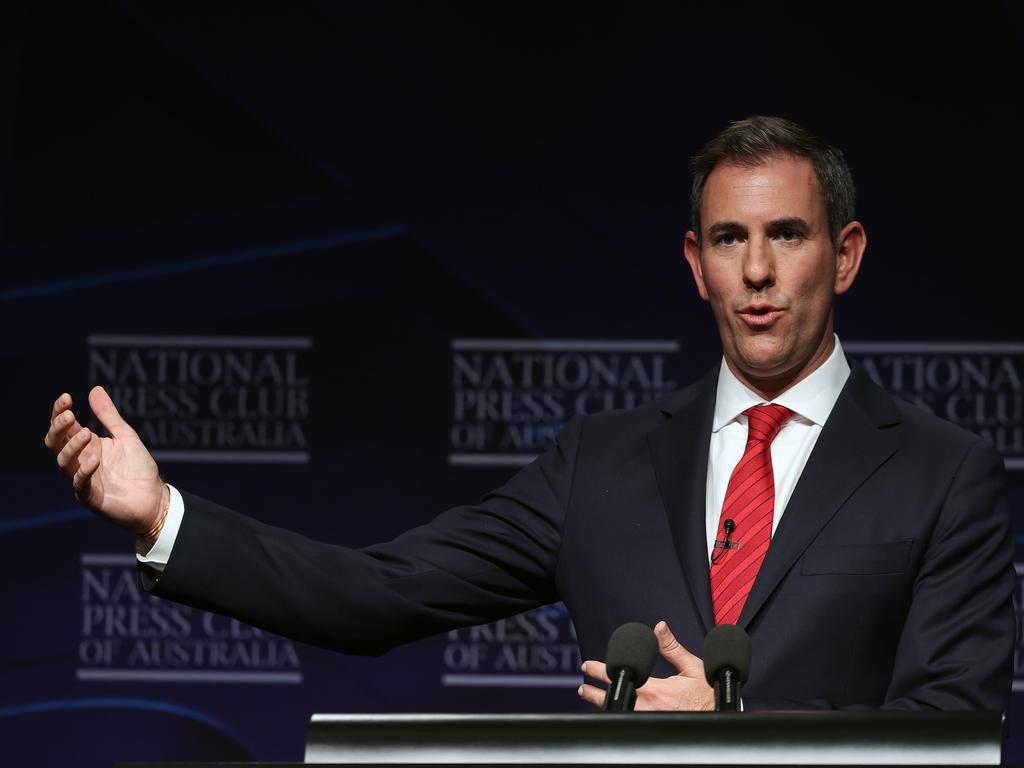

Jim Chalmers lays out Labor’s economic plan

The would-be treasurer has unveiled Labor’s three-pillar economic blueprint, which includes tax reform.

Labor has promised nearly $5bn in budget improvements over four years by cutting contractors in the public service and cracking down on multinational tax avoidance, pledging to be fiscally “responsible and conservative” if Anthony Albanese wins the election.

Opposition Treasury spokesman Jim Chalmers said Labor would raise almost $1.9bn from its multinational tax policy and recoup billions of dollars through a “waste and rorts” audit during its first year in power.

Labor’s 13-page economic plan and budget strategy – which was panned by senior Coalition figures as a “pamphlet” – commits to slashing costs on consultants, contractors and labour hire by 10 per cent in Dr Chalmers’ first budget, and banking savings of $3bn over the forward estimates.

Opposition finance spokeswoman Katy Gallagher said Labor would abolish the government’s arbitrary Australian Public Service staffing cap and spend almost $500m under a first-phase “strategic reinvestment” to hire more frontline bureaucrats.

With the nation’s gross debt set to peak over $1 trillion following record spending on Covid-19 support packages, Senator Gallagher said Labor understood the “budget repair job” ahead.

Under the cover of a massive spike in inflation, and with Mr Albanese still in Covid-19 isolation, Dr Chalmers conceded the economic plan would not deliver immediate results.

“One budget, one term in office, will not completely fix all of the damage that’s been done to the economy or to the budget. Our responsibility is to do what we meaningfully can, and to begin where we can to start to improve the quality of the budget,” Dr Chalmers said.

With the Morrison government’s reforms to battle tax avoidance by international firms already generating $5bn in extra tax each year, Dr Chalmers’ multinational tax grab fell short of expectations and raised questions about how Labor would fund its election policies.

Dr Chalmers said the multinational tax crackdown would limit debt-related deductions at 30 per cent of profits, limit the ability of hundreds of companies to abuse Australia’s tax treaties when holding intellectual property in tax havens, and introduce new transparency and reporting requirements.

Under Labor’s plan, Australia remains signed on to the two-pillar OECD rewrite of tax rules, which will create a global 15 per cent minimum tax. When finalised, it will target the profits of the world’s largest multinationals including tech giants Amazon, Facebook and Google.

Finance Minister Simon Birmingham said Labor’s “$5bn of so-called savings doesn’t even cover their $5.4bn childcare policy let alone come close to covering the $302bn of vague spending promises in their platform”.

“This isn’t a remotely credible plan when Labor can’t tell you by how much the economy would grow, how many jobs they would create or by how much wages would supposedly rise,” Senator Birmingham said.

Since mid-2016, the ATO has raised almost $26bn in additional tax from multinationals, large companies and wealthy individuals. Labor has previously voted against the government’s changes to multinational tax avoidance, including the diverted profits tax.

Senator Birmingham said the government had committed to implementing OECD-recommended reforms, “aiming for effective implementation in 2023”.

“Labor is simply seeking to count revenue that will form part of future budgets anyway,” he said. “Moving ahead of the agreed OECD timelines may breach the OECD commitments Australia has made, in particular to stand still on unilateral measures until the full package is finalised so as to bring certainty and to ease trade tensions.”

Labor’s commitment to scale back APS outsourcing and hire 1080 frontline workers at Services Australia, the Department of Veterans’ Affairs and National Disability Insurance Agency is expected to be the first in a series of recruitment drives to expand the bureaucracy.

Dr Chalmers, who would not commit to extending the temporary fuel excise reduction beyond September 28 or reintroducing the low-to-middle income tax offset, said Labor would lift stagnant wages by growing the economy and focusing on key productivity drivers.

“There are at least five ways that we would get real wages growing again. First of all, making it easier for people to work more and earn more by reforming childcare, training people for higher wage opportunities, investing in industries where we’ve got issues with wages growth, particularly in the care economy, supporting wage cases,” he said.

A Labor government will prepare a white paper on the labour market, focused on wages and insecure work, and a new “all-of-government framework” dedicated to building collaboration between big business, unions and the $3.5 trillion superannuation fund sector.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout