Jim Chalmers warns of another year of falling real wages as inflation heads to 8pc

A ‘once-in-a-generation’ inflationary challenge will not tip the economy into recession despite a year of slow growth, falling wages and a budget with no major cost-of-living relief.

A “once-in-a-generation” inflationary challenge will not tip the Australian economy into a recession despite another year of slowing growth, falling real wages and an October budget that will offer no major cost-of-living relief to households.

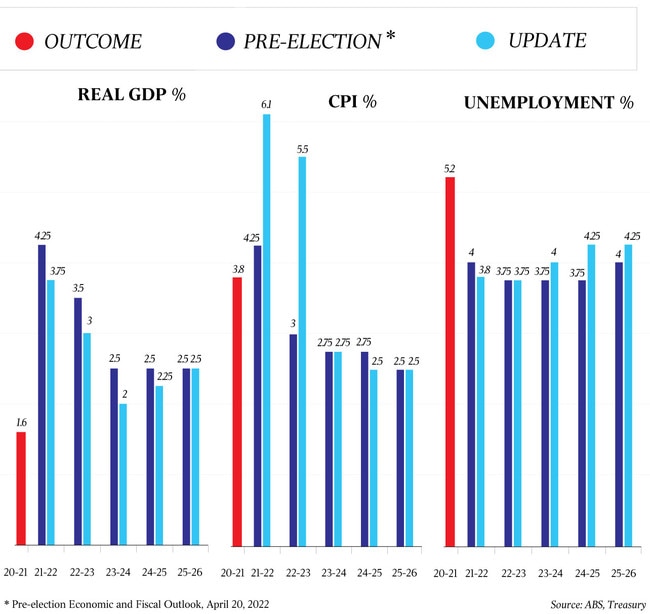

In an economic update to parliament, Jim Chalmers revealed new forecasts showing the country would navigate a peak inflation rate of 7.75 per cent by the end of the year, up from the 6.1 per cent estimate in June and higher than the 7 per cent figure predicted by the Reserve Bank.

By mid-2024, unemployment would be 4 per cent – higher than the current 3.5 per cent but still at a level consistent with full employment – inflation would have dropped to 2.75 per cent and wages would be rising by a solid 3.75 per cent.

The Treasurer also said the 2021-22 budget outcome would be “dramatically” better than expected, due to soaring commodity prices, while nominal growth for the current financial year – which most closely tracks to government receipts – was set to surge by 5.25 per cent against a previous estimate of only 0.5 per cent. But Dr Chalmers warned these positive trends were temporary and that the commonwealth’s financial position remained dire as he foreshadowed a conservative budget on October 25.

“People know not every good idea can be funded, not every support program can continue indefinitely,” he said.

“The short, medium and longer term pressures on the budget are more pronounced. The temporary improvement in tax receipts may not persist over time, the impact on payments will persist, and the cost of interest on debt will grow as more debt is refinanced at higher yields.

“We know that the debt burden left to us – the highest level as a share of the economy since the aftermath of the Second World War, with deficits stretching beyond the decade – is growing heavier because the impact of higher interest rates on repayments.”

Dr Chalmers blamed the former government for this year’s surge in consumer prices which have been driven by the Ukraine war, ongoing supply constraints associated with Covid and floods on the east coast.

With economists anticipating the RBA will hike rates by a further half a percentage point to 1.85 per cent at Tuesday’s board meeting, and to as high as 3.35 per cent by the end of the year, Dr Chalmers said that “the medicine is also very tough to take”.

“Millions of Australians with a mortgage are feeling that pain right now,” he said.

He warned key challenges lay ahead, including the “precarious and perilous” state of the global economy, alongside the ongoing impact of the pandemic and intensifying cost-of-living pressures.

Reflecting on the new forecasts, CBA head of Australian economics Gareth Aird said “we should be heartened to the extent they (Treasury) don’t think a recession is required to bring the rate of inflation under control”.

Judo Bank economic adviser Warren Hogan described the economic statement as “an optimistic view of how we are going to get our economy back to normal without too much disruption”.

“The problem, though, is it’s not far off a best-case scenario,” Mr Hogan said.

“Everyone wants it to be play out like this – that the RBA engineers a soft landing via a modest lift in rates. There’s still a good chance this will happen. But the reality is that, if this scenario doesn’t happen, the alternatives are going to be much more difficult for the community.”

Rich Insight principal Chris Richardson said the “news on the budget was mostly good”, as he predicted the deficit in this financial year would prove smaller than anticipated three months ago, despite Dr Chalmers saying spending would be $30bn higher over the forward estimates.

“Compared to earlier forecasts, we are going to have more jobs, and national income is going to be higher – partly because commodity prices will be stronger for longer – and those two are good news for the budget,” he said.

“The Treasurer doesn’t want to jump up and down about that (good news) because he doesn’t want the states, and the frontbench and the public to know about it. And that’s because there’s no scope to hand people back money, because the Reserve Bank will take it away via higher interest rates.”

With Treasury economists now anticipating inflation to peak at 7.75 per cent, Dr Chalmers said cost-of-living pressures would “moderate” next year. But the updated forecasts still showed CPI running at an elevated 5.5 per cent by mid-2023, before easing to 3.5 per cent by the end of that year. Dr Chalmers said that households could only expect “normal” rates of inflation of 2.75 per cent by June 2024.

“Just as the domestic forces contributing to some of the supply side pressures have been building for the best part of a decade, it will take some time for them to dissipate – but they will,” he said.

Wage growth was expected to accelerate from 2.4 per cent over the year to March, to 3.25 per by June 2023 – cementing further declines in real worker incomes as pay rises fail to keep pace with cost of living. Real wages were only expected to start growing again in 2023-24.

“If this eventuates – and I’m careful, cautious and conscious of the history here – it would be the fastest pace of nominal wages growth in about a decade,” Dr Chalmers said.

“The harsh truth is – households won’t feel the benefits of higher wages while inflation eats up wage increases, and then some. Real wages growth relies on moderating inflation and getting wages moving again.”

Unemployment – which sits at 3.5 per cent – was expected to stay low through the back half of this year, before creeping up to 3.75 per cent in June next year, and to 4 per cent by the middle of 2024.

“In the meantime, higher interest rates, combined with the global slowdown I’ve described, will impact on Australia’s economic growth,” Dr Chalmers said.

Weaker consumption and the waning of the commodity and homebuilding booms would knock half a percentage point off real GDP growth in each of the financial years to mid-2024, and to as slow as 2 per cent in 2023-24.

Dr Chalmers said Labor’s economic plan would “lift the speed limit on the economy” without adding to the inflation challenge.

He pointed towards cost of living relief via cheaper childcare and prescription medicines. He also said the government had a plan to “grow wages over time”, by pushing for “decent” pay rises for those on minimum wages and in the care economy, and by spending more on training and supporting high-paying industries.

Investing in green energy, working to ease labour and skills shortages, and pumping money into sectors that enhanced the country’s self-reliance would help “unclog and untangle our supply chains and deal with the supply side of the inflation challenge”.

Dr Chalmers said the task ahead for the Albanese government and the nation was a “once-in-a-generation challenge” that also represented “a once-in-a-generation opportunity for our country”.

“There is a genuine appetite to address these challenges, a broad acceptance of the hard things we have to do now, to pay off in the future. Australians know we’ll only rise to this occasion if we work together,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout