Federal Budget 2020 live news: Early tax cut puts millions in the money

More than 11m Australians will pay significantly less in tax after cuts were bought forward by two years.

- Budget winners and losers

- Early tax cuts put millions in the money

- Experts’ budget verdict

- PM’s swipe at Labor’s GFC response

- PM’s policies saved 16,000 Aussies

- Uni fee overhaul set to pass parliament

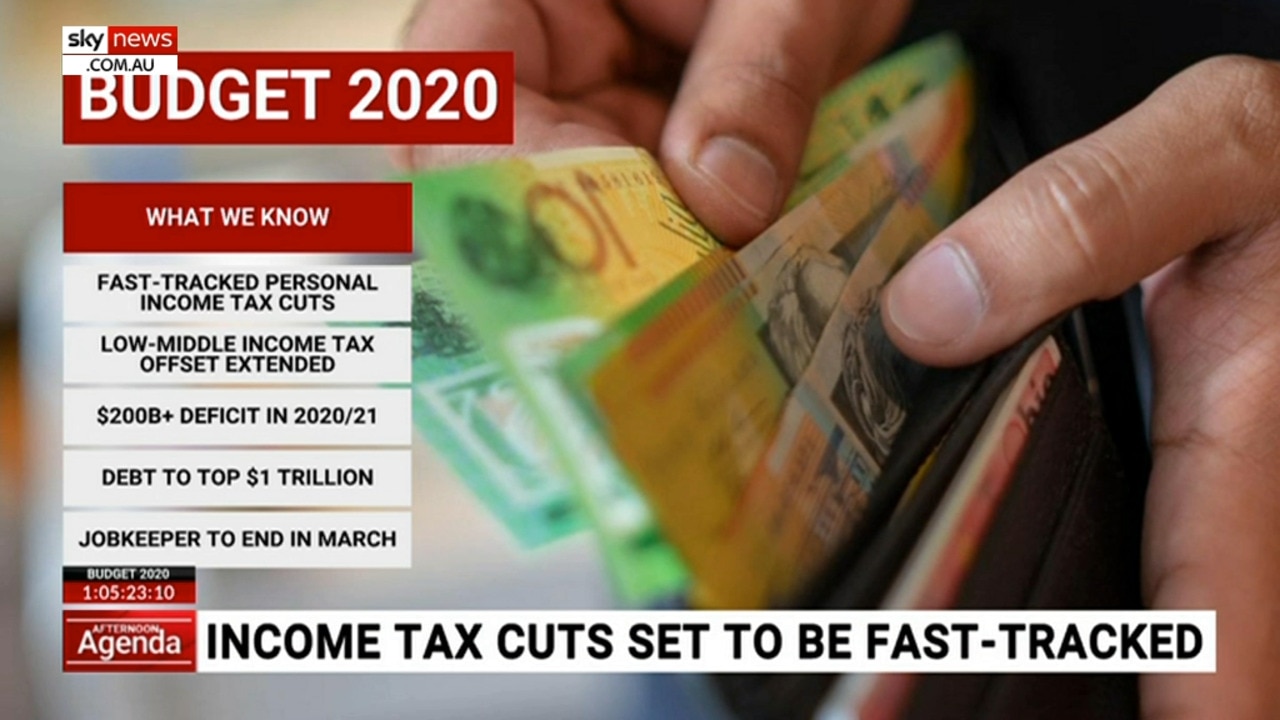

Josh Frydenberg has delivered a budget promising a shorter road to economic recovery with tax cuts for 11m Australians, wage subsidies and business tax breaks. Review the highlights from Federal Budget Day 2020 below.

Simon Benson 9.36pm: Frydenberg’s $74bn road to recovery

Josh Frydenberg will bank on a $74bn jobs and tax stimulus plan including tax cuts for 11 million Australians, $200-a week wage subsidies for new workers and $35bn in business tax breaks to restore the economy to pre-COVID levels next year and drive down the jobless rate.

Delivering a budget promising a shorter road to economic recovery and $17bn back into the pockets of taxpayers, the Treasurer revealed that government spending in response to the pandemic had now reached an unprecedented $507bn.

The government will move immediately to pass its personal income and corporate tax plan in a $74bn JobMaker omnibus bill to be put to parliament on Wednesday claiming it would underpin the creation of 950,000 jobs over the next four years.

But Mr Frydenberg warned the spending would have to come to an end with gross debt forecast to hit as high as $1.7 trillion by the middle of the decade and net debt peaking at $966bn or 44 per cent of GDP in June 2024. The budget confirmed a record deficit of $213bn.

With Geoff Chambers

READ the full story here.

9.30pm: AMA commends $16bn health response

Federal Australian Medical Association president Omar Khorshid has commended the Federal Government’s $16 billion COVID-19 health response and further stimulus spending.

“The budget commits $1.1 billion to a COVID-19 vaccine arriving by next July and assumes any further COVID-19 outbreaks will be localised and contained,” he said.

“The government needs to be willing to rethink scaling back JobSeeker and JobKeeper if a vaccine-led economic recovery is delayed or doesn’t eventuate.

“Governments cannot drop the ball and must continue a broad range of strong policies to keep COVID-19 out of the community in order to ensure a sustained health and economic recovery.”

Adam Creighton 9.24pm: Vaccine tipped to trigger economic rocket

Despite forecasts for the population to shrink for the first time since the 1940s the economy is expected to roar back next year, more than making up for the decline in GDP this year, the government has said in an otherwise sombre set of economic forecasts.

The economy will shrink by 3.75 per cent this year, before growing by 4.25 per cent next year if a “population-wide Australian COVID-19 vaccination program is full in place by late 2021”, the budget papers have forecast, setting the economy up for a feat few others are expected to enjoy.

Economic growth in the US, Japan and eurozone nations next year is expected to be significantly smaller than the decline experienced this year.

READ the full story here.

9.19pm: Budget ‘fails to deliver adequate JobSeeker rate’

The Australian Council of Social Service has expressed disappointment that no permanent increase to unemployment benefits was announced in the budget.

“The federal budget had failed to deliver a permanent, adequate JobSeeker rate,” chief executive officer Cassandra Goldie said.

“It leaves more than two million people receiving higher income support uncertain about their future beyond the end of the year, when income support rates will go to their pre-COVID levels – which, for JobSeeker, was $40 a day.

“This budget provides a glimmer of hope on jobs for young people in a really tough year. While we welcome the wage subsidy for under-35s who are badly impacted in this recession, the budget lets down 900,000 people on JobSeeker who are over 35.

“We’re calling for the wage subsidy for young people to be urgently extended to people of all ages who have been unemployed for a year or longer.”

9.16pm: Income tax cuts to adjust spending behaviour: CBA

Fast-tracked income tax cuts included in the federal budget will alleviate pressures upon households and businesses, the Commonwealth Bank says.

The major bank has been advocating for the cuts to be fast-forwarded for the past 18 months.

Commonwealth Bank chief economist Stephen Halmarick said the permanent changes in tax brackets would boost take-home pay and consumer spending.

“If you permanently decrease someone’s tax liability, they can adjust their behaviour on a permanent basis,” he said.

He said the changes to instant asset write-offs and loss carry-back refunds for businesses making a loss due to COVID-19 would be significant in generating economic activity during the recovery.

“All those policies ... will really be important in maintaining cash flow while we are in this recession,” he said.

Rachel Baxendale 9.12pm: ABC set for years of decreased funding

The ABC is set to face ongoing cuts to its budget in real terms, with funding for broadcasting — which covers the national broadcaster and SBS — subject to a 0.7 per cent decrease in real terms from 2019-20 to 2020-21, and a 3.7 per cent decrease in real terms from 2020-21 to 2023-24.

The decrease reflects the Morrison government’s decision in the 2018 budget to freeze ABC funding at 2018-19 levels until at least 2021-22, saving $84m. The broadcaster’s average staffing level fell from 4069 people in 2019-20 to 4030 in 2020-21, necessitating a recent round of redundancies.

The freeze has been partially offset by a $33m package for the screen sector and a $7.6m package over four years to assist SBS in providing enhanced language services, both of which were announced earlier this year, as well as the $44m “Guaranteeing Australia’s Public Broadcasters” package announced in last year’s budget, which runs for three years from 2019-20 and provides supplementary funding for the ABC and SBS.

READ the full story here.

9.05pm: ‘A budget that is right for the times’

A peak Australian industry group has welcomed the stimulus in the budget, saying it is “a budget that is right for the times: stimulatory, inclusive, confidence-building and forward-looking”.

Ai Group chief executive Innes Willox said the budget would help to counteract the decline in gross domestic product brought on by the lack of immigration, which traditionally plays a critical role in Australia’s economy.

“In the face of these forces, the large boost to household incomes from the bring forward of personal income tax cuts; the additional direct payments to households and the large commitments to infrastructure spending will stimulate aggregate demand and fuel the recovery,” he said.

David Ross 9.01pm: ‘No other alternative’ but to splash cash: Frydenberg

Josh Frydenberg has locked in behind his budget, saying the government had “no other alternative” but to splash cash to support the economy.

“There is great uncertainty, unprecedented uncertainty in the economic environment not just here in Australia but globally right now,” Mr Frydenberg said, speaking with ABC journalist Leigh Sales.

The budget papers make several assumptions, notably including a border closure with West Australia well into 2021, pointing to an April end to restrictions.

“The treasury papers outline a couple of other scenarios that may be better cases. So we could get access to the vaccine earlier than is laid out in the budget papers, and will lead to a $34 billion boost to the economy,” he said,

“These are projections. These are forecasts, these are made during a once in a century global pandemic. But there is a clear path back to jobs and employment for hundreds of thousands of Australians.”

The Treasurer defended the hard end to the JobKeeper and JobSeeker schemes, saying they would be supplemented by a cash flow boost that would support small businesses in addition to other incentives.

“There is a whole suite of measures designed to boost the employability of Australian workers and to encourage businesses to take them on,” he said.

“All those inputs are helping to create a stronger economy. JobKeeper was temporary targeted and at $101 billion, the most significant and successful program any Australian government has undertaken in an environment such as this.”

The government is set to bring forward all but stage 3 of its tax cut scheme, with the Treasurer saying it was “what the economy needs at this time”.

“The changes to stage two, bringing it forward by two years but also kept in an additional low, middle income tax offset will see an Australian who earns $60,000 today paying $2160 less tax this year compared to prior,” he said.

However, he said the government would maintain a “watching brief” on whether to bring forward stage 3.

But the Treasurer declined to be drawn on whether he expected to be able to deliver a surplus during his time in government.

“I’m not putting a date on that,” he said.

“The reality is we printed a series of deficits tonight and at a higher debt burden but this has been the heavy price to save lives and livelihoods, we had no other alternative but to spend as we have and it has helped make Australia a stronger nation and helped see Australia come through this crisis nearly better than any other developed economy across the world.”

Olivia Caisley 9.00pm: Budget does good job in Pacific, but not Asia

Mark Purcell, CEO of the Australian Council of International Development, said the budget didn’t go far enough when it came to aid in Asia, but said it had “done a really good job in the Pacific.”

Mr Purcell said the Morrison government needed to try harder in the 2021 budget when it came to assisting Australia’s neighbours in southeast asia.

“All of our trading relationships in the future are going to be based around Southeast Asia and we’ve seen no real effort to address the impacts, both the health impacts and the economic impacts of COVID-19 among our major neighbors in Southeast Asia and what’s more, we’ve actually seen small declines in funding and assistance to countries in West Asia.”

He also hit out at cuts to the International Committee of the Red Cross, which he said was surprising given the world was experiencing the biggest pandemic in a century.

Ewin Hannan 8.53pm: JobMaker Hiring Credit to to create 450,000 jobs

Employers who take on an unemployed young person will be eligible for a $200-a-week wage subsidy for the next 12 months under a $4bn scheme designed to create 450,000 jobs.

The JobMaker Hiring Credit, to be made available from Wednesday, is a key feature of the government’s bid to drive down the unemployment rate, which Treasury now forecasts will peak at 8 per cent in December.

READ the full story here.

Olivia Caisley 8.50pm: Big deficit ‘essential’ to fight unemployment rate

Chris Richardson, Partner at Deloitte Access Economics, said big deficits were essential in the fight to reduce the unemployment rate.

“The key point of the budget is the cost of that debt,” he said. “The interest payments that we are making are no higher across the entire four years than the government’s forecast. In fact they are lower than they were in 2018.”

He said the dominant part of the budget was tax cuts but wage subsidies were also a “good idea”, especially for the young unemployed.

8.42pm: ‘Concerning’ detail hidden in budget

There is a detail in the budget that should “concern” all Australians, a peak business body says.

“There’s one thing in the budget that should give us all pause to concern and that is the prediction that Australia’s net overseas migration is actually going to turn backwards and go negative, and our population growth is going to slow right down,” Australian Chamber of Commerce and Industry chief executive officer James Pearson said.

“That’s a problem because while we can boost productivity ... and we can encourage participation, we need to have a growing population ... if we’re going to underpin solid economic growth into the future.”

Despite this worry, Mr Pearson applauded the budget measure that allows 99 per cent of businesses to deduct the total cost of eligible depreciable assets.

“The provision of a significant accelerated depreciation ... will encourage businesses large and small to go out there and take risks. Make the plunge to buy capital equipment. They’ll buy that 3D printer; they’ll buy that new truck if they’re a tradie.”

Olivia Caisley 8.40pm: ‘Good budget for farmers, regional Australia’

Tony Mahar, Chief Executive of the National Farmers’ Federation, said the budget was good for farmers and regional and rural communities in general.

He said he was pleased the government had recognised that farmers were going to help kickstart the economy and hoped new infrastructure funding would result in new dams.

He said there needed to be less finger pointing between the states and commonwealth when it comes to water management so “we can grow food and fiber that Australians demand and the community the international community”.

“By and large, this is a good budget for farmers, a good budget for rural and regional economies, and we hope the Australian agriculture sector can continue to kick start the economy, so that we can grow the Australian farming sector $100 billion by 2030.”

Meanwhile, Ian Henschke, Chief Advocate for National Seniors Australia, slammed the budget as a missed opportunity, declaring he was very disappointed by the announcements.

“The royal commission heard that 30,000 people either died waiting for a package or going into aged care unnecessarily because they couldn’t be kept in their home,” he said. “So this is really not addressing the problem.”

Mr Henschke said he hoped the next budget would fix the problem, especially the issue of ballooning home care waiting lists.

“There are 100,000 Australians waiting for home care and the government has provided 23,000 places over four years, so it’s barely addressing the need … I’m deeply disappointed.”

8.36pm: ‘Very good news for older Australians’

Boosts to the age pension announced in the Budget are “very welcome”, the peak group for Australian seniors says.

“Some very good news for older Australians in the Budget: two lots of stimulus supplements for the age pension $250 in December and $250 next March,” Council on the Ageing chief executive Ian Yates said.

“We’re very pleased ... with 23,000 new home care packages to provide Australians with better care and more care at home. It’s not sufficient to bring the waiting list down to 30 days, but it’s a very big first step.”

8.33pm: Our experts deliver their budget verdict

Our experts weigh in on how the budget will affect tax, welfare, aged care, health, education and the economy. Read their verdict here.

Dennis Shanahan 8.29pm: Recession-busting recovery plan built on optimism

COMMENT

Scott Morrison’s pandemic recession busting budget and economic recovery plan are built on optimistic forecasts, classic Liberal commitments to private sector investment, a political pinching of Labor’s clothes and an assumption there will be a COVID-19 vaccine generally available next year.

It has also been made possible by historically low interest rates on a day the Reserve Bank kept official rates at just .25 per cent.

In a sea of uncertainty, Josh Frydenberg and Mathias Cormann have decided to make the brave assumption, based on health advice, that there will be a vaccine available to the general Australian population — and elsewhere — by late 2021.

READ the full story here.

Joe Kelly 8.26pm: Who are the budget's winners and losers?

Josh Frydenberg’s COVID-19 budget does its best to turn everyone into ‘winners’, but many will miss out. Read the full list here.

8.23pm: Money Cafe: decade of deficits and a blizzard of measures

Alan Kohler and James Kirby discuss the 2020 budget from inside the lockup: the debt scenario facing the nation after COVID, surpises, super reforms and their verdict. Listen below, or in the podcast app of your choice.

Patrick Commins 8.20pm: Early tax cut puts millions in the money

More than 11 million Australians will pay thousands of dollars less in tax this financial year after the Morrison government brought forward the second stage of its tax cuts by two years to July 2020, in a move Josh Frydenberg said would boost the economy by $12.5bn and create an additional 50,000 jobs.

“Australians will have more of their own money to spend on what matters to them, generating billions of dollars of economic activity and creating 50,000 new jobs,” the Treasurer said. “As they spend their tax cuts, this will also help local businesses to keep their doors open and hire more staff.”

Framing the tax cuts as a stimulatory measure that will help the economy recover from the COVID-19 crisis, Mr Frydenberg said “the greatest benefits will flow to those on lower incomes”.

READ the full story here.

8.18pm: ‘The right budget at the right time’

The business community has hailed the government for delivering “the right budget at the right time”.

The Business Council of Australia said the budget’s measures, such as the instant asset write-off, would increase business investment and create jobs.

“By shifting from emergency support to targeted spending, the budget will help employers get back to business and get on with urgently creating the new jobs needed for the recovery,” chief executive Jennifer Westacott said.

“This investment incentive will create new purchase orders and jobs by encouraging businesses to immediately expand, innovate, update technology and buy new equipment.”

She added the fast-tracked income tax cuts would increase demand in hard-hit sectors such as hospitality, retail and tourism.

Adrian McMurray 8.16pm: The Treasurer’s $74bn road to recovery

With our reporters and editors now out of the budget lock-up, we’re going to focus on getting you the best of our budget coverage and the latest reaction from all the key players. You can read Josh Frydenberg’s speech in full here. Simon Benson and Geoff Chambers’ overview of the budget is here.

8.11pm: Recession to be deeper than necessary: Labor

Shadow treasurer Jim Chalmers says the budget will rack up trillion of dollars in debt but does not do enough to create jobs.

“Despite producing a grab-bag of headline-seeking announcements, the government expects another 160,000 Australians to be added to the jobless queues by Christmas,” Mr Chalmers said in a statement.

Labor criticised the government’s failure to lift the permanent JobSeeker rate above $40 per day, improve access to childcare, promote cleaner energy, or address the crisis in aged care.

“While the average worker will receive a $50 per fortnight tax cut, millions on JobKeeper have seen their payment cut by at least $300 per fortnight,” Mr Chalmers said.

“Decisions taken by the Liberals in this budget mean that the Morrison Recession will be deeper and longer than necessary.”

Adrian McMurray 8.09pm: Infrastructure boost across nation

Infrastructure is getting a shot in the arm, with the following projects to be funded:

• The Singleton Bypass and Bolivia Hill Upgrade in New South Wales

• The upgrade of the Shepparton and Warrnambool Rail Lines in Victoria

• The Coomera Connector in Queensland

• The Wheatbelt Secondary Freight Network in Western Australia

• The Main South Road Duplication in South Australia

• The Tasman Bridge Upgrade in Tasmania

• The Carpentaria Highway Upgrades in the Northern Territory, and

• The Molonglo River Bridge in the Australian Capital Territory.

“Funding for these shovel ready projects will be provided on a use it or lose it basis. If a state drags its feet, another state will get the money. We need works to start, not stall,” he says.

Adrian McMurray 8.02pm: Focus on supporting women return to work

Mr Frydenberg says the government is committed to seeing women return to the workforce after many lost their jobs during the pandemic. New cadetships and apprenticeships for women in STEM, job creation and women’s safety at work and home comprise part of the $240m in measures announced.

Adrian McMurray 8.00pm: Instant asset write off expanded

There’s good news for businesses too, with the popular instant asset write off scheme expanded.

“From tonight, over 99 per cent of businesses will be able to write off the full value of any eligible asset they purchase for their business.

“This will be available for small, medium and larger businesses with a turnover of up to $5 billion until June 2022.

“It is a game changer. It will unlock investment.”

Adrian McMurray 7.58pm: Tax cuts for 11 million Australians

Mr Frydenberg has good news for 11 million taxpayers: a tax cut backdated to 1 July this year.

“Lower- and middle-income earners will this year receive tax relief of up to $2,745 for singles, and up to $5,490 for dual income families compared with 2017-18,” he says.

“We will achieve this by bringing forward stage two of our legislated tax cuts by two years, lifting the 19 per cent threshold from $37,000 to $45,000, and lifting the 32.5 per cent threshold from $90,000 to $120,000.

“We will also retain the Low and Middle Income Tax Offset for an additional year.

“Under the Coalition taxes will always be lower.”

Adrian McMurray 7.52pm: Jobs at the centre of 2020 budget

The Treasurer rams home the jobs message, outlining the JobMaker hiring credit scheme.

“The JobMaker hiring credit will be payable for up to twelve months and immediately available to employers who hire those on JobSeeker aged 16-35.

“It will be paid at the rate of $200 per week for those aged under 30, and $100 per week for those aged between 30-35.

“All businesses, other than the major banks, will be eligible.”

He says it will create around 450,000 jobs for young Australians.

“Having a job means more than earning an income. It means economic security. It means independence. It means opportunity. We can’t let this COVID recession take that away.”

Mr Frydenberg talks to the $1.2bn set aside for 100,000 new apprenticeships and traineeships, in the form of a 50 per cent wage subsidy.

Adrian McMurray 7.48pm: ‘Our circumstances have changed, but our values endure’

The Treasurer says the nation embarks on the next stage of its journey tonight.

“Our plan will continue to guarantee the essential services Australians rely on. Without increasing taxes. Our plan is guided by our values. Our circumstances may have changed, but our values endure.

“Providing a helping hand to those who need it. Personal responsibility. Reward for effort. The power of aspiration.

“We owe it to the next generation to ensure a strong economy so that their lives are filled with the same opportunities and possibilities we have enjoyed.”

Adrian McMurray 7.44pm: ‘The Australian economy is fighting back’

Of course, the huge financial support has come at a cost. The Treasurer, outlining the “heavy burden” that awaits the nation, says the deficit will reach $213.7 billion this year, falling to $66.9 billion by 2023-24.

“Net debt will increase to $703 billion or 36 per cent of GDP this year and peak at $966 billion or 44 per cent of GDP in June 2024,” he says.

“By comparison, Australia’s net debt as a share of the economy will peak at half of that in the UK. Around a third of that in the US. And around a quarter of that in Japan today. Australia’s economy contracted by 7 per cent in the June quarter. By comparison, there were falls of around 12 per cent in New Zealand, 14 per cent in France, and around 20 per cent in the UK. Mr Speaker, the Australian economy is now fighting back.”

Adrian McMurray 7.40pm: ‘Temporary, targeted and proportionate support’

Mr Frydenberg continues by working through the government’s “unprecedented support”.

“Our measures were temporary, were targeted, and were proportionate,” he says. “JobKeeper is a $101 billion economic lifeline that is today supporting more than 3.5 million Australians. The cash flow boost has already provided $28 billion, helping around 800,000 small and medium-size businesses stay afloat. JobSeeker doubled the safety net. And two $750 payments went to millions of pensioners, carers and others on income support.

“Together our actions saved 700,000 jobs.

“We could do this because we entered this crisis from a position of economic strength. We brought the Budget back to balance for the first time in 11 years. And we maintained our AAA credit rating. This gave us the fiscal firepower to respond when we needed it most.”

Adrian McMurray 7.30pm: Frydenberg begins budget speech

Treasurer Josh Frydenberg begins by looking back over a horror 2020.

“In 2020, Australians have been tested like never before. Flood, fires, drought and a global pandemic. So many Australians, through no fault of their own, are doing it tough,” Mr Frydenberg says.

He says tonight is a night to give thanks health care workers and firefighters, and “a proud nation” will “get through this together”.

“The Great Depression and two world wars did not bring Australia to its knees and neither will COVID-19. Mr Speaker, COVID-19 has resulted in the most severe global economic crisis since the Great Depression. Across the world, the equivalent of 600 million jobs have been lost. The global economy is expected to contract by 4.5 per cent this year, compared to just 0.1 per cent during the GFC. Australia has not been immune. Our economy has been hit and hit hard. In the space of just one month more than one million Australians have lost their job or saw their working hours reduced to zero. In my home state of Victoria, millions have been in lockdown.”

Sarah Elks 5.30pm: Palaszczuk begins re-election bid in Mount Isa

Queensland Premier Annastacia Palaszczuk has kicked off her election campaign and headed straight for Mount Isa, the state’s safest seat and held by crucial crossbencher Robbie Katter.

Mr Katter, leader of the Katter’s Australian Party and commander of three of the seven crossbench votes in the current Queensland parliament, holds the enormous north-west Queensland electorate of Traeger by 28.49 per cent.

In a break from tradition, Ms Palaszczuk has flown to the resources capital of Queensland, despite expectations she might go directly to must-win marginal coastal regional Labor seats in Townsville and Cairns.

Labor holds 48 of the parliament’s 93 electorates, a two-seat majority, with the LNP on 38. The Opposition needs a net gain of nine seats to win majority government. Eight of Labor’s seats are regional and are held on a margin of less than 4.5 per cent.

She is expected to centre the second day of her re-election push on mining – an issue she tried to avoid during her 2017 campaign, when Indian conglomerate Adani’s controversial Carmichael coal mine project dominated.

Ms Palaszczuk’s Labor government was hammered from both sides: anti-Adani environmental activists demanding the project be stopped, and pro-resources rural and regional communities – including Labor-aligned unions – demanding it go ahead to provide much-needed jobs.

Recently, the CFMEU slammed the government for forgetting its blue-collar roots, by stalling approvals of New Hope’s New Acland coal mine expansion, west of Brisbane. The union’s construction and mining divisions left Labor’s dominant Left faction, promising not to provide donations, manpower or other resources to the government for this campaign.

While both sides of politics have ruled out doing a deal with minor parties or independents to form government, Mr Katter has told The Australian he’s willing to help Labor or the LNP to form minority government – but his price is support for key north Queensland initiatives.

In an interview with The Australian, he said he’s willing to negotiate with both sides of politics in the event of a hung parliament, but the price of power is ambitious demands for regional Queensland, including a state-funded rail line to open up the burgeoning Galilee coal province.

He wants part of the $5bn Queensland Future Fund – established by former Treasurer Jackie Trad to pay down debt – quarantined to build infrastructure in north Queensland and run by an independent corporation. And he wants the “weak” four per cent ethanol mandate – negotiated by the minor party with Ms Palaszczuk’s first-term minority government in 2017 – beefed up to an enforced 10 per cent.

Mr Katter will also call for the building of more dams, including the Hells Gate dam north of Charters Towers, and the Hughenden Irrigation project.

Earlier today, Ms Palaszczuk said it was “up to the market” if the Galilee Basin coal province becomes one of the world’s largest, declaring she supports jobs in coal.

Ms Palaszczuk’s Labor government rushed to sign a royalties deal with Indian mining conglomerate Adani, which is building a large thermal coal mine in the Galilee Basin, which Labor sources said was to remove the “barnacles” before the election campaign, which kicked off today.

During the 2017 election campaign, Ms Palaszczuk’s travels were marred by anti-Adani protesters, and Labor’s federal campaign last year was also dogged by the issue of the party’s equivocal support for coal mining.

Asked whether she hoped the Galilee Basin would fulfil its promise as one of the world’s largest coal provinces, Ms Palaszczuk said: “That’s up to the market, but let me say very clearly, we support the resources industry, I’ve made that absolutely clear”.

“We back jobs, whether they be in coal, whether they be in copper, whether they be in bauxite, whether they be in renewables. Queenslanders are employed in a whole range of fields … in other parts of the world, people are not working. Mining is shut down, agriculture is shut down, schools are just going back in some countries (due to COVID-19),” she said.

After federal Labor’s drubbing at the 2019 federal election, particularly in Queensland, Ms Palaszczuk announced she was unhappy with her government’s action in progressing Adani’s approvals, and ordered they be fast-tracked.

Asked if her government was re-elected, would she give the other Galilee Basin proponents the confidence their approvals would go through speedily, Ms Palaszczuk demurred.

“The approvals have to go through the normal processes,” she said.

READ MORE: Let me finish the job, Palaszczuk says

Olivia Caisley 3.52pm: QT wrap: Morrison launches defence of pandemic response

Labor used Question Time on Tuesday to attack Scott Morrison’s claims he would bring the budget “back to black” as his government prepares to deliver an eye-watering deficit in the wake of the coronavirus pandemic.

“Isn’t that the case that this government has never delivered a surplus, never will deliver a surplus,” Mr Albanese asked.

But the Prime Minister stood by his claim and seized on the question to attack Labor over its own economic track record and handling of the Global Financial Crisis.

“What I know, Mr Speaker, is this government brought the budget back into balance before the COVID recession hit,” he said. “And Mr Speaker, those opposites seem completely oblivious … In fact, it is a carnival over there.”

Deputy Labor leader Richard Marles flashed the infamous “Back in Black” mug before receiving a warning from the Speaker about the use of props.

“I was just wondering what might be on the Prime Minister‘s mug this year?” Mr Marles quipped, leading the chamber to erupt in jeers as Mr Morrison accused the Opposition of “juvenile tactics”.

Mr Morrison took repeated swipes at Labor’s response to the GFC and defended his government’s economic management, declaring Australia was one of the few countries to be able to steer its way through the pandemic.

“You manage a crisis with the strength and responsible economic management and the responsiveness and the certainty that our government has provided over these many past months,” he said.

Mr Morrison also accused Labor of mismanaging the GFC by building “overpriced school halls” and “setting fire to people’s houses”.

“The Leader of the Opposition may not know this, but the forecast fall in the global economy is 4.5 per cent,” he said. “During the global financial crisis, the global economy fell by 0.1 per cent, so what our government is facing is 45 times more severe than when those opposite thought the response was to build overpriced school halls and set fire to people’s houses.”

During the fiery hour of questioning Speaker Tony Smith issued a warning to opposition treasury spokesman Jim Chalmers for interjecting.

Meanwhile, a question about delays to key infrastructure projects led Deputy Prime Minister Michael McCormack to quip “how good is infrastructure” as he rattled off a list of new building works.

“Ask me a question about it, I would love to answer it,” Mr McCormack said. “Thankfully you asked one directly, I would love to answer more from you, because it is just like a Dorothy Dixer, it‘s fantastic, I love questions about infrastructure, because we have got so much delivery.”

Over in the Senate, Aged Care Minister Richard Colbeck drew the ire of the chamber when he said the Aged Care Royal Commission “made no comment” about the government’s response to the coronavirus crisis in nursing homes.

The special report, handed down last Thursday, called on the government to provide immediate funding for more staff to ensure family and friends can safely visit nursing home residents.

It recommended additional funding for allied and mental health services for people in aged care, saying the existing restrictions had “tragic, irreparable and lasting effects which must be immediately addressed”.

And it said the government must ensure all nursing homes have at least one accredited infection control officer.

Senator Katy Gallagher asked him how he could possibly make that statement, given the royal commission had recommended the government publish a national aged care plan for COVID-19.

But Senator Colbeck said he had been taken out of context and his comment was simply about the “withholding of PPE” as he accused Labor of “dishonesty”.

“I was directly answering and being directly relevant to a question that I was asked with respect to the provision of PPE.”

READ MORE: Another $2bn to build our recovery

Jade Gailberger 3.18pm: Deputy PM loves ‘questions about infrastructure’

How good is infrastructure? Just ask Deputy Prime Minister Michael McCormack.

“Ask me a question about it, I would love to answer it,” Mr McCormack said. “Thankfully you asked one directly, I would love to answer more from you, because it is just like a Dorothy Dixer, it’s fantastic, I love questions about infrastructure, because we have got so much delivery.”

Jade Gailberger 3.10pm: PM defends budget surplus claims

Prime Minister Scott Morrison has been grilled over the truth of his comment last year that he “brought the budget back into surplus next year”.

“Isn’t that the case that this government has never delivered a surplus, never will deliver a surplus,” Mr Albanese questioned.

But Mr Morrison has stood by his claim.

“What I know, Mr Speaker, is this government brought the budget back into balance before the COVID recession hit,” he said.

“And Mr Speaker, those opposites seem completely oblivious … In fact, it is a carnival over there.”

READ MORE: Signs of life ahead of budget

Jade Gailberger 2.54pm: PM blasts Marles’ ‘juvenile tactics’

Deputy Labor leader Richard Marles has flashed the infamous “Back in Black” mug before receiving a warning from the Speaker about the use of props.

“I was just wondering what might be on the Prime Minister’s mug this year?,” Mr Marles said.

The chamber erupted as the PM accused the Opposition of “juvenile tactics”.

“Those outside this place will look on the juvenile tactics of the opposition and form their own judgements,” Mr Morrison said.

READ MORE: We need a big-government budget

Jade Gailberger 2.50pm: PM’s swipe at Labor’s GFC response

The Prime Minister has taken a swipe at the Labor government’s response to the global financial crisis.

“Those opposite thought the response was to build overpriced school halls, set fire to people’s houses and that is not how you manage a crisis, that’s not how you manage a crisis,” he said.

“You manage a crisis with the strength and responsible economic management and the responsiveness and the certainty that our government has provided over these many past months.”

The PM’s voice strained during his fiery attack, forcing him to take a drink of water once he finished speaking.

READ MORE: Sweden defied zealots and never met its Waterloo

2.47pm: Only hours to go before 2020 budget is handed down

Final run through of this year’s Budget with Treasurer Josh Frydenberg earlier today. We have a plan to create jobs, rebuild our economy and secure Australia’s future.

— Scott Morrison (@ScottMorrisonMP) October 6, 2020

Tune in at 7:30pm AEDT tonight to watch @JoshFrydenberg deliver #Budget2020 âž¡ï¸ https://t.co/7EJpn8xEcS pic.twitter.com/dNfkqMAB4w

Jade Gailberger 2.43pm: Labor presses on cuts to JobKeeper

And the federal budget questions have begun with opposition treasury spokesman, Jim Chalmers, asking about cuts to the rate of the JobKeeper payment.

But the Prime Minister has rolled out the talking points Australians are set to hear later tonight when the Treasurer stands at the dispatch box to deliver his budget speech.

“What you will hear tonight is again, the government’s plan for not just cushioning the blow as we have done so now for these many months through the COVID-19 pandemic and the COVID-19 recession that has followed,” he said.

“It is a plan for the recovery of what has been lost, and it is a plan to build Australia’s economy again for the future, so Australians can indeed plan for their own future with confidence.”

READ MORE: Tax breaks on the road to recovery

David Rogers 2.34pm: Rates on hold ahead of budget

The Reserve Bank has left interest rates unchanged at its monthly board meeting, after some economists had predicted another cut to help tackle the blow to the economy from the pandemic.

In a statement just hours before the federal budget, RBA governor Philip Lowe said the central bank board had decided to maintain the targets for the cash rate and the yield on three-year Australian government bonds at 0.25 per cent.

Eyes will now turn to the possibility of a cut to 0.1 per cent in November.

READ the full story here.

Jade Gailberger 2.32pm: ‘A Labor giant … a feminist hero’

Tributes have also flowed following the death of Labor’s first female senator, Susan Ryan.

Mr Morrison thanked her for her advocacy for women and the rights that his daughters now benefit from.

“A woman who wants to buy a house today can go to the bank and get a home loan without needing her husband or father there,” he said.

“Something today we just assume sometimes has always been the case but … she made it a reality.”

Mr Albanese said thanks to the power and the sheer scale of her legacy, her presence “is all around us”.

“As the first female minister for the status of women, she became a feminist hero,” he said.

“When she ran for the Senate, she did indeed run under a woman’s place is in the Senate.

“She lives in our hearts as a Labor giant, and even more than that, as a great Australian.”

READ MORE: Susan Ryan dies, aged 77

Jade Gailberger 2.25pm: Tributes to Fahey during Question Time

Prime Minister Scott Morrison and Opposition leader Anthony Albanese have paid tribute to former Liberal politician and finance minister John Fahey, who died in September.

“John Fahey, like indeed Bob Hawke and Tim Fischer, he was an Australian

original,” Mr Morrison said.

“He mastered state politics, federal politics, world sport.”

Mr Albanese, who was elected on the same day as Mr Fahey in 1986, said he was a “great bloke”.

“That is the greatest thing you can say about an Australian male, that we all aspire to,” he said.

Speaker Tony Smith also offered his condolences and read a special message from former treasurer Peter Costello.

“He had great attention to detail and he had courage. He got things done, including Australia’s biggest ever privatisation, concerning Telstra,” Mr Costello wrote.

READ MORE: Fahey farewelled at state funeral

Rachel Baxendale 2.22pm: Tracing a ‘gargantuan task’ during second wave

Chief Health Officer Brett Sutton said he was not pleased with Tuesday’s number of new cases either.

“I don’t like to see a number that’s in double figures and not in single figures, and no one obsesses over the daily numbers more than me or my team, but they are, again, predominantly related to known cases, to outbreaks, and we have to get on top of these outbreaks to really drive these numbers down,” Professor Sutton said.

Of the 15 new cases on Tuesday, eight have so far been linked to known outbreaks, while seven remain under investigation.

Professor Sutton did not have details of which clusters the known cases had been linked to, but said a cluster linked to The Butcher’s Club butcher shop at the Chadstone shopping centre in Melbourne’s southeast had now reached 28 cases, including eight staff members, 11 family and household contacts, and four customers.

Another linked case in a staff member at the Oddfellows cafe in Kilmore, north of Melbourne, is being treated as a separate cluster.

One contact of that case had also tested positive, after a contact of the Chadstone cluster travelled to Kilmore for permitted work purposes and ate at the cafe in breach of the law which currently prevents Melbourne residents eating in at regional Victorian hospitality venues, even if they have legally travelled to the area for a permitted reason.

The positive case who travelled to Melbourne continued on to Benalla, in north east Victoria, where the White Line Tyres business has been named as a high risk location having been visited by the case.

No one in or linked to Benalla has yet tested positive for the virus, but testing of close contacts is underway.

“The Chadstone outbreak is an illustration, again, of just how significantly this can spread far and wide, and the particular challenges we have in outbreak management,” Professor Sutton said.

Professor Sutton said the large size of households linked to coronavirus cases as part of Victoria’s second wave highlighted the challenge contact tracers faced.

“It’s profoundly different to what any other jurisdiction in Australia has followed up,” he said.

“I don’t think anyone really understands what a gargantuan task the contact tracing has been through this wave.

“I think the average family size in Australia is about 2.5 people.

“We’ve made estimates that the average family size for the 20,000 cases in this second wave has been between six and 10 people, and so, when there’s a case here, you’re not looking at one other contact or two other close contacts, you’re looking at five or six or seven or eight or nine routinely for every single household, and you’re not looking at no other workplaces where those close contacts might be, you’re looking at three or four.

“And again, with each of those individuals who are in workplaces, they will have their own households and they will have five or six or seven or eight close contacts.

“So it’s not twice as hard as the first wave, it is 10 times as hard as the first wave in terms of the challenges of following up these cases.

“Many of them come from difficult social and economic circumstances, certainly not every one, but there are challenges with respect to that as well.”

Professor Sutton said 96 per cent of test results were now being returned within 24 hours, with 80 per cent of contact tracing interviews conducted within four hours of the Department of Health and Human Services receiving the results.

“We are jumping on each and every close contact, on each and every case in a very timely way,” he said.

“The Kilmore case is an illustration of a cafe that did all of the right things, as a fantastic register of names, all of those close contacts are being contacted, but there are 150 of them, so again, the infectiousness of this virus and the opportunity to have dozens and dozen of people potentially exposed speaks to the challenge.”

READ MORE: Trump takes zinc – maybe you should too

Rachel Baxendale 2.10pm: Second wave ‘by no means over’: Andrews

Victorian Premier Daniel Andrews has warned Victoria’s second wave of coronavirus is “by no means over”, after the state recorded 15 new cases on Tuesday – triple the 14-day daily average of no more than five cases required under the Andrews government’s threshold for an easing of restrictions on October 19.

The 15 cases on Tuesday, following eight readjusted from nine due to a false positive on Monday, mean Victoria needs to record an average of 3.9 new cases over the next 12 days to be within the threshold.

Asked whether hospitality businesses might be able to start planning to open to some customers for the AFL Grand Final public holiday on October 23rd, Mr Andrews said: “I don’t want to put a downer on all of these things but I’ll say, look at the numbers today.”

“This is by no means over,” Mr Andrews said.

“We’re very, very close, but I can’t, with any sense of certainty, I can’t tell people where we’re going to be on the 17th, 18th, 19th of October, let alone the 23rd.

“That’s why we’ve all got to make the right choices.”

Mr Andrews said the 14 day cycle of coronavirus and an asymptomatic infectious period made it particularly difficult to predict “what Grand Final weekend will look like”.

“I can tell you what I want it to look like. I want to see the numbers as low as possible, which then means that we can keep them low and we can take a big step – not the final, or the biggest step, but a big step towards COVID-normal in just a few weeks,” he said.

“I would just say this – it is important to understand, and we’ve been very clear about this from the word ‘go’, the numbers will drive us, but the narrative behind the numbers is important also.

“So we’ll look at the story. We’ll look at how confident we are about whether it’s contained. That’s where the focus on mystery cases comes from. It is a numbers game. But it’s also a qualitative thing.

“You’ve got to look at what sits behind those numbers and that’s why there’s such a big team of people doing that contact tracing, so we’ve got the most complete picture.”

Mr Andrews has previously said there may be some flexibility to the reopening threshold, should a large number of cases be clearly linked and contained.

READ MORE: How COVID-19 created a perfect storm of sport

Olivia Caisley 1.58pm: PM’s virus response ‘saved 16,000 Australians’

Scott Morrison has praised the nation’s response to the coronavirus crisis, declaring his government’s health response had saved the lives of 16,000 Australians.

The Prime Minister welcomed the improving situation in Victoria and said the “light was getting a little brighter”, paying tribute to the resilience of Australians as he addressed colleagues in a party room meeting on Tuesday ahead of the release of the most significant budget since World War II.

Mr Morrison conceded that the measures announced on Tuesday evening would be “extraordinary” but he insisted the government would continue to be guided by its economic principles with any fiscal support being “temporary, targeted and proportionate”.

“It’s extraordinary in what will be announced tonight but we maintain the system of principles and actions of temporary, targeted, proportionate response to challenges we face,” he said according to a government spokesman.

He cited new data from the Medical Journal of Australia, released on Monday, that used mortality data at the peak of the COVID-19 outbreak in March and April to calculate the number of lives that would have been lost if Australia’s coronavirus outbreak had been as widespread as the UK.

The modelling calculated that there would have been an extra 16,313 deaths in Australia.

“The recent analysis of Medical Journal of Australia, indicating that Australia’s responses saved an estimated 16,000 lives across our country,” Mr Morrison said, according to a government spokesman. “One of the few countries in the world to have been able to navigate and both health and economic crises, alongside those such as Norway, or South Korea.”

Mr Morrison said the world had never seen a recession of this scale at a time when the economy was so globally interconnected, but said the budget should provide Australians with “confidence, assurance and hope” as the nation begins to rebuild.

He said the Coalition would continue to demonstrate they were responsible economic managers and new measures announced tonight will “empower Australians to be able to plan for their future with confidence”.

“It’s about building a plan to deal with challenges of today, tomorrow, and for the future,” he said.

READ the full story here.

Rachel Baxendale 12.20pm: Seven of 15 new Victorian cases under investigation

Victoria now has 216 active cases of coronavirus — a decrease of 11 since Monday.

Of 15 new cases on Tuesday, eight have so far been linked to known outbreaks, while seven remain under investigation.

Two previously recorded cases have been reclassified, including one of Monday’s cases, linked to a person from Shepparton in Victoria’s north, which has been found to be a false positive.

One death reported in the 24 hours to Tuesday has taken Victoria’s coronavirus death toll to 807.

Premier Daniel Andrews did not disclose the age or gender of the person who died, nor did he say whether the death was linked to aged care, to which 640 deaths have so far been attributed.

There are 21 people in Victorian hospitals with coronavirus on Tuesday, including one person who is in intensive care but not on a ventilator.

This compares with 30 people in hospital on Monday, including three in intensive care, of whom two were on ventilators.

There were 9286 tests processed in the 24 hours to Tuesday, taking the total number processed in Victoria since the pandemic began to 2,763,802.

The positive test rate for Tuesday is 0.16 per cent — the highest positive test rate since September 22, but well down from a peak of 3.73 per cent at the height of the second wave.

The number of active cases linked to aged care is 66 – down from 77 on Monday.

The number of active cases in health workers, including aged care and disability workers is 27, down from 29 on Monday.

There is one case in a staff member linked to residential disability accommodation – the same number as Monday.

READ MORE: Maybe I'm immune: Trump

Rachel Baxendale 11.35am: Andrews to address media at 12pm

Victorian Premier Daniel Andrews is due to hold a press conference at midday alongside his Minister for Public Transport, Roads, and Road Safety, Ben Carroll.

The press conference comes ahead of this evening’s federal budget.

Imogen Reid 11.25am: Leigh: budget ‘all too familiar’

Opposition frontbencher Andrew Leigh has said the government’s plan to save the pandemic-hit economy looks “all too familiar” to past budgets, which have “given the most to those who have the most”.

Mr Leigh said the people most impacted by the coronavirus crisis, like the short term casuals who will no longer have access to JobKeeper after it is phased out, need to be the first priority of the budget.

“We’ve got debt going into a trillion dollars, we’ve got to remember that all this spending is borrowed spending and so it needs to do maximum good in getting the economy going,” Mr Leigh told 2SM radio.

“It’s only stimulus when it’s spent, so giving tax cuts that end up being saved isn’t going to create jobs. The priorities have got to be to create jobs and to build back better through the economy.”

Mr Leigh said high income earners tend to save about one quarter of their income, instead of injecting it back into the economy.

“It’s difficult to imagine that if you offer a tax cut to somebody on $200,000, suddenly they’ll say ‘oh, well, I’ll take that $200,000 job rather than staying unemployed’,” he said.

“I would certainly benefit from a tax cut for people on $200,000, but that doesn’t mean that that’s good for the economy at a time when we’re borrowing every single dollar.”

READ MORE: ‘$40 a day is not enough'

Imogen Reid 11.20am: NSW in 11th day of no community transmission

NSW has reported its eleventh straight day with no new cases of COVID-19 community transmission.

NSW Health said eleven overseas travellers in hotel quarantine were diagnosed with coronavirus in the 24 hours to 8pm on Monday night, taking the total number of cases in the state to 4,057.

For the eleventh consecutive day, NSW has reported no recent cases of locally transmitted #COVID19.

— NSW Health (@NSWHealth) October 6, 2020

Eleven cases in overseas travellers in hotel quarantine were diagnosed in the 24 hours to 8pm last night, bringing the total number of cases in NSW to 4,057. pic.twitter.com/W6kaFmYG0z

Health officials have appealed to people in the Hawkesbury and South Western Sydney to come forward for testing after the state’s sewage surveillance program detected fragments of the virus at the North Richmond and West Camden treatment plants.

“The most recent cases in the West Camden catchment were reported in September, but no one living in the North Richmond catchment has recently tested positive for COVID-19,” NSW Health said.

“Virus fragments in sewage can mean that there are active cases in the catchment area, but people can continue to ‘shed’ virus genetic material for some weeks after recovery.”

Imogen Reid 10.20am: Rex Patrick slams Sharkie for uni reform support

Former Centre Alliance senator Rex Patrick has weighed in on the party’s move to support controversial university reforms by sharing a tweet by Rebekha Sharkie and accusing her of not caring for future students.

In Ms Sharkie’s original tweet, which she posted in June when the reforms were first announced, she said she was “forever grateful” for her Arts Degree, adding she would not have her career without it.

“It took me ten years to complete while working and raising three children,” she said.

“I would not have had my career or the privilege of sitting in the House of Representatives without it.”

So, whilst you are forever grateful for the opportunity afforded you, you don’t care for future students in your electorate or state that might want the same opportunity #auspol #FundUniFairly #highered https://t.co/Hsz2lYMsqJ

— Rex Patrick (@Senator_Patrick) October 5, 2020

Today, Mr Patrick responded saying: “So, whilst you are forever grateful for the opportunity afforded you, you don’t care for future students in your electorate or state that might want the same opportunity.”

It comes after the Centre Alliance party released a statement outlining its decision to support the reforms.

Mr Patrick and South Australian Greens senator Sarah Hanson-Young have urged Centre Alliance senator Stirling Griff to reject the laws.

“We believe this bill will have a negative impact on South Australia’s young people, research capacity and job creation in our state,” they said in a joint statement.

“The government’s proposed changes will be devastating, at a time when we actually need more options for our state’s young people to be engaged in study and training, if they are unable to work.”

READ MORE: Frydenberg buries the deepest of all faiths

Sarah Elks 10.05am: Palaszczuk kicks off Queensland election campaign

Queensland Premier Annastacia Palaszczuk has visited the state’s Governor to officially kick off the October 31 election campaign.

Both Ms Palaszczuk and LNP leader Deb Frecklington will spend the next three and a half weeks crisscrossing the state to convince voters to back them.

Ms Palaszczuk – who will pin her re-election hopes on her management of the COVID-19 crisis – said she had to make the “hard decisions, tough decisions” during the pandemic, the most contentious of which has been to keep the state’s borders largely closed.

“But they were all about putting lives first and keeping Queenslanders safe,” she said.

This is the first time Queensland has had a fixed election date and a fixed four-year term to follow. It’s also the first time both major parties have been led by women at an election campaign.

READ MORE: Big business should lead recovery: BHP

Richard Ferguson 9.30am: Uni fee overhaul set to pass parliament

The Morrison Government’s radical overhaul of university student fees is set to pass parliament as Centre Alliance pledges its support for Education Minister Dan Tehan’s package.

The reforms will see the cost of post-pandemic job creator subjects like maths and science slashed, while the price of law and humanities degrees will skyrocket by up to 113 per cent.

Lower house MP Rebekha Sharkie and senator Stirling Griff have secured protections for South Australian universities and students who fail half their subjects in the past year.

Ms Sharkie praised the package to The Australian yesterday for supporting regional universities – who will be $400m better off under the new laws – and told Sky News her party will now vote for it.

“We think that we’ve got to a position with the government around how South Australia is viewed … it’s a much better package for South Australia,” she told Sky News.

“As well as some extra protections for students, particularly students that perhaps fail more than half of their subjects that will fit in a year.

“The government’s trying to shift the balance of their focus people on areas but we know that we have a huge demand for skills. And we think that the package is very good for regional Australia.”

READ MORE: How Covid makes this budget different

Rachel Baxendale 9.00am: Victoria records 15 cases, one death

Victoria has recorded 15 new cases of coronavirus and one death in the 24 hours to Tuesday.

Yesterday there were 15 new cases & the loss of 1 life reported. In Metro Melbourne, the 14 day rolling average is down from yesterday & the number of cases with unknown source is the same. Info: https://t.co/eTputEZdhs#COVID19VicData pic.twitter.com/te66ISo3ba

— VicGovDHHS (@VicGovDHHS) October 5, 2020

The 15 cases come on the second day of the fortnight which counts towards Victoria’s reopening prospects on October 19, and represent three times the Andrews government’s threshold of a 14-day daily average of just five cases.

They follow eight cases yesterday after a ninth case was found to be a false positive, 12 cases on Sunday, eight on Saturday seven on Friday, and 15 on Thursday, and are a significant increase on five cases on Monday September 28, which represented a three and a half month low.

The single death brings Victoria’s death toll to 807.

All but 19 of these deaths have occurred as a result of the state’s second wave of coronavirus cases, sparked by breaches in the Andrews government’s hotel quarantine program.

Melbourne’s 14 day daily average number of new cases is now 10.6, down from 11.6 on Monday and 18.2 last Tuesday.

This compares with a 14 day daily average of 0.3 in regional Victoria – the same as on Monday.

As of Monday there were three known active cases left in regional Victoria, and 227 statewide.

There have been 13 cases with an unknown source of infection in metropolitan Melbourne in the most recent fortnight for which this statistic is available – the same as on Monday.

As The Australian has reported today, these 13 cases are spread all over Melbourne, and eight of them occurred over a three-day period.

Regional Victoria has had no unknown source cases over the same fortnight, which spans September 20 to October 3.

Melbourne is set to move to its next step of easing restrictions on October 19, provided the city reaches a threshold of a 14 day daily average of fewer than five cases – a prospect made less likely by today’s 15 new cases – with fewer than five cases with an unknown source over that fortnight.

This would see stay-at-home rules relaxed for the first time since July 7, and hospitality businesses able to reopen to predominantly outdoor service, subject to density limits and a limit of 10 people per group.

The reopening road map does not allow hospitality businesses to have up to 20 patrons indoors and 50 outdoors until the state has had 14 days with no new cases.

Melburnians are currently under stay at home restrictions allowing them to leave home only for permitted work, medical care, essential shopping, exercise and public outdoor gatherings of up to five people from up to two households for up to two hours.

READ MORE: Labor keen to draw blood from this fiscal horror show

Imogen Reid 8.25am: Albanese: Labor wanted stage two tax cuts in 2019

Anthony Albanese has indicated Labor will support stage-two tax cuts being a priority in the federal Budget, saying he had hoped to see them brought forward in 2019 when Australia experienced two negative quarters.

“The economy was really struggling before the pandemic hit,” the Federal Opposition Leader said on Radio National this morning.

“Of course we will wait to see what’s in the budget but the decisions that we make will be consistent with what we said last year.”

Mr Albanese said while the Morrison government is good at making and “leaking” announcements, “sometimes when you look at the announcement the detail didn’t match up.”

Mr Albanese also backed calls for a national Centre for Disease Control to manage responses and resources for future pandemics.

He said Australia “can’t be left playing catch up again.”

“We can’t afford another Ruby Princess, or another tragic disaster in aged care,” Mr Albanese said.

“Our health, our lives and our economy all depend on us getting our response to future pandemics right.”

READ MORE: Another $2bn to build recovery

Imogen Reid 8.15am: Frydenberg: This is all about jobs

Treasurer Josh Frydenberg has said the priority of today’s federal Budget was jobs, which will see measures that will include a second women’s economic security scheme, place a heavy focus on boosting female workplace participation and focus on getting young Australians back to work.

“Women and young people are among those who have been heaviest hit by this crisis. Fortunately, more than half of those who have lost their jobs have now got back to work and we saw 54 per cent of the jobs being jobs lost by women,” the Treasurer told reporters ahead of his budget announcement this evening.

“Sixty-four per cent of the jobs coming back are jobs that are going to women. Young people have also seen jobs come back strongly.

“The history of previous recessions in Australia, in the 1980s and the 1990s, is that it’s taken a long time to get unemployment back to where it was … in the 1980s it took six years to get unemployment back below six per cent from where it started. In the 1990s, it took 10 years. We want to move faster than that and more importantly we want to help women and young people get back to work.”

Mr Frydenberg said 10 per cent of Australia’s workforce either lost their job or saw their working hours reduced to zero.

“In tonight’s budget, I will lay out our economic recovery plan to rebuild the Australian economy and secure Australia’s future,” he said.

“Our plan will create jobs. This is all about jobs. It’s all about helping those who are out of a job get into a job. It’s all about helping those that are in work, stay in work.

“Our plan will create opportunity. Our plan will drive investment. Our plan will grow the economy and guarantee the essential services Australians rely on. Our plan will see Australia a stronger nation.”

READ MORE: Stimulation behind push for stage two reform

Imogen Reid 7.45am: Tax cuts ‘priority but big risk’

Tax cuts for middle income workers will be a priority in Tuesday’s federal Budget, which will focus heavily on job creation and building to boost Australia’s unemployment rate and rescue the nation’s pandemic-struck economy.

But concerns over Treasurer Josh Frydenberg’s plans to fast track tax cuts have been raised due to the success rate of similar measures in previous years.

Chris Smith from 2GB told Nine’s Today show that Mr Frydenberg will have his “fingers crossed” the creation of about 450,000 jobs will replace the JobKeeper subsidy and resuscitate the economy.

“The big risk for Josh Frydenberg is, he had JobKeeper, which was massive, and incredibly expensive. But the risk is the last two times that we have introduced tax cuts they’ve been a fizzer. They have not stimulated the economy,” Mr Smith said.

“So he will have his fingers crossed under the table, you can bet on that.”

READ MORE: We need a big government budget

David Rogers 7.15am: ASX set to rise higher as US stocks, oil rise

Australian stocks are set to open higher, as world markets rebounded from last Friday’s falls after reports Donald Trump’s health had improved following his positive test for the coronavirus, while traders were also cheered by progress towards a new US stimulus package. Locally the focus will be on the Reserve Bank meeting and the federal budget, while James Packer will give evidence to an inquiry on Crown’s gambling licence.

Simon Benson 6.30am: How Cormann went from gardener to parliament

By any measure, the biggest hole in next year’s budget will be the absence of Mathias Cormann.

No finance minister has served longer in the job. Arguably, none has been as instrumental, nor as influential. And none has had to contend with what is, for most Australians, the greatest economic challenge of their lifetime.

Today marks the seventh and final budget for the senator from Western Australia, who landed on Antipodean shores 25 years ago as a European migrant with English as his fourth language.

“Mathias is quite a remarkable story,” says Chris Ellison, the former justice minister under John Howard who was the first to give the young Jesuit-university-educated Belgian a job.

“He was working as a gardener when he came to see me,” he says, because Cormann’s European law degree was not recognised by the Australian legal fraternity.

“But I thought this guy is whip smart. I got him to do some work for me pro-bono. He helped me with a couple of Senate inquiries.

“And within two weeks, I had hired him.”

Read the full story here.

Joe Kelly 5.15am: Pressure on Labor to back Budget’s tax cuts

Finance Minister Mathias Cormann has urged Labor not to “stand in the way” of any fast-tracked personal income tax cuts, with the nation’s peak business group arguing the acceleration of tax relief could “put around $10bn to $15bn in people’s pockets”.

Labor has held off committing to any decision to bring forward tax relief before it can examine the package in full, but the opposition runs the risk of again being forced into passing a package with which it has major objections.

Business Council of Australia chief executive Jennifer Westacott told The Australian the government’s tax cuts represented “real dollars for Australians”, while Deloitte Access Economics director Chris Richardson said “the more economic support the better”.

Speaking yesterday, one day after the budget papers were printed, Senator Cormann gave a strong indication that tax cuts could be brought forward to help pump-prime the economy through the pandemic-induced economic crisis.

“We have a track record of always looking for opportunities to lower the tax burden on hardworking families. Personal income tax cuts put more money into workers’ pockets. They boost take home pay for hardworking Australians. So it’s always something that we are committed to pursue where that makes sense,” Senator Cormann said.

Read the full story, by Joe Kelly and Olivia Caisley, here.

Simon Benson 5am: Budget’s new incentives to move off welfare queue

Average families will receive up to $5000 in income tax relief and young Australians will be targeted through a back-to-work wage subsidy in a budget that will map a path to economic recovery and seek to prevent a lost generation of unemployed.

In the most important fiscal and economic statement to be delivered by a treasurer in more than 60 years, Josh Frydenberg will offer a jobs lifeline for up to 700,000 Australians aged under 35 who have been forced onto welfare payments.

He will also call on Australian households to turbocharge the post-pandemic economy through a revamped income tax plan that will deliver about $2000 to the average earner and more than double that for households.

The Australian understands the direct wage subsidy — a key centrepiece of the budget — will be limited to those under 35 and made to businesses taking on young Australians who have been forced on to JobSeeker during the COVID-19 pandemic.

Read the full story, by Simon Benson and Geoff Chambers, here.

Patrick Commins 4.45am: Why debt of $1 trillion is merely the start

Australia’s debt burden will push beyond the $1.1 trillion debt ceiling expected in Tuesday’s COVID-19 budget, with one of the nation’s leading economic analysts saying it will continue to rise to 70 per cent of GDP — or $1.4 trillion — by the middle of the decade.

As revealed by The Australian, Tuesday’s budget will confirm that the federal deficit will peak at just over $210bn in this financial year, accompanied by a lift in the debt ceiling to beyond $1.1 trillion, or 55 per cent of GDP – the highest level since 1958, according to IMF data.

But UTS professor Warren Hogan said the Morrison government would be forced to spend and borrow more over the coming five years to prop up the economy through the aftermath of the COVID-19 recession, predicting the debt to GDP ratio will grow to 70 per cent of national output by the middle of the decade.

This suggests a gross debt burden of $1.4 trillion.

“Unless we have a miracle recovery, history tells us it (the debt level) will be more,” Professor Hogan said.

Read the full story here.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout