Economy on the up but risk of early rate hike, says OECD

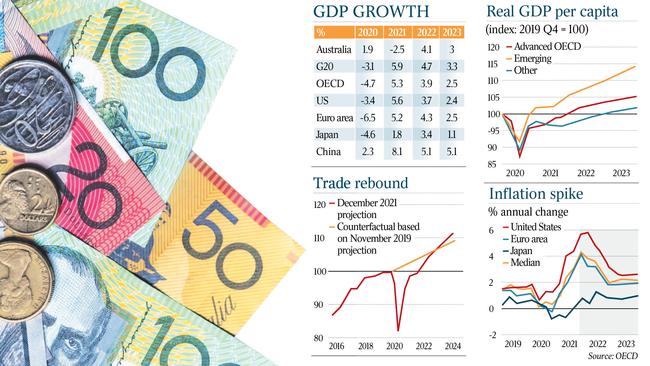

The OECD expects the Australian economy to grow by 4.1 per cent next year.

The OECD expects the Australian economy to grow by 4.1 per cent next year but warns an even stronger global recovery from the pandemic could be undone by rampant inflation and new Covid-19 variants.

In its Economic Outlook, released late on Wednesday, the Paris-based body said the Reserve Bank may be forced to raise interest rates sooner than expected and also called on the federal government to lay out clear targets and time frames to repair an ailing budget.

With the Australian Bureau of Statistics on Wednesday reporting gross domestic product plunged by 1.9 per cent in the September quarter due to Delta lockdowns, Josh Frydenberg said the economy was now “recovering strongly”.

The Treasurer said the budget was already moving away from a crisis setting, with further details to be revealed when the mid-year economic and fiscal outlook is released on December 16.

But Mr Frydenberg rejected the suggestion inflationary pressures were out of control or comparable to supply chain related price hikes in the US and UK.

“It’s not the house view,” the Treasurer said of his official economic advice, noting headline core inflation was 2.1 per cent and there was still significant slack in the economy, with unemployment at 5.2 per cent.

The OECD’s caution on inflation comes after a more hawkish US Federal Reserve chairman Jerome Powell signalled interest rates could rise sooner as uncertainty about the impact of the Omicron variant weighed on financial markets for a third day.

Mr Powell told congress the Fed would consider tapering its asset purchase program even more quickly when it met next, conceding that high inflation – which Fed officials had earlier said would be ‘transitory’ – would last until the middle of next year.

On Wall Street, the Dow Jones Industrial Average closed 1.9 per cent lower, while Australian shares hit two-month lows before rallying, with the benchmark S&P/ASX 200 Index down 0.3 per cent at the close.

The OECD is forecasting the world economy to grow by 4.5 per cent next year, a deceleration from this year’s 5.6 per cent, as nations battle new coronavirus variants and endemic inequalities.

Global inflation was forecast to peak at 4.9 per cent in the December quarter, easing to 3.4 per cent by this time next year, as central banks tightened monetary policy and supply troubles abated.

OECD chief economist Laurence Boone said the outlook was cautiously optimistic. “The recovery is real, but the task for policy makers is a tough one,” she said, calling for patience and care in avoiding missteps on public spending and fighting inflation.

Dr Boone said the OECD’s primary concern was the global split in caseloads, hospital capacity and vaccination rates.

“The harshest scenario is that pockets of low vaccination end up as breeding grounds for deadlier strains of the virus,,” she said.

“Even in more benign scenarios, ongoing coronavirus outbreaks may continue to restrict mobility in some regions and across borders, with potential long-lasting consequences for labour markets and production capacity, as well as prices.”

In its section on Australia, the OECD said the RBA “should be vigilant about signs of rising inflation and may need to tighten monetary policy faster than it is currently anticipating”, forecasting 2.4 per cent core inflation (excluding food and energy) next year.

The RBA expects the cash rate will not rise be before 2024 or until underlying inflation is sustainably within its 2-3 per cent target zone. Some market economists are tipping the first rate hike will be in late 2022.

The OECD projects the RBA to conclude its bond buying program in the first half of next year and raise the cash rate at the end of 2023 “following a sustained increase in underlying inflation into the target band”. “However, there is a risk of an earlier rise in interest rates if inflation surprises to the upside,” the OECD said.

In 2020, Australia experienced the largest slide in its budget position of OECD nations, as the government provided emergency payments to households and businesses. This year, as the labour market recovered, the $89bn JobKeeper wage subsidy was withdrawn, and unemployment benefits were reduced from crisis levels, Australia’s fiscal improvement led the OECD.

Still, the deteriorating trade relationship with China poses a risk to revival and the OECD said “further fiscal support may be needed if the recovery falters”.

In any case, the OECD said “a clear medium-term fiscal strategy should be laid out”.

As well, the OECD said savings accumulated during the pandemic, which Mr Frydenberg said was now valued at $370bn, “could pose an upside risk to the projections”. “Given that most employment relationships were preserved during the most recent lockdowns, a rapid unwinding of accumulated savings could drive a stronger rebound in activity in the coming months,” the OECD said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout