Australia is witnessing an astonishing budget recovery without the public having to bear any budgetary pain.

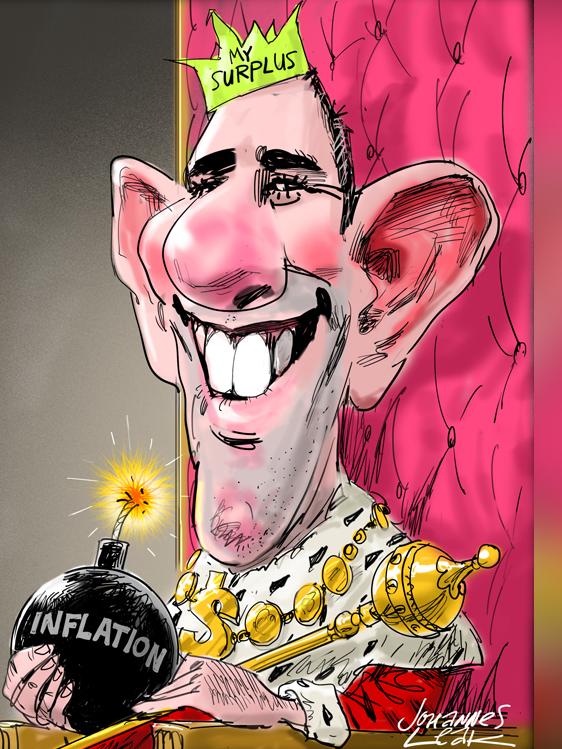

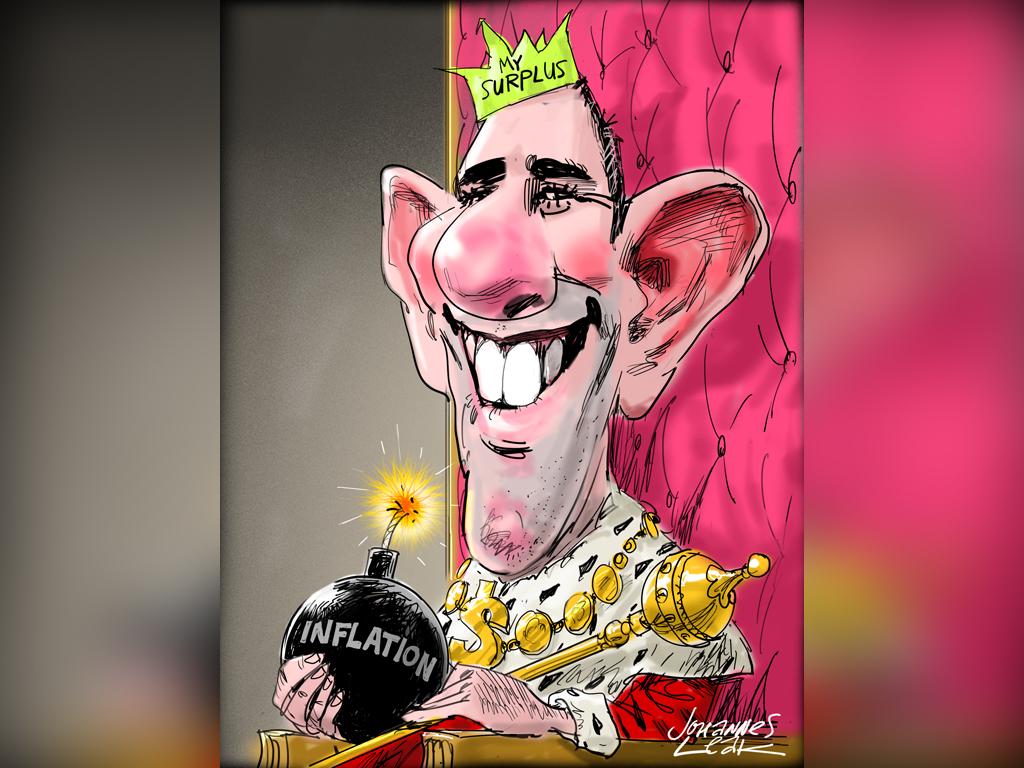

Jim Chalmers should be recognised – it is a budget of calculation and discipline.

But the big picture is writ large: the lucky country has rarely been more lucky. Labor did not make this luck – it is the inheritance of Chalmers and Anthony Albanese – but Labor is using this luck to immense political and economic advantage.

The aspiration is a re-elected and long-run Labor government.

With this budget, Chalmers seeks to resolve the contradiction plaguing Labor since its election win – reconciling its compassion pledges with a fiscal agenda to wind back deficits and debt.

The budget shows a surplus in the 2022-23 year just ending; it projects dramatically reduced deficits across the coming decade; it records a substantial fall in debt levels; and it shows the structural budget deficit – assumed to be $50bn annually – heading towards elimination. It is a budget enshrined in optimistic forecasts.

It looks too good to be true – but might it be true?

There are three big catches.

The cost-of-living package purports to cut the CPI by 0.75 per cent but this raises a conflict between its direct and indirect impacts – the point being this fiscal expansion must put more pressure on the Reserve Bank. The equation is obvious: Labor delivers cash to households now but will blame any downside of more interest rate increases on the bank.

The second catch is the heroic claim that Labor has changed its spending habits – that real annual spending growth will average only 0.6 per cent a year over the five years from 2022-23 and then stay disciplined for the rest of the decade. Is this believable? If true, that’s a new Labor Party. It means Chalmers is reinventing the party. But how does that square with Labor’s recent identity as a progressive party, chasing bigger government and more compassionate outlays?

The third catch is the flaw in Labor’s long-run growth strategy – productivity is weak, economic growth is unconvincing, private sector investment falls short of what Australia needs.

The budget raises profound questions about whether government responsibility will change Labor, or whether Labor will eventually buckle before governing responsibility. That’s the issue for Australia – and for Labor. Chalmers, Katy Gallagher and Albanese believe they are answering this question. We shall see.

The key to the budget is the surge in revenue from home and abroad. Full employment, rising population, increasing tax returns and record commodity prices – the product of war and inflation – have delivered astonishing revenues. The Treasurer had the discipline to take 82 per cent of revenue to the bottom line. That still left a nice package for people suffering under monetary pain.

The cost-of-living package is justified – in terms of politics and fairness. It is an electoral imperative for the government. Chalmers is trying to cover every base – fairness, responsibility and credibility.

The cash support reveals a faithful Labor budget, though the government will come under certain attack for not doing more.

For most people, there are no specific unpopular decisions. The winners are spread wide and rewarded now, with the losers awaiting future decisions from the RBA. It’sa complex compromise between relief, repair and restraint.

With a $4.2bn projected surplus for the year just ending, Chalmers’ dual objective was to validate Labor’s compassion credentials while boosting his fiscal credentials, with a bottom line showing a $125.9bn improvement over the five years from 2022-23.

The cost of government decisions since the October budget is shown at $20.5bn. But that’s a fudge. It doesn’t include the $11bn to fund pay rises for aged-care workers, suggesting the real figure is more like $32bn. Again, what is the inflation impact?

When questioned, Chalmers was adamant; he stood by Treasury’s view that the direct impact of the lower CPI will outweigh the indirect impact of a stimulatory measure adding to higher prices.

The short-term relief is targeted and is intended by the government to signal its values and future intentions. The $14.6bn cost-of-living package over five years includes a $3.5bn boost to help GPs offer free consultations to more than 11 million people, direct energy bill relief for more than five million households, a $40-a-fortnight increase for JobSeeker recipients, rent assistance and boosting support for single-parent payments until their child turns 14.

With his surplus, Chalmers seeks to bury the Coalition’s boast that Labor can’t be trusted with money. While the surplus disappears immediately, the deficits are thin in coming years.

The budget is projected to be back in balance by 2033-34. But this also reflects a different nation – spending is moving onto a higher plateau estimated to be 26.5 per cent of GDP in 2023-24, with tax receipts at 23.9 per cent of GDP, the cap the Coalition imposed on tax levels.

On the spending side, the long-run gains are the reduction in growth of the NDIS – an aspiration not a decision – and the decline in interest payments on debt. Defence spending is projected to rise above 2.3 per cent of GDP by 2032-33, a modest target that will provoke concerns about Labor’s commitment to AUKUS.

Chalmers said he had worked towards “a considered, methodical balance” in the budget. The surplus, the first for a Labor treasurer since Paul Keating in 1989, is a powerful symbol. “In dollar terms this is the biggest budget turnaround on record,” Chalmers told The Australian, a claim that is sure to be disputed.

There is another story. Labor’s growth strategy is dangerously dependent on making Australia “a renewable energy superpower with strong strategic industries in global supply chains.” It’s a laudatory goal, but filled with risks.

For Chalmers, the central messages lies in spending restraint. He said: “We get asked all the time: is the focus of the next budget going to be savings and the structural position of the budget? Our answer to that is ‘No, it’s going to be the focus of every single budget’.”

This budget looks too good to be true. We have never seen budget miracles on this scale before.