Interest rate cuts causing pain for no substantial gain

Tim Wilson has accused the RBA governor of hurting savers and retirees with a series of rate cuts.

The chairman of a parliamentary committee has accused Reserve Bank governor Philip Lowe of hurting savers and retirees with a series of economically damaging rate cuts and laying the groundwork for “radical” money creation programs.

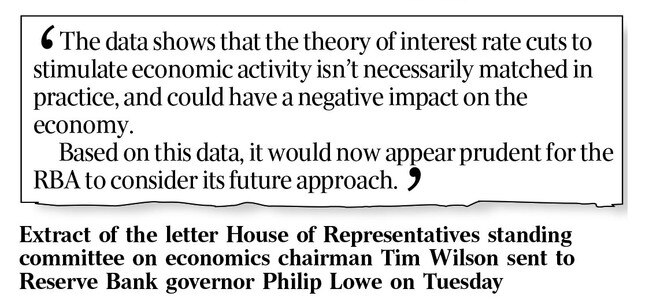

In a private letter seen by The Australian, Liberal MP Tim Wilson has urged the central bank to “consider its future approach”, arguing that its trifecta of interest rate cuts had done little for borrowers while hurting holders of term deposits.

“An insignificant number of Australians with a mortgage have seen an increase in their disposable incomes as a result,” Mr Wilson wrote.

READ MORE: RBA out of rate cut power, says ex-governor Ian Macfarlane | Responsible lending laws choking credit, says former federal treasurer Peter Costello

“The data shows the theory of rate cuts to stimulate economic activity isn’t necessarily matched in practice, and could have a negative impact on the economy.”

The letter challenges the central bank’s strategy as it struggles to meet its inflation target and follows a groundswell of disquiet with the direction of monetary policy — including from former treasurer Peter Costello, former RBA governor Ian Macfarlane and a trio of Liberal backbenchers.

The cuts have also sparked alarm for reigniting house prices in Sydney and Melbourne without boosting economic growth, or household or business confidence.

Mr Costello — Nine chairman — said record low interest rates and tax cuts had failed to stimulate consumer spending, which had hit advertising spending.

Speaking on the sidelines at the Nine annual general meeting, he said there was “a lot of intervention” following the banking royal commission earlier this year that may have “gone a little too far”.

“Once you’ve got a cash rate of 75 basis points, cutting by another 25 is unlikely to change sentiment or behaviour much at all,” Mr Costello said. “And that’s even if you can pass it on into the real economy. And I query whether you can pass full cuts now through to business lending, or for that matter even on mortgages.”

Fresh data from the big four banks provided to the house economics committee has revealed as few as 1 per cent of borrowers have adjusted their monthly mortgage payments down following official cash rate cuts this year, which has facilitated home loan interest rates below 3 per cent for the first time.

“Many banks do not automatically follow through with interest rate reductions unless directly requested by customers,” Mr Wilson said. The percentage of borrowers who had requested a reduction in their repayments ranged from 0.4 per cent at Westpac to 7 per cent at ANZ.

“The impact of reduced interest rates on term deposits is likely to disproportionately hit the disposable income of savers and retirees compared to the contribution of mortgage holders,” he said.

The letter from Mr Wilson emerged as the Reserve Bank announced the governor would give a speech on “unconventional monetary policy: some lessons from overseas” at a business forum in Sydney later this month.

Mr Wilson said he was worried the Reserve Bank had started talking about quantitative easing — a policy where central banks create new money to buy government bonds — to make the policy seem less radical.

His letter asked the governor whether the Reserve Bank, which last week downgraded its economic growth and inflation forecasts, received data from banks before changing the cash rate.

“If not, why has such data not been sought?” the letter asked.

In its latest quarterly update, the RBA conceded conventional monetary policy — adjusting the cash rate to effect lending rates — was nearing the limits of its effectiveness. It conceded further easing could “unintentionally convey an overly negative view of the economic outlook”.

Three Liberal MPs on Tuesday backed Mr Wilson’s call, echoing arguments from economist and former RBA board member Warwick McKibbin that further monetary easing wasn’t working.

Liberal MP Craig Kelly said the cuts could have had a “completely counter-productive effect”.

Jason Falinski, chairman of a separate committee on taxation, said RBA policy risked prompting a “self-fulfilling prophecy” and warned against resorting to quantitative easing: “Every nation that has gone into QE can’t get out of it, starting with Japan, followed by Europe and followed by the US.

“You have people talking up the dangers of the economy and then you have the Reserve Bank lowering the rates to record levels. That sends a signal to people: we really are in trouble.”

Victorian senator James Paterson was also concerned: “Given the profound distributional implications of the asset-price inflation driven by low interest rates, the RBA should carefully consider this new information before embarking on any unconventional monetary policy measures.”

Nine issued a profit warning on Tuesday morning, citing difficult ad market conditions.

Mr Costello said there were restrictions on business, “which if ameliorated would help”.

“I think the responsible lending laws are having the effect of choking credit,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout