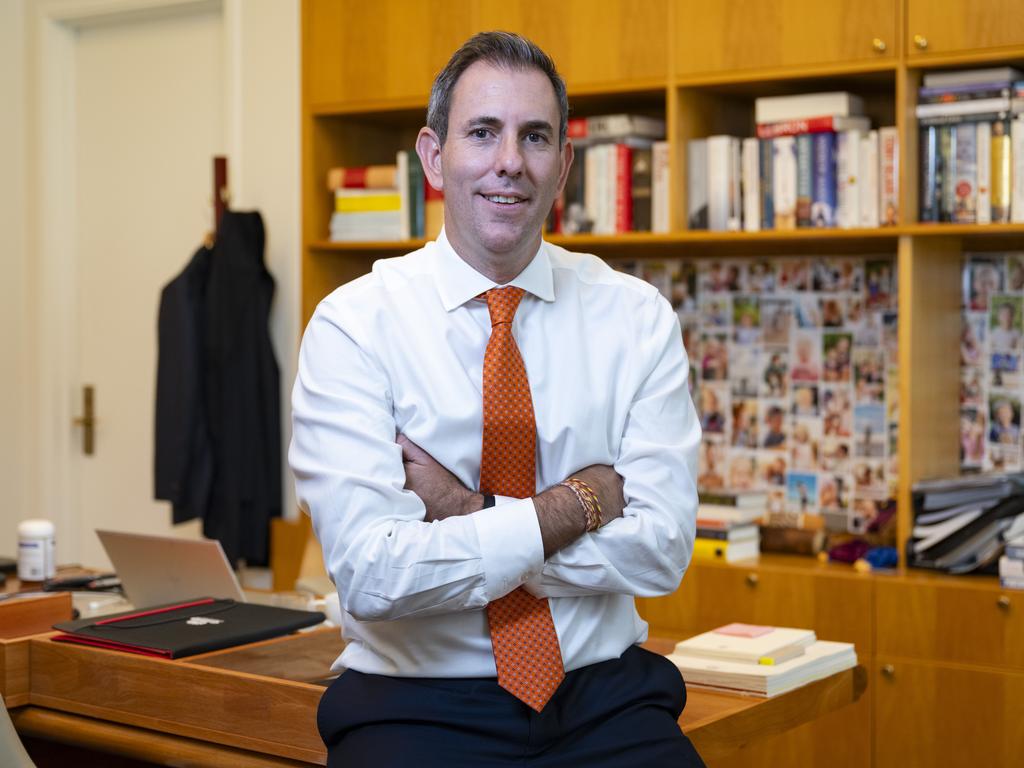

Jim Chalmers’ warning of no quick inflation fix

Jim Chalmers is preparing to pull regulatory and policy levers in a bid to lower price pressures, after warning Australia faces a prolonged battle to drive-down stubbornly high inflation.

Jim Chalmers is preparing to pull regulatory and policy levers ahead of the May budget to lower household price pressures after warning Australia faces a prolonged battle to drive down stubbornly high inflation.

Despite new monthly figures on Wednesday revealing the lowest consumer price index increase in almost two years, the Treasurer cautioned that CPI was unlikely to moderate in a straight line and “we are a long way from prevailing” in the inflationary fight. Under pressure from Labor MPs to expand cost-of-living measures and use an expected second surplus to increase direct support for households, Dr Chalmers said he was focused on “helping not hampering a fight against inflation, which is far from over”.

Australian Bureau of Statistics data showed while energy, housing, rental and insurance prices remained high, annual inflation fell from 4.9 to 4.3 per cent in November, the lowest increase since January 2022.

Amid increasing global uncertainty and rising cost-of-living pressures fuelled by 13 interest rate hikes, economists expect the Reserve Bank of Australia board will keep the 4.35 per cent cash rate on hold when it meets on February 6.

The RBA, which last year forecast inflation wouldn’t return to its 2-3 per cent target until the second half of 2025, will closely monitor quarterly and December CPI data released on January 31.

While the May 14 budget is not expected to include major cash splashes, the government is pursuing regulatory and policy levers to combat inflation including tougher competition rules, strengthening the grocery code, further budget repair, modernising the migration system and recalibrating the $120bn infrastructure pipeline.

Writing in The Australian, Dr Chalmers welcomed the November inflation data but warned that “monthly figures can be volatile”.

“We don’t get carried away by one month’s data. But even on a quarterly basis, inflation is around half the peak left behind by our predecessors. Inflation doesn’t always moderate in a straight line, and the recent tick up in Europe is a warning against complacency – as is the broader uncertainty in the global economy,” Dr Chalmers wrote.

“But even if we do see inflation zigzag on its way down, the overall trend in Australia is now quite clear. Our plan to address inflationary pressures is helping, but the fight is far from over and we are a long way from prevailing.”

ABS data shows the biggest contributors to November inflation increases were housing (6.6 per cent), insurance and financial services (8.8 per cent), food and non-alcoholic beverages (4.6 per cent), alcohol and tobacco (6.4 per cent).

Electricity prices rose 10.7 per in the year to November, with gas up by 12.9 per cent. The annual rate of fuel inflation plunged from 8.6 per cent in October to 2.3 per cent. There were also prices falls for clothing, appliances, meat and seafood.

After excluding volatile price changes including fuel, travel, fruit and vegetable costs, the rise in November was 4.8 per cent compared with 5.1 per cent in October.

Job vacancies in November fell by 3,000 since August to 389,000, representing the sixth straight quarterly drop. ABS data shows job vacancy numbers have fallen by around 18 per cent since their historical peak in May 2022 but remain high compared to pre-pandemic levels. ABS head of labour statistics David Taylor said the labour market remained tight despite the slow fall in job vacancies and recent increases in the historically low unemployment rate.

Outlining the government’s plan to “finish the fight against inflation”, Dr Chalmers said more work was required despite significant progress since the 2022 peak.

“By reviewing our grocery code and competition settings, and by working with the ACCC to consider further price monitoring in supermarkets, we are looking to boost competition and put downward pressure on prices,” he wrote.

“By recalibrating our $120bn infrastructure pipeline we are delivering projects in ways that improve living standards, boost productivity and don’t compound capacity constraints. By reforming our migration system we are building a more productive, dynamic economy and ensuring migration serves our national economic interests.

“Each part of this plan: easing the costs of living; boost housing supply; repair our budget; refresh competition settings; recalibrate infrastructure; and reform migration – plays a role in fighting inflation and strengthening our economy over time.”

“We are coming at this challenge from every possible angle, deploying everything at our disposal. Australian Bureau of Statistics data has showed that inflation would be much higher without our policies on electricity rebates, cheaper childcare, and rent assistance.

ABS head of prices statistics Michelle Marquardt said the inflation rise was the “smallest annual increase since January 2022”, assisted by government rent and electricity supports.

“The increase in Commonwealth Rent Assistance has reduced out-of-pocket rent costs for eligible tenants since its introduction. Excluding these changes to rent assistance, rents would have increased 8.8 per cent over the year to November,” she said.

“Electricity prices have risen 8.8 per cent since June. Excluding the rebates, electricity prices would have increased 19 per cent over this period.”

Ms Marquardt said while annual inflation for food and non-alcoholic beverages remain elevated, favourable weather conditions had increased supply and kept prices lower for fresh food including meat, seafood, fruit and vegetables.

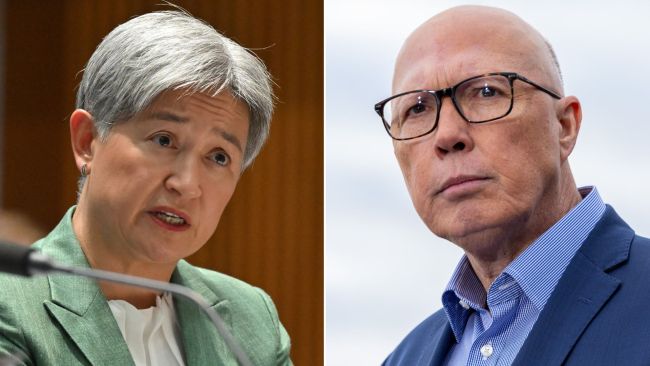

Opposition Treasury spokesman Angus Taylor said “Australia has one of the most entrenched and persistent inflation problems”. Mr Taylor said the “ABS’ measures of core inflation remain even higher with the annual trimmed mean at 4.6 per cent and the CPI excluding volatile items at 4.8 per cent”. “This is more than 2 percentage points above the midpoint of the RBA’s target band. The price of essential items remain too high: electricity has gone up 10.7 per cent and gas by 12.9 per cent, bread and cereals have gone up by 8.6 per cent and dairy by 6.1 per cent. Rents have increased by 6.6 per cent over the last year, while healthcare costs are 5.2 per cent higher,” Mr Taylor said.

Master Builders Australia deputy chief executive Shaun Schmitke said housing and rental inflation trends were “out of step with the rest of the economy”: “Across most categories of goods and services, there was a reduction in inflationary pressures with the exception of rents, where annual inflation accelerated to 7.1 per cent in November compared with 6.6 per cent in October”.

“New dwelling costs have also intensified, having risen by 5.5 per cent over the past year. A lack of enough new housing supply continues to impede our battle against inflation.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout