Economic recovery plan: tax relief for small businesses to create jobs, cut red tape

Josh Frydenberg will announce tax concessions for an additional 20,000 businesses and exempt eligible companies from fringe benefits tax.

Josh Frydenberg will hand businesses major tax exemptions in next Tuesday’s budget to drive jobs growth, retrain workers and slash red tape as part of the federal government’s COVID-19 economic recovery plan.

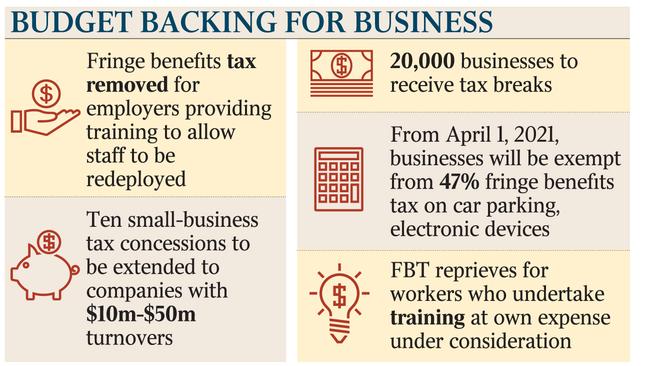

The Treasurer on Friday will announce tax concessions for an additional 20,000 businesses and immediately exempt eligible companies from fringe benefits tax to support employer-provided retraining and reskilling for workers redeployed into new jobs.

The move to support small businesses comes as Assistant Minister to the Prime Minister Ben Morton delivers a Business Council of Australia speech outlining additional budget support for Scott Morrison’s Deregulation Taskforce to expand its capacity and streamline government services.

Calling national cabinet “an opportunity to turbo-charge competitive federalism”, Mr Morton will unveil red-tape reductions for childcare providers, medical businesses and agricultural producers.

Under the business plan devised by Mr Frydenberg and Assistant Treasurer Michael Sukkar, companies with turnovers of between $10m and $50m will be able to access up to 10 small business tax concessions.

The expanded access to small business tax concessions would provide at least $105m in support of companies employing about 1.7 million Australians.

From April 1, thousands of businesses will be exempt from the 47 per cent FBT on car parking and multiple work-related devices, including phones and laptops. Immediate tax relief will be granted for deductions on start-up expenses and prepaid expenditure.

Time limits for company tax returns to be amended by the Australian Taxation Office will be reduced from four to two years to relieve pressure on businesses.

The ATO will also offer simplified GST accounting methods for businesses with turnovers under $50m, and brewers and distillers will only need to pay and report excise monthly instead of weekly to support cashflow.

Mr Frydenberg said the business package would provide “further tax relief to attract and retain workers and reduce red tape”.

“We know that the pathway to recovery is not through higher taxes but through a more competitive and efficient tax system that supports jobs and promotes investment,” Mr Frydenberg said.

“Enabling small businesses to keep more of what they earn means they can keep operating, pay their bills and retain or hire more staff.”

The FBT changes, which come into effect on Friday, will remove “costly barriers” that could put training opportunities for Australian workers at risk.

Mr Frydenberg said under current rules, the 47 per cent FBT was payable if an employer provided training to employees that was not “sufficiently connected to their current employment”.

“For example, a business that retrains their sales assistant in web design to redeploy them to an online marketing role in the business can get hit with FBT,” he said.

“By removing FBT, employers will be encouraged to help workers transition to new employment opportunities within or outside their business.”

The Morrison government is also considering changes to arrangements for workers who undertake training at their own expense. The FBT, which was introduced in 1986, generated $3.8bn in revenue from more than 43,000 businesses in 2018-19.

In his pre-budget address on Friday, Mr Morton will announce the streamlining of government services and removal of red tape across the childcare, agriculture, medicines and training sectors, saving Australian businesses $100m in transaction costs by 2030.

Mr Morton will declare “bad regulation is a job killer with no redeeming features”.

“It inhibits consumer choice, business innovation and investment, and jobs growth,” Mr Morton will say. “The approach that I take is that, where regulation is required, it must be fit for purpose and lightest touch.”

Mr Morton, who heads the Prime Minister’s deregulation taskforce, will also announce plans to reduce red tape for voluntary private sector action to reduce emissions reduction, and streamline business reporting to the Australian Bureau of Statistics in a reform that could save companies “at least 50,000 hours per year”.

On childcare, Mr Morton will outline easier processes for childcare providers to receive subsidies, saving 5100 hours a year from the federal government’s Child Care Subsidy applications and reducing processing times by 75 per cent.

“Currently, childcare providers who receive the Child Care Subsidy must be approved under both commonwealth and state government law,” Mr Morton will say.

“From July 2023 new childcare service applicants will only have to lodge one application, improving the ability of state and commonwealth authorities to monitor childcare compliance and fraud in the sector.”

For international students, barriers will be removed for supplementary and vocational courses such as first aid and responsible-service-of-alcohol qualifications.

“Deregulation agendas must not rise and fall. They must remain embedded in government,” Mr Morton will say.

“It is like painting the Harbour Bridge, the work will never be completed, but it must never be paused.”

Mr Morton will use his speech to pressure Anthony Albanese and Senate crossbenchers over the government’s overhaul of the Environment Protection and Biodiversity Conservation Act, declaring it a “real test for the Senate and the Australian Labor Party”.

“Not only will its passage give effect to the Graeme Samuel’s interim report, it will also give effect to the will of the national cabinet,” he will say.

“The essential minor and technical improvements within this bill provide legal certainty for proponents and ensure the efficient operation of agreements.”

Subscribers can sign-up to receive budget newsletters at theaustralian.com.au/newsletters

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout