Great Australian Dream strangled by government taxes and costs

Australians are paying up to 49 per cent of the total value of home and land packages on taxes, regulatory costs and infrastructure charges, which have accelerated by as much as 106 per cent since 2019.

Australians are paying up to $576,000 – or 49 per cent of the total value of home-and-land packages – on taxes, regulatory costs and infrastructure charges, which have accelerated by as much as 106 per cent since 2019.

Modelling obtained by The Australian reveals the impact of the nation’s crippling red tape and high-taxing environment, as federal, state and local governments drive up the cost of building homes amid calls for Labor and the Coalition to freeze GST on housing.

Ahead of the March 25 budget and a May election campaign that will focus on housing and cost-of-living pressures, Centre for International Economics analysis shows it has never been more expensive for families to build a home. The CIE Taxation of the Housing Sector report, commissioned by the Housing Industry Association, reveals 49 per cent of the total $1.182m outlay to acquire a house-and-land package in a Sydney greenfield estate is made up of regulatory costs, statutory taxes and infrastructure charges.

Crippling cost imposts are replicated across the country, with government-imposed charges dominating outlays in Melbourne (43 per cent), Brisbane (41 per cent), Perth (36 per cent), and Adelaide and Hobart (both 37 per cent). New apartments in infill developments are also copping massive government charges and taxes, with Sydney leading the pack at $346,000 or 38 per cent, followed by Brisbane and Melbourne.

With approvals now taking much longer than the time it takes to build a home, housing industry chiefs are calling on governments to address high levels of taxes and red tape to help deliver Anthony Albanese’s pledge to build 1.2 million new homes by mid-2029.

The report shows it takes more than 12 months to obtain development approval for a subdivision, with seven months attributed to unnecessary delays. Analysis shows it takes up to 50 per cent longer to gain approvals to build a home, with nine months to attain planning permits and just six months to build a house.

CIE figures reveal the value of taxes and charges in Brisbane for greenfield houses has jumped 106 per cent, rising from $169,000 to $348,000 in six years. There has been a 38 per cent hike in Sydney, a 73 per cent rise in Melbourne, a 90 per cent surge in Adelaide and 33 per cent jump in Perth.

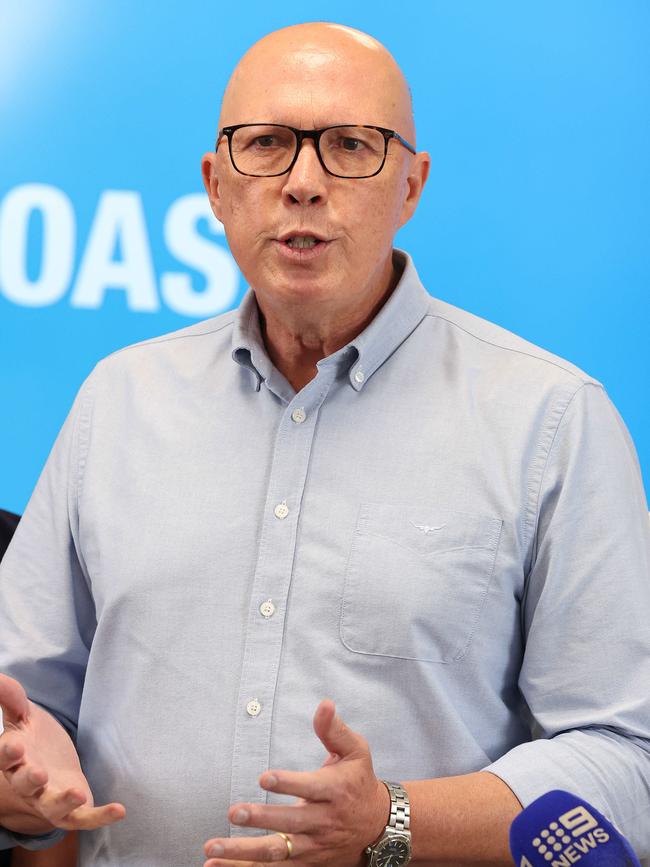

While state, territory and local governments are typically blamed for Australia’s high-taxing housing environment, 14 per cent of all GST revenues are directly associated with housing construction and dwelling ownership. As Jim Chalmers finalises his fourth budget, and with Anthony Albanese and Peter Dutton announcing housing policies worth tens of billions of dollars, industry chiefs are ramping-up pressure to freeze GST on new homes.

HIA chief economist Tim Reardon, who will launch the CIE modelling on Wednesday, said “with half of the cost of a new home being taxes and government charges, new home buyers are spending the first 15 years of a 30-year mortgage just paying off that tax”. He said “politicians continue to deflect the cause of the housing crisis on foreigners, investors, and foreign investors, but it is Australian governments that are the primary main cause of the shortage of housing”.

“Australia has an acute shortage of housing because governments continue to tax new home building and impede productivity in the sector. Government taxes, fees and charges on new homes have doubled in five years. Not even the best, legitimate investment strategies could achieve that same level of return,” he said.

The CIE analysis defined total outlay to acquire a new home as including resources costs, statutory taxes including GST, income taxes and stamp duties, regulatory costs related to cost increases when governments restrict the supply of land and housing relative to demand, and charges associated with government services or infrastructure.

Mr Reardon said “around 10 per cent of total revenue collected by all tiers of government is from taxes on the housing sector … the Australian government should remove the GST from new homes, at least until we build 1.2 million homes”.

“Housing is a necessity and should be exempt from the GST, like other essentials. Housing provides around 14 per cent of GST revenues despite being around 11 per cent of value add. The cascading nature of housing taxes account for this difference. The solution to the housing shortage is to remove government involvement in the sector to ensure that builders can deliver the homes necessary to meet demand.”

Mr Albanese and Mr Dutton have put forward competing plans to fix the housing crisis, with Labor’s strategy underpinned by the $32bn Homes for Australia plan, $10bn Housing Australia Future Fund and $10,000 cash incentives to boost building apprentice completion rates.

Mr Dutton has promised $5bn for enabling infrastructure to unlock up to 500,000 homes and committed to a 10-year freeze on further changes to the National Construction Code, a two-year ban on foreign investors and temporary residents purchasing existing homes, and immigration cuts to free up more than 100,000 additional homes over five years.

With the construction and housing sectors warning of crippling labour shortages, red tape and costs, Labor and Coalition strategists have flagged that voters should expect more housing policies during the election campaign. For new house-and-land packages in greenfield estates, CIE estimated the outlay in Sydney at around $1.2m, $850,000 in Melbourne and Brisbane, and $650,000 in other capital cities.

“Across the seven cities, the share of the outlay that reflects statutory taxes is broadly similar. A substantial share of these statutory taxes is income tax levied on variable resources and GST,” the CIE report says.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout