JobKeeper’s boost for business bottom line

Only a quarter of the $90bn JobKeeper program has been used for emergency income support for workers, according to new research.

Only a quarter of the $90bn JobKeeper program has been used for emergency income support for workers, according to new research, with the peak small business body also warning of the loss of 32,000 accommodation jobs in Sydney and Melbourne next week following the end of the wage-subsidy scheme.

As tens of thousands of workers and businesses still suffering from COVID restrictions brace for the end of JobKeeper, the Australian Chamber of Commerce and Industry said employees were already receiving notices of termination and warned of a “surge” in business failures that would “add to the wave of job losses”.

“We have already witnessed a 61 per cent increase in insolvencies in February with the removal of the temporary safe harbour protections,” ACCI acting chief executive Jenny Lambert said.

Treasury secretary Steven Kennedy this week revealed he expected about 150,000 jobs would be lost when JobKeeper ended, and that more than 100,000 small businesses were at high risk of folding.

But Dr Kennedy said he was confident the strength of the labour market recovery would help limit the damage to overall employment to a month or two.

Australian Industry Group chief executive Innes Willox said there were contrasting feelings among employers about the end of JobKeeper. He said sectors such as tourism and arts and recreation would “unquestionably” need further support.

Others, however, would “welcome the end of JobKeeper because of the difficulties they are experiencing in attracting labour, especially relatively unskilled labour, as the economy grows”.

Amid an increasingly heated debate about how to support vulnerable businesses and employees in the months ahead, new research has revealed three in every four taxpayer dollars paid out in the wage-subsidy scheme have gone instead to boosting businesses’ bottom lines.

Analysis by economic consultancy AlphaBeta suggests 16 per cent of JobKeeper cash went to workers who would have otherwise lost their jobs, while 9 per cent went to topping up the pay of recipients who had been earning less than the wage subsidy.

The balance was a direct subsidy to businesses.

The estimates, which are based on Treasury’s own findings from its July review into the scheme, show between March and December, $15.9bn in JobKeeper payments went to directly boosting workers’ income. That same review found the scheme “kept jobs in place, especially among those in ongoing full-time and part-time roles” and “achieved this by providing employers a subsidy to keep on employees and reduce business costs”.

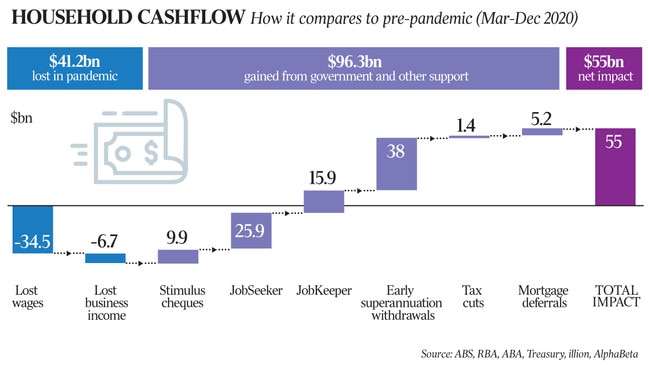

Over the nine months, household income in aggregate increased by an extraordinary $55bn (more than $35bn of which came via the early access to super measure) despite the worst recession in close to a century.

When introducing the appropriations bill in October last year, Josh Frydenberg described JobKeeper as an “economic lifeline that is supporting around 3.5 million Australian jobs”. But AlphaBeta director Andrew Charlton said only the $15.9bn paid out via JobKeeper between March and December could be classified as an income transfer to workers, with the balance serving to subsidise employers’ wage bills.

The Treasurer said the JobKeeper payment “helped to keep hundreds of thousands of businesses in business and millions of Australians in work”.

He said “without JobKeeper there would have been more jobs lost, more businesses close, more workers on fewer hours and a prolonged economic downturn with major labour market scarring”.

Opposition Leader Anthony Albanese on Friday accused the government of abandoning vulnerable workers and businesses who were still suffering from the impact of COVID-19 restrictions.

“We have always said that these measures, wage subsidies, shouldn’t be there forever, but for particular industries, in particular places, the idea that you just withdraw support is very unwise,” Mr Albanese said. “If the conditions were right for these wage subsidies to be in place for particular workers and businesses, then they should be right to remain.”

University of Melbourne economics professor Jeff Borland said there was the potential for between 100,000 and 200,000 job losses. “I don’t think anyone is saying it will be business as usual, there will definitely be a noticeable impact, but we will recover from that in a few months at most,” Professor Borland said.

Mr Charlton, who advised former prime minister Kevin Rudd during the GFC, said JobKeeper “was implemented rapidly, in the context of high uncertainty, and dire forecasts”.

“We can’t expect them (the government) to land a golf ball on a lily pad; it was reasonable to spend a little bit more and chalk it up as an insurance policy.”

In Senate estimates this week, Dr Kennedy said “designing a program of this nature as a pandemic was unfolding involved trade-offs”.

“In our view, these trade-offs were well considered and a sensible and prudent balance was struck,” he said. “It is our assessment that the economic measures have been highly effective in supporting the Australian economy and are now proving equally successful in driving the recovery.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout