Gas tax hike: Jackie Trad sparks energy backlash

Former Rudd minister Martin Ferguson warns Queensland’s gas tax threatens investment and energy prices.

Former federal resources minister Martin Ferguson warned last night that the Queensland government’s surprise 25 per cent hike of gas production royalties in the state budget would jeopardise investment in mining and increase energy prices.

The one-time Labor Party and ACTU figure, who also opposed the Rudd government’s resource super-profits tax, which blindsided the mining industry in 2010 and sparked a backlash, said Queensland Treasurer and Deputy Premier Jackie Trad had made the same mistake by failing to consult over the “tax grab”.

“This is going to effectively increase the price of gas and probably raise serious questions in the minds of investors about sovereign risk,” Mr Ferguson told The Australian.

“Can you invest in Queensland with any safety when the Treasurer has just … out of the blue increased royalties by 25 per cent?

“It seems to me that some people in the Labor Party will never learn that, in terms of taxation, you must consult widely and openly, because you have to have a tax regime that means Australia will remain attractive, one that ensures we will get ongoing investment, a reliability of supply and means we are competitive internationally.

MORE: Judith Sloan says Trad doesn’t have a clue | Editorial: Maroon state deeper in the red despite tax hikes | Business: Gas industry pay for heavy spending | Property: Fixer-uppers cut state’s stamp duty takings | Bottomline: ALP turns blind eye to $88bn debt

“Jackie Trad’s tax grab just sends a message to the resources industry generally, not just the gas industry, that you could have serious problems going forward with the Queensland government.”

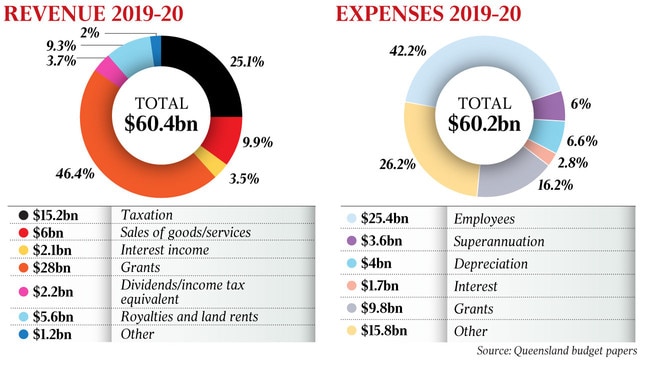

The royalty increase, from 10 per cent to 12.5 per cent, will raise $476 million over the budget’s forward estimates, a key revenue driver for the state Labor government as it struggles to fund record spending on health, education and infrastructure ahead of an election next year.

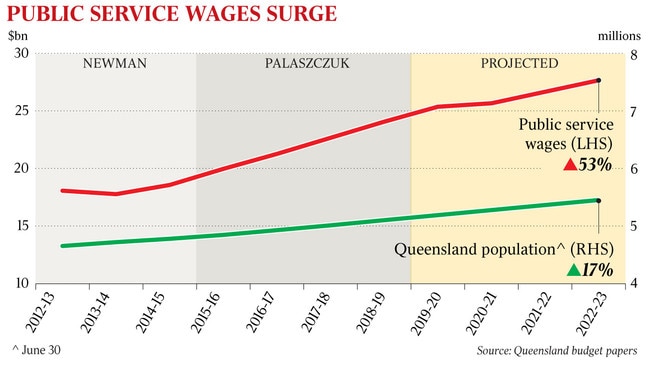

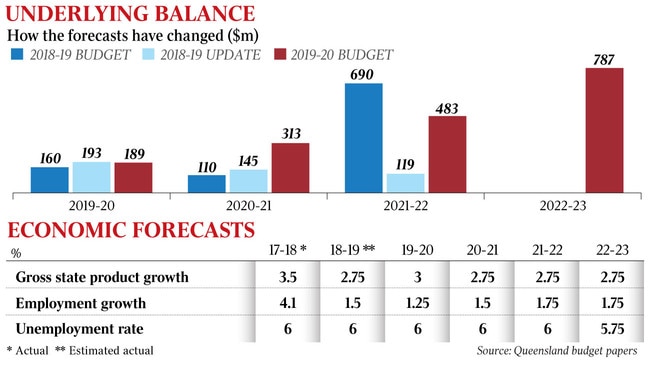

Delivering her second budget yesterday, Ms Trad mirrored Bill Shorten’s failed tax-and-spend agenda, slugging big business with higher taxes, and driving the state further into the red, with total debt to increase to a record $88.1 billion by 2022-23.

The wages bill for an already swollen public sector will grow by 5.4 per cent in the next financial year, costing the budget an additional $1.3bn to take the total to $25.4bn in 2019-20.

The warnings from Mr Ferguson, who chairs an advisory committee to the Australian Petroleum Production and Exploration Association, came as the state ALP government tried to reposition after the Labor vote in Queensland collapsed at last month’s federal election.

Ms Trad branded yesterday’s financial blueprint a “budget for regional Queensland”.

Mr Ferguson’s comments were echoed by another former federal resources minister, Queensland Resources Council chief executive Ian Macfarlane. The Howard government frontbencher said the royalty increase risked long-term jobs in the resources sector and consumers’ gas supply.

“Queensland is the only state on the east coast that is developing its gas resources,” Mr Macfarlane said. “This tax hike risks the gas supply for all Australians, not only Queenslanders, given Queensland gas suppliers have been doing all the heavy lifting for the gas market.”

Resource giants Shell, Santos and APLNG are likely to absorb the brunt of the tax increase, which comes after the government promised to freeze coal royalties for up to three years if coal companies paid $70m into a regional infrastructure fund.

Ms Trad rejected claims she had ambushed the $80bn liquefied natural gas industry, saying she had met APPEA representatives last week and refused to rule out a royalty rise to them.

“Royalties have been frozen for LNG for 10 years,” she told The Australian last night. “LNG grew by more than 40 per cent last year and it continues to grow and we think now is the right time to bring it in line with other exports, other minerals, and to make sure that Queenslanders are getting a good return on the resource.”

Asked if the royalty move had sovereign implications, Ms Trad said: “I just don’t accept it. I think the biggest sovereign risk is not actually opening up the industry. We have released new tenements for explorations and extraction, we have encouraged the industry to think about developing a domestic market for manufacturing in particular. The … other factor we need to consider is that some nations who are exporting their LNG, like Canada, have a royalty rate of 30 per cent. So I think the increase from 10 per cent to 12.5 per cent with an interim royalty rate in between is a modest measure.”

Larger than expected resources royalties of $5.45bn this year, including $4.34bn from coal, are propping up the state’s ailing bottom line, but the budget is still plunging further into debt.

Total government debt is now forecast to climb even higher than predicted, hitting $88.1bn in 2022-23. There is a further $2.6bn in long-term leasing liabilities.

A new accounting principle introduced this year masked the size of overall government borrowings.

There are no debt reduction measures in the budget, but Ms Trad insisted the state’s borrowings were manageable and stable.

She said the government would spend $49.5bn on infrastructure investment over four years, with a focus on projects in the state’s regions, where Labor holds a slew of marginal seats.

As well as the gas royalties increase, more than 6000 big companies will be hit with $500m in payroll tax rises, helping to deliver modest concessions for small and medium businesses and regional operations.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout