To surplus with love: back in black

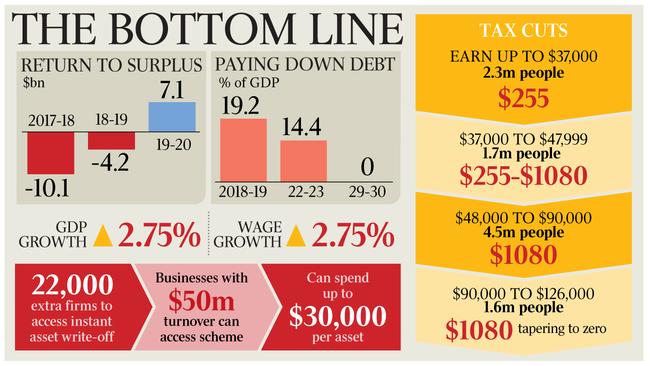

Coalition will double tax cuts for low and middle-income earners in a battle for middle Australia.

Scott Morrison will double tax cuts for low- and middle-income earners in a $300 billion battle for middle Australia after confirming the pre-election budget is “back in the black” after more than a decade of deficits.

An unprecedented $100bn “congestion-busting” infrastructure plan will also form the centrepiece of an election war plan based on a gritty seat-by-seat campaign to win back the Howard battlers.

With the promise of increased funding for services, health and education, and more money into the accounts of a further 22,000 small businesses, Josh Frydenberg last night declared the May election would be a contest over who could be trusted to deliver tax cuts and keep the economy humming.

But the government will refuse to take the tax plan to the parliament this week, claiming it is not prepared to “haggle” with the Senate for the two remaining sitting days before the election.

Instead, Scott Morrison will seek a mandate from the Australian people on the lure that a vote for the Coalition will deliver tax refunds of up to $2160 for some families within 13 weeks.

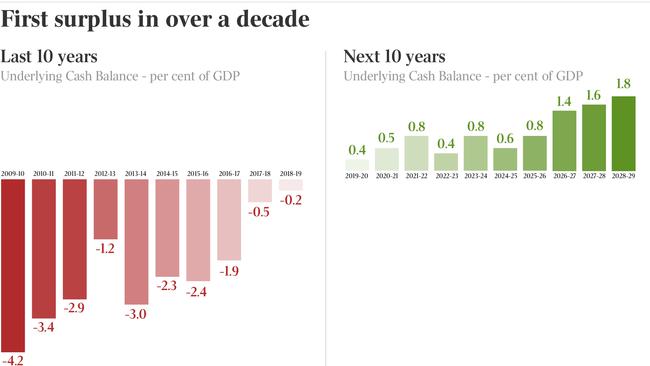

“I announce that the budget is back in black and Australia is back on track. For the first time in 12 years, our nation is again paying its own way,” the Treasurer said.

Labor last night pledged to support the first phase of the Coalition’s tax package.

Mr Frydenberg declared the 10-year agenda would deliver the largest personal income tax cuts since the Howard government, adding an extra $158bn to the $144bn in cuts announced in last year’s budget. With the government’s final hopes of turning around its political fortunes before a May election resting largely on the success of the budget, Mr Frydenberg claimed that after two terms in government the Coalition had restored the nation’s finances after being left with Labor’s debt-and-deficit legacy.

Despite significant spending promises primed for the election, including a $3.2bn secret election campaign fund allocated under spending measures as yet “unannounced”, he claimed the budget was responsible and, unlike Labor, all its promises would be met without raising taxes.

“The country is now living within its means,” Mr Frydenberg said. “We have got there by being restrained and disciplined. We will put a speed limit on taxes while our opponents will put a speed limit on the economy.”

Finance Minister Mathias Cormann said “we believe that it is going to be up to the Australian people to decide whether they back us in to deliver the income tax relief for hardworking families after the election”.

“And, if we get a mandate, we will expect that the parliament will pass this legislation the same as the parliament passed the last $144bn worth of income tax relief,” Senator Cormann said.

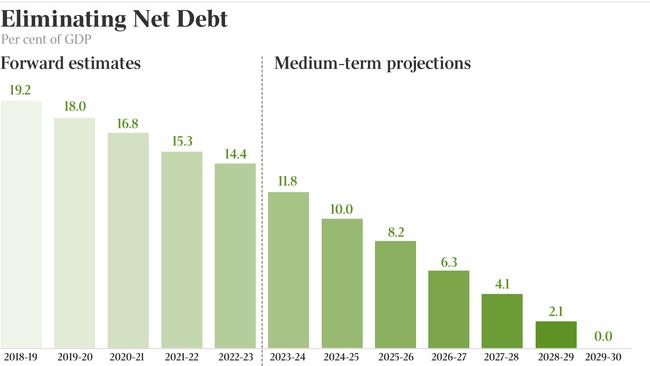

As expected on the back of increased company tax revenue, the return to surplus will be delivered on time, and for the first time in 12 years, with a $7.1bn windfall for 2019-20. This was forecast to rise to accumulated surpluses of $45bn over the next four years, with government net debt to be wiped from the books by 2029-30 as surpluses continued to rise to 1 per cent of GDP from 2026.

But the budget was delivered against a backdrop of a slowing global economy, a dramatic drop in forecast housing investment amid a falling property market, a return to only modest domestic growth of 2.75 per cent and the bottoming out of the unemployment rate at 5 per cent.

Treasury’s economic forecast citied a “high degree of uncertainty” over global growth amid evolving economic, trade and geopolitical risks. With a 7 per cent fall in property investment forecast for next year, Mr Frydenberg said it was “the worst possible time for Labor’s housing taxes”.

Admitting that there were concerns over household consumption, the $302bn package, much of which is to be delivered beyond the forward estimates and over 10 years, would also act as a short-term economic stimulus.

The first round of the election sweeteners will begin this year with a doubling of the low- and middle-income tax offset, offering refunds of up to $1080 for individuals and $2160 for dual-income families. This would deliver refunds as soon as people lodged their 2018-19 tax returns, setting up the Coalition’s pitch over who could be trusted to deliver tax relief. They would be expanded beyond the forward estimates with an increase in the top threshold of the 19 per cent bracket from $41,000 to $45,000. In 2024-25 the 32.5 per cent tax rate would be reduced to 30 per cent. This would mean permanent tax relief for 13.3 million Australians and would be consistent with the commitment to keep tax as a share of the economy below 23.9 per cent of GDP. Small businesses would also be a major beneficiary, with an increase in the instant asset write-off from $25,000 to $30,000 and its expansion to businesses with an annual turnover of up to $50 million. This would extend the write-off to an extra 22,000 businesses, on top of the 350,000 that had already taken it up.

Spending on services will also become a key piece of the Coalition’s election narrative, with an extra $453m to extend preschool education and give 350,000 children 15 hours a week of learning before they reach school age.

A record $80bn health spend for this year would have a focus on 2000 medicines listed on the Pharmaceuticals Benefits Scheme, including the listing of a lifesaving leukaemia drug, Besponsa, which would reduce its cost from $120,000 to as low as $6.50.

The improved balance sheet would also underwrite a record $100bn infrastructure plan and deliver an extra $25bn in new spending for local “congestion-busting” projects aimed directly at the plight of working families in suburban electorates and concerns over population growth in Sydney and Melbourne.

The Urban Congestion Fund announced last year for local projects would also be increased from $1bn to $4bn, and include a $500m “commuter carpark fund” to improve access to public transport.

“This fund will focus on immediate, practical measures to cut travel times within our cities,” Mr Frydenberg said. “Cranes, hard hats and heavy machinery will be seen across the country as we build Australia for current and future generations.”

In a bid to address a skills shortages in construction and other sectors, there will be a $525m package to create 80,000 apprenticeships.

Breaking from budgets of the past, Mr Frydenberg avoided any additional or controversial spending cuts ahead of the election, with $62bn in budget repair having already passed through parliament.

Mr Frydenberg also announced a $3.9bn fund to help support communities affected by fire, flood and drought.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout