Future Fund ruled out of bounds as commonwealth liability hits $50bn

Record-low interest rates have blown out the commonwealth’s unfunded superannuation liability by $50bn in a year.

Record-low interest rates have blown out the commonwealth’s unfunded superannuation liability by $50bn in a year, heaping pressure on the Morrison government as it ruled out drawing on the Future Fund, which has surged to more than $165bn.

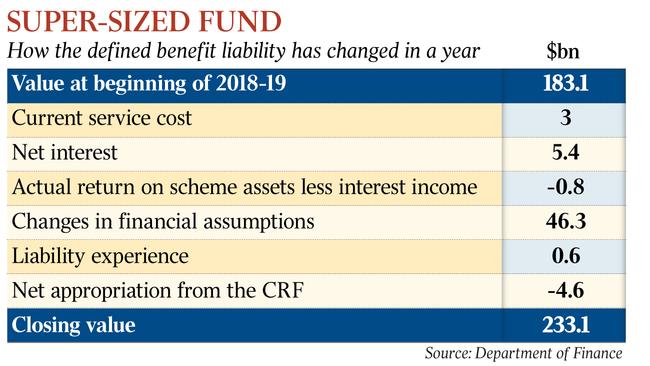

Updated analysis of future pension payouts based on lower discount rates and new wage growth forecasts shows liabilities for defined benefits schemes set up for public servants, judges and former MPs has hit $233.1bn.

The majority of defined benefits schemes remain unfunded but are expected to peak in coming years, with public service veterans claiming lifetime indexed pensions, former parliamentarians claiming annual pensions or lump-sum payments, and judges receiving pensions equal to 60 per cent of their judicial salary.

The Department of Finance, which administers the schemes through the Commonwealth Superannuation Corporation, has warned of exposure to interest rate, investment, longevity and salary risks.

Facing domestic and international economic headwinds, the government on Monday recommitted to a 2017 Coalition pledge to not make withdrawals from the Future Fund in 2020. The earlier pledge indicated a preference to allow the fund to grow further until at least 2026-27.

The Future Fund’s assets are owned by the federal government and exist to “make provision for unfunded commonwealth superannuation liabilities”, to ease pressure on the budget.

Under the Future Fund Act 2006, funds can be withdrawn from the sovereign wealth fund from next year to meet unfunded superannuation liabilities.

Future Fund chairman Peter Costello said from next year the fund would be contributing its profit to the budget bottom line.

According to the Future Fund’s September quarter update released on Monday, the fund had grown to $165.7bn, up from $148.8bn a year earlier.

“The Future Fund is Australia’s sovereign wealth fund that is heading up to around $170bn. It’s the government’s biggest asset and offsets a portion of the government’s debt,” Mr Costello told The Australian.

The former treasurer said the Future Fund was “performing for all Australians by strengthening our financial position”.

“It is a national institution and it has given Australia an entry into the global investment community and is also very valuable in terms of long-term advice,” he said.

On its website, the Future Fund states: “Investment performance, how much money is taken in future years to meet the liabilities and any additional flows in the fund will influence how long the fund lasts but it is expected to continue to operate in much the same way as today for many decades to come.”

In his report to Finance Minister Mathias Cormann, Auditor-General Grant Hehir identified the valuation of superannuation provisions as a “key audit matter”, pointing to overall liabilities and “complex” estimation of long-term assumptions, including wage growth and discount rates.

“To address the key audit matter I assessed the design and effectiveness of control processes over the management of defined benefit schemes, including management of members’ data used in the valuation model,” Mr Hehir said.

He also evaluated the “reasonableness of the review performed by management’s actuary to confirm the integrity of the data used for estimating the defined benefit provision”.

Actuarial assumptions for salary growth up to mid-2023 were estimated at between 2 per cent and 4 per cent across multiple schemes, and up to 3.5 per cent post mid-2023 for eligible public service employees.

A spokeswoman for Senator Cormann said the discount rates applied to value the superannuation liability at June 30 last year were between 2.9 and 3.1 per cent. The discount rates applied as at June 30 this year were between 1.7 per cent and 1.9 per cent.

“The increase in unfunded superannuation liabilities to 30 June, 2019, compared with 30 June, 2018, largely reflects the impact of lower discount rates, which consistent with the Australian Accounting Standards are used to value the liability,” the spokeswoman said.

Long-term commonwealth superannuation membership data released last year showed the Commonwealth Superannuation Scheme (closed in 1990) and Public Sector Superannuation Scheme (closed in 2005) had more than 189,000 contributors, deferred and preserved members and 158,000 pensioners. Most of the defined benefit legacy pensions have been closed, excluding the Judges’ Pension, Governors-General Pension and Federal Circuit Court Judges Death and Disability schemes.

Senator Cormann’s spokeswoman said they expected unfunded superannuation liabilities to fall. “The two largest civilian schemes, the CSS and PSS, have been closed to new entrants for many years,” she said.

“As shown in the 2017 Long Term Cost Report for the CSS and PSS, both the unfunded liability (when valued using a steady long-term discount rate) and nominal outlays will continue to fall as a percentage of GDP.”

For discount rates, the Finance Department used relevant Australian Government Treasury Bond rates to calculate the “defined benefit obligation”.

The short-term wages growth rate was based on the government’s current workplace bargaining policy plus “assumed promotional increases”.

The long-term rate was calculated by “taking into consideration the duration of the salary-linked liabilities, economy-wide wage growth, productivity growth and inflationary expectations plus assumed promotional increases”.

“The assumed rate for future salary increases has been determined having regards to the average expected long-term outlook for the national wage inflation,” the Department of Finance annual report said.

According to the most recent membership figures, there were 482 individuals eligible under the Parliamentary Contributory Superannuation Scheme (closed in 2004).

Membership in the JPS included 94 serving judges and 211 judicial pensioners.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout