Elderly in $1m-plus homes claim $6.3bn in pension

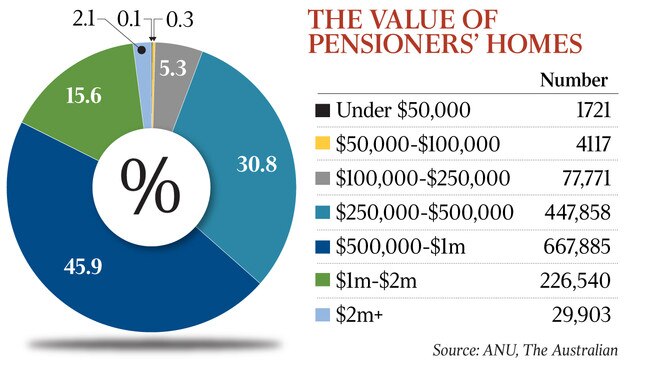

More than 255,000 retirees live on taxpayer-funded incomes while owning $1m homes.

Retirees living in $1m-plus homes are receiving more than $6.3bn a year in age pension payments, enough to fund income tax cuts that would supercharge economic growth.

More than 255,000 pensioners across the nation, mainly in elite pockets of Sydney and Melbourne, live on taxpayer-funded incomes while owning homes worth more than $1m — a more than twentyfold increase in a decade — according to analysis of social security data by ANU.

READ MORE: JUDITH SLOAN- Flaws in home owner-pension argument | Retirees ‘upsize’ the family home to get the Age Pension | The pension should not be protecting mansions

Almost 30,000 age pensioners lived in homes worth more than $2m this financial year — two-thirds of them in Sydney and a fifth in Melbourne — receiving $680m in pension payments annually, according to the analysis.

The figures emerge as a landmark review into the efficiency and effectiveness of the age pension and compulsory superannuation gets under way.

Ben Phillips, an associate professor at ANU, said such pension payments meant workers were paying higher rates of tax to protect sizeable inheritances. More than 1190 pensioners lived in affluent postcodes including Vaucluse in Sydney, Peppermint Grove in Perth and Canterbury in East Melbourne, according to analysis by The Australian.

Requiring wealthy pensioners to access reverse mortgages to stay in their homes, Mr Phillips said, “would be politically difficult as people would say it’s not the Australian way”.

University of Queensland economist John Humphreys said the top marginal tax rate including the Medicare Levy, which is 47 per cent for incomes above $180,000, could “easily” be reduced to 36 per cent if pensions to wealthy pensioners were clawed back.

“The benefit for the economy would be extraordinary, encouraging work, saving, and obliterating work for accountants and lawyers currently employed to hide income,” he said, noting GDP would grow by $17.9bn a year.

“Alternatively, the 34.5 per cent tax rate, which is faced by around 6.2 million taxpayers, could be cut to 32 per cent.”

Council on the Ageing chief executive Ian Yates said he hoped the retirement income review, which is due to report by the middle of next year, would produce data and options to generate more public discussion on this issue.

“Should we really be paying the pension to people in homes worth more than $2m?” he said, while noting that a $1m home in Sydney was “very different” to one in Adelaide.

The national average dwelling price in October was almost $530,000, according to CoreLogic, ranging from $394,000 in Darwin to $818,000 in Sydney.

Reverse mortgages — financial products that allow retirees to stay in their home while living off some of the equity — have been deserted by major lenders, while a little over 1100 pensioners use the Pensioner Loan Scheme, a government-provided reverse mortgage that allows pensioners to borrow up to 1.5 times the age pension at an interest rate of 5.25 per cent.

The age pension, at almost $50bn a year, is the federal government’s biggest expense. But successive Coalition and Labor governments have been loath to tamper with the exemption from the eligibility test for the principal place of residence — in place since 1912.

A decade ago the Henry tax review recommended capping the exemption for the principal place of residence at $1.2m. “An uncapped exemption provides for very high levels of wealth to be sheltered from means testing,” it said.

“A cap of $1.2m would currently mean that around 10,000 age pensioners’ homes would be partially assessed under the means test,” it concluded, based on national 2009 data.

More than 29,900 pensioners were living in a $2m home a decade later, according to the ANU analysis.

The age pension, which pays $1407 a fortnight for a couple, along with discounts on medicine and public transport, was introduced in 1909 to reduce the incidence of poverty in old age.

“Based on our surveys of older Australians there is disquiet among about half of them when some retirees have invested heavily in their house yet receive a pension while others worth the same who have chosen to live in median value homes and save financial assets to fund retirement do not qualify,” Mr Yates said.

Mr Phillips said recouping pension payments from estates would “allow large budget savings that could be used for health or education or to cut income tax significantly — with commensurate incentives to work and save”.

“Such policy also removes some of the incentive for older Australian’s to arguably over-invest in their own home to keep assets within the family or avoiding downsizing to what may be more suitable accommodation for older persons,” he said.

“If inheritances were a bit smaller from an equity perspective it’s not so concerning given these children, largely adults in their 50s or 60s, also tend to be in higher income and wealthy households.”

Almost 137,000 pensioners owned their home with a mortgage, the analysis found, compared to 1.32 million who owned their home outright. Western Australia was home to 1900 pensioners in $2m-plus homes compared to 890 in Queensland, based on Department of Social Security and CoreLogic data.

More than 15,500 holders of a Commonwealth Seniors Health Card, a benefit that provides discount pharmaceuticals and other benefits for retirees too well off to receive a full or part-age pension, lived in postcodes where the median dwelling prices was above $1.5m.

“Reverse mortgage style solutions have been criticised in the past for excessive fees and interest charges suggesting the need for closer government regulation or government backed schemes such as the government’s pension loan scheme,” Mr Phillips said.

The government came under fire last month for not having cut the interest rate it charges on the Pension Loan Scheme in line with interest rate cuts by the RBA.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout