Federal election 2022: Supply-demand balance ‘as safe as houses’

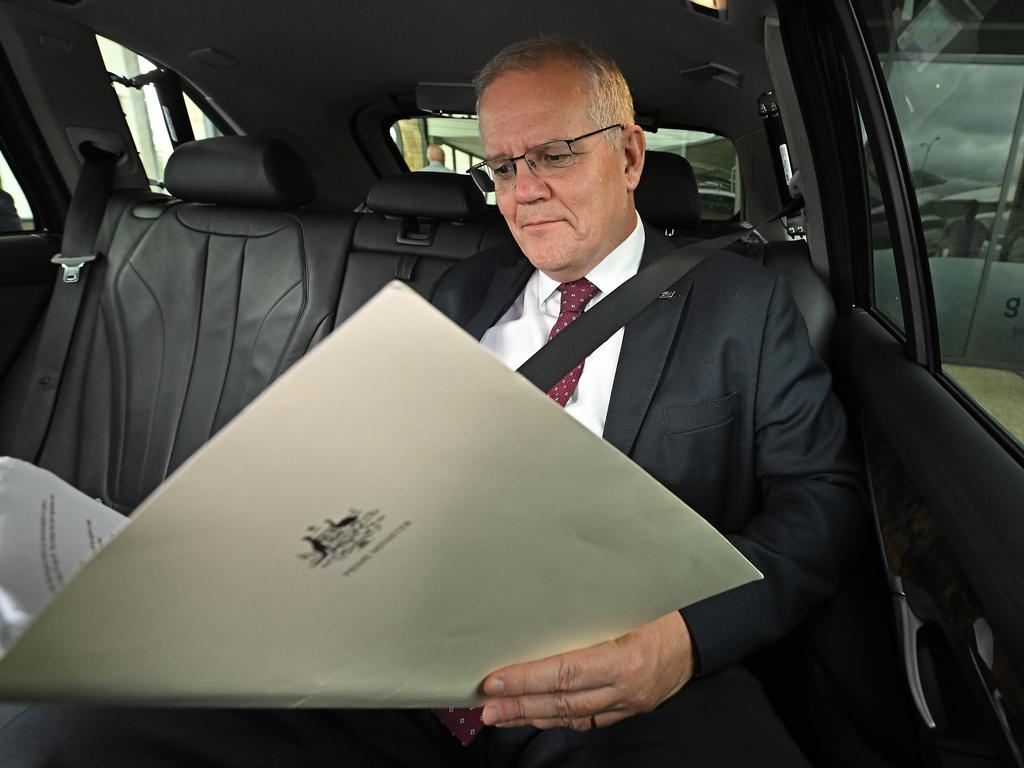

Scott Morrison’s homebuyers scheme aims to fast-track first house purchases by about three years and ease long-term pressure on the age pension.

Scott Morrison’s super homebuyers scheme aims to fast-track first house purchases by about three years and ease long-term pressure on the age pension, with the Coalition promising to avoid a price bump by balancing supply and demand.

The Prime Minister said the scheme, allowing first-home buyers to access up to $50,000 or 40 per cent of their nest eggs, would ensure Australians are “better off” in retirement.

Contrasting the Coalition’s no-strings-attached super housing policy with Labor’s plan to claim a 40 per cent stake in the first homes of low-and middle-income earners, Mr Morrison said “we are reinforcing people’s retirement savings” and addressing supply issues by providing incentives for empty-nesters to downsize.

Anthony Albanese joined union super funds and Paul Keating in lashing the government’s election eve policy, slamming it as “not a good idea” and an “attack on future savings … on future generations”.

Analysis of census data by The Australian reveals nine of the top 16 electorates with voters aged 25-39 are marginal Coalition and Labor seats, including Brisbane, Wentworth, Reid, Parramatta, Solomon, Higgins and Swan.

North Sydney, which is under threat from Climate 200 and Labor, and Mr Albanese’s electorate of Grayndler also feature in the top 20 seats with the highest percentage of potential first-home buyers.

The top 20 seats with voters aged 55-64, who are being targeted by the Coalition with incentives to downsize, include the battleground electorates of Page, Gilmore, Lyons, Eden-Monaro and Braddon.

Ahead of ramping up his campaign schedule in coming days across battleground states, Mr Morrison visited the Labor-held Queensland seat of Blair and must-hold Cairns-based electorate of Leichhardt on Monday to sell his housing policies.

“The number one issue that forces up housing prices in this country is insufficient supply. And this (super) policy, the downsizing policy, the HomeBuilder policy has all been about increasing and supporting that supply, and that’s what can put down the pressure,” Mr Morrison said.

“I know Labor doesn’t like this idea. I know Labor doesn’t want you to have access to your super.

“I know they think that those who run superannuation are more important to them than you are to them because they won’t let you get access to your money.

“They want to keep your money in someone else’s control. I don’t agree with that. I just don’t agree with it. It’s your money and it should be your home.”

The competing housing affordability policies from Coalition and Labor, which have become a centrepiece of the election campaign, are contrasted by longer-term pledges and stricter conditions on ALP pledges.

While Labor has matched most of the government’s housing policy offerings, it will not support using superannuation to help buyers into the market.

Speaking in the marginal Liberal-held Perth seat of Swan on Monday, which Labor is confident of winning, Mr Albanese said the government had released a “thought bubble” with no modelling.

“They have no idea what the impact will be. If you take super away from people, then you’ll have higher deficits and bills from the government in the future,” Mr Albanese said.

“What super is about is making sure that people can retire with a decent income. If you gut people’s super savings, that means down the track more people dependent upon the pension, more pressure on budgets in the future.”

The 2020 retirement income review, led by former Treasury deputy secretary Mike Callaghan, said owning a “home is the most important component of voluntary savings and an important factor influencing retirement outcomes”.

“Homeowners have lower housing costs and an asset that can be drawn on in retirement. If the decline in home ownership among younger people is sustained into retirement, there will be an increasing number of retirees who rent,” the review said.

“The system favours homeowners, such as through the exemption of the principal residence from the age pension assets test.

“Most household wealth for people aged 65 and over is held outside the superannuation system, with owner-occupied housing the largest asset for most retirees.”

The super homebuyer scheme, which the government says will have an “immaterial impact on the superannuation system”, is estimated to reduce the time taken to save for a deposit by about three years.

Government analysis of the scheme says even if all of the average 100,000 first-home buyers per year bought a median-priced property, the “combined value of their home purchases would be less than 1 per cent of the current value of the housing market, which is valued at $9.9 trillion”.

“On average, there are around 100,000 first-home buyers each year. Even if all of them were to access their super, it would still add less than 1 per cent to property transactions given that there was $687bn in housing turnover in Australia in 2021,” the government analysis said.

With $3.5 trillion in superannuation assets under management, the government says if every first-home buyer accesses the full $50,000 from their super every year, “it would amount to $5bn being withdrawn from the super system”. “This equates to 0.14 per cent of total superannuation assets and around 3.6 per cent of annual contributions.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout