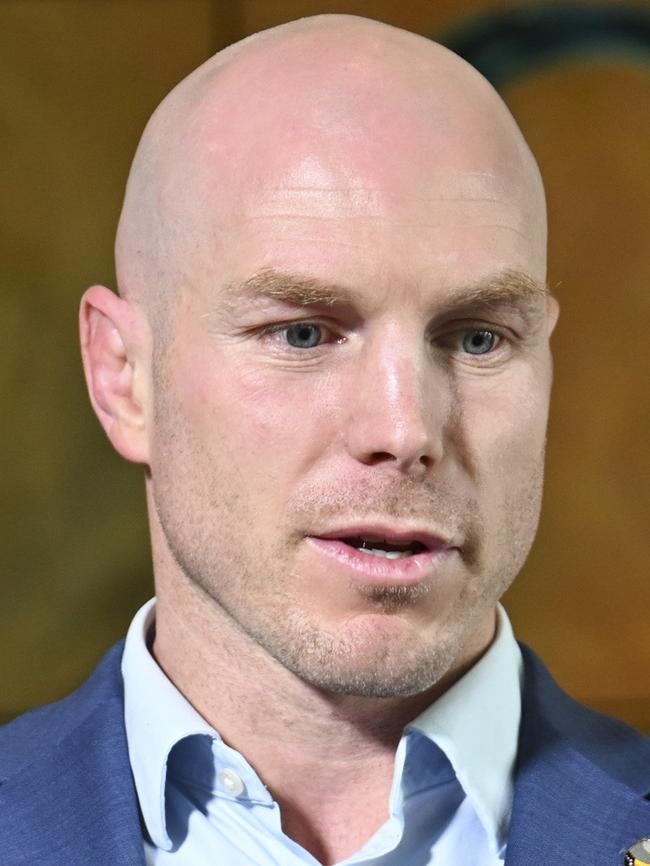

Jim Chalmers fails to win Senate support for raised tax on super earnings above $3m

Jim Chalmers fails to win crossbench Senate support for his bid to raise tax on super accounts worth more than $3m.

Jim Chalmers’s plans to increase the tax rate on superannuation accounts worth more than $3m are set to be blocked by parliament, with the Treasurer failing to win the necessary crossbench support amid warnings that farmers and small business will be forced to sell their assets.

Coalition opposition to the “unfair” overhaul means the government must gain the support of the Greens and at least three Senate crossbenchers to legislate the Better Targeted Superannuation Concessions bill, which Dr Chalmers labelled “unfinished business”.

The Australian has confirmed with seven out of 10 crossbenchers that they are opposed to the legislation, which doubles the tax rate on super earnings above $3m from 15 per cent to 30 per cent – in large part because it applies the tax increase on unrealised gains.

David Pocock, David Van, Gerard Rennick, One Nation’s Pauline Hanson and Malcolm Roberts, Ralph Babet and Tammy Tyrrell rejected the “super tax” plan.

Jacqui Lambie has also voiced opposition to the overhaul, making her the eighth crossbencher to reject the changes, but her office said she wouldn’t comment before having a legislation meeting on Monday.

Independent senator Fatima Payman did not respond to a request for comment while Lidia Thorpe said her support for the bill hinged on whether the government would “step up and deliver better equity in superannuation for First Peoples”.

With the legislation friendless among the crossbench and the Greens waiting to see whether the government will lower the threshold upon which the 30 per cent rate is applied to $2m, the National Farmers Federation and Council of Small Business Organisations Australia ramped up a campaign against the bill.

They say the tax on unrealised gains will have a particularly harmful impact on farmers and small business owners who often hold their farms or premises in self-managed super funds.

“This bill must be blocked,” NFF president David Jochinke said. “Thousands of farmers have placed their assets in super so they can lease the farm business to the next generation.

“It provides retirement income for parents while often giving their children the opportunity to continue the family farm. This tax will undermine all of this.

“Like any property, farmland values can rise, but these paper gains don’t translate to real income. Rises in land values usually mean very little when farms are multigenerational with no intention of being sold. This tax could force some farmers and small businesses and farmers to sell up just to pay their tax bill.”

The NFF estimates 3500 farming families will be hit by the new tax from July if the legislation passes parliament before the election and another 14,000 families will face the same fate if property values grow above the threshold.

COSBOA chief executive Luke Achterstraat said the new tax on unrealised gains on assets held in SMSFs could impose obligations so significant they could consume or even exceed a business owner’s annual income.

“For many, this could mean selling assets to meet the tax bill or raising lease rates so high that their children’s businesses become unviable. This jeopardises the very foundation of family businesses and succession planning,” he said.

“Communities across Australia face a reality where business owners may have to sell off their restaurant, dairy farm, pharmacy or hairdressing premise just to pay their tax bill.”

The change is not indexed, meaning more people will reach the threshold at which the tax rate increases, but the government noted 99.5 per cent of Australians with balances less than $3m would keep receiving the same tax breaks.

“The government is committed to making super tax concessions fairer and more sustainable and we will continue to engage in the Senate to pass the bill,” the Treasurer’s spokesman said.

“These modest changes only apply to the 0.5 per cent of people with more than $3m in super, who will still get generous tax concessions, just slightly less generous ones.”

There is a view within government that the concerns from farmers and small business are overblown, given the new tax rate applies only to a very small number of accounts, the tax liability is only for income above $3m and shouldn’t be that large, and holders of SMSFs must keep some liquid assets as part of their cash flow requirements.

Opposition Treasury spokesman Angus Taylor said the Coalition was “deeply concerned” farmers and small businesses would be forced to sell assets to pay tax on unrealised gains.

“Before the election, Anthony Albanese explicitly ruled out changes to super,” he said.

“It isn’t indexed, meaning a 20-year-old today earning an average wage over their lifetime will pay higher taxes under this scheme.”