that through as well with states and territories. We need to acknowledge that in half of the states, we’re literally talking about state-owned assets involved here,” Mr Albanese told ABC radio on Friday.

“So the states and territories will need to be engaged here, particularly in New South Wales and Queensland,” he said before preparing to fly to Asia for nine days.

In relation to the possibility of a new tax on gas and thermal coal producers which could be used to assist energy-intensive businesses facing closure because of high energy prices, Mr Albanese said: “We need to acknowledge that there are extraordinary profits being made at the same time as the customers are really doing it tough”.

Federal cabinet is set to consider a new tax on gas and thermal coal aimed at cutting energy prices when Mr Albanese returns from a nine-day overseas trip to attend three Asian summits.

It is expected that the new tax on thermal coal and gas producers would be temporary and aimed at reducing domestic energy prices and easing pressure on low-income households struggling with rising costs of living.

Mr Albanese said the Government’s timeline was still to take action on energy prices before Christmas.

The UK has just increased a power levy on gas producers to help ease the burden on consumers but has allowed concessions to encourage more supply of gas.

Despite assurances before the election there would be no new taxes and specifically no new mining tax - the failed initiative of the Rudd-gillard Governments in 2010 - ministers are campaigning on the “excessive profits” of gas and coal producers because of the war in Ukraine.

Mr Albanese, who told mining companies before the election there would be no mining tax as introduced in the Rudd-gillard Government, also said on 2GB on Friday that there would be no MRRT - the Minerals Resource Rent Tax introduced in 2010 and killed off in 2014 - but “any sensible” proposal would be considered.

There are calls for a windfall tax and the Treasury has argued intervention in the gas market is feasible.

Any new tax on gas and coal producers and exporters will create a fiery political response from the gas and mining industries at a time when the Albanese government is warring with business over its contentious industrial relations changes.

Any additional tax on exports of gas and thermal coal would also concern trading partners such as Japan, which is sensitive to price rises and supply.

While senior government examination of the proposed new tax is imminent and described as a “live issue”, the Prime Minister’s overseas travel agenda precludes a full cabinet consideration for at least 10 days.

In recent days, Mr Albanese, Jim Chalmers, Energy Minister Chris Bowen and Resources Minister Madeleine King have all indicated that “everything is on the table” as far as increasing energy supplies and cutting prices are concerned.

There have also been calls to amend the Petroleum Resources Rent Tax on gas and oil to recoup more of the profits of gas companies under the 1980s legislation.

Government sources have confirmed to The Australian that a new tax is set to be considered during the remaining two cabinet meetings this month.

Despite repeated undertakings from Mr Albanese and the Treasurer not to reintroduce a Rudd government-style resource super profits tax on the mining industry, coal and gas producers have been gearing for a campaign against new imposts on gas and thermal coal as part of a political campaign to cut domestic energy bills.

The UK government has just extended its Energy Profits Levy from 25 to 30 per cent and out to 2028, with the aim of producing more gas and cutting prices. The UK levy was initially aimed at raising an extra £5bn to help households with rising bills but provided concessions to industry to encourage more exploration and supply.

On Tuesday, Treasury secretary Steven Kennedy opened the door for “temporary” and “direct” intervention in the energy market, saying it was justified by the extraordinary circumstances associated with Russia’s invasion of Ukraine.

Dr Kennedy said the war had triggered super profits for some firms while rising costs were threatening the viability of energy-intensive businesses.

“The current gas and thermal coal price increases are leading to unusually high prices and profits for some companies; prices and profits (are) well beyond the usual bounds of investment and profit cycles,” Dr Kennedy said. “The same price increases are leading to a reduction in the real incomes of many people, with the most severely affected being lower-income working households. The energy price increases are also significantly reducing the profits of many businesses and raising questions about their viability.”

The Treasury chief warned that any policy changes aimed at easing the burden on the most-affected and vulnerable businesses and households should not feed the inflation spiral through direct subsidies.

“Policy responses could take many forms but in the current circumstances of generalised price pressures, they need to be mindful of not contributing further to inflation,” Dr Kennedy said. “This would suggest to us that interventions that directly address the higher domestic thermal coal and gas prices are more likely to be optimal.”

Also on Tuesday, Ms King, who is going to Japan on the weekend to reassure Japanese importers of gas and thermal coal, said “the Treasurer has been clear and all ministers have been clear, everything remains on the table”.

Ms King said the government wanted to “maintain very important trading relationships because this is a country built on international investment and international trade”.

“We all want to protect our manufacturing industry,” she said. “We need it to thrive to employ people and we want to make sure that people can afford power and gas.

But Ms King added: “We have to think it through very quickly.”

Previously Mr Albanese has assured mining company executives that he backs the continued export of energy and minerals as well as a shift to renewable power.

In September, the Prime Minister ruled out a return to the Rudd Government mining tax after the idea was floated at the government’s Jobs and Skills Summit, saying that “times have changed”.

The Minerals Council fiercely opposed the mining tax Labor implemented in 2010 and the newly elected Coalition government repealed in 2014.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout