Dutton threatens to break up insurance industry over premium price hikes

Marking a deepening of the fissure between the Coalition and corporate Australia, the Opposition Leader says intervention may be required to break up the country’s major insurers.

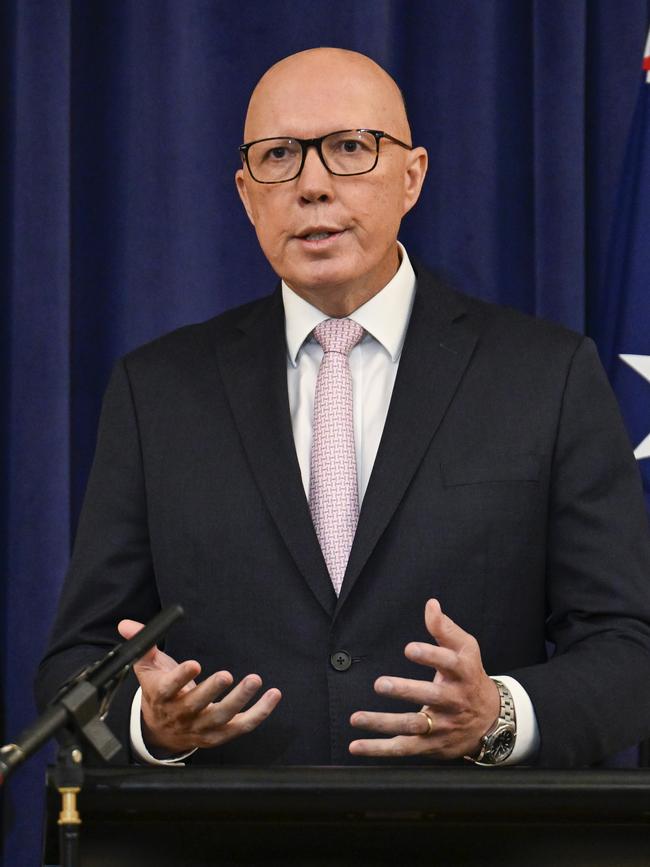

Peter Dutton is threatening to break up the country’s major insurers to ensure consumers receive “a fair go”, saying a lack of competition in the insurance industry has given rise to a sharp increase in premiums and left many uninsured.

In a deepening of the divide between the Coalition and corporate Australia, the Opposition Leader on Sunday said intervention may be required in the insurance industry and likened it to Australia’s major supermarket retailers, which face accusations of price gouging.

“There are obviously reinsurance issues, some of which are outside of our country’s control, but we need competition,” Mr Dutton told Sky News on Sunday.

“We need depth in the insurance pool, and we need to make sure that we’re not being ripped off by insurance companies.

“As we’ve done with the supermarkets, where we have threatened divestment, if consumers are being ripped off, similarly in the insurance market, we will intervene to make sure that consumers get a fair go.”

Such an intervention would mark an expansion of the Coalition’s divestiture policy as a power of “last resort” to target major grocery and hardware chains – including Coles, Woolworths and Bunnings – in the event they engage in anti-competitive behaviour.

Insurance costs are one of the fastest-growing items in the basket of goods and services surveyed in the Bureau of Statistics’ measure of consumer prices, climbing 11 per cent in the year to December to outpace the headline inflation rate, which lifted by 2.4 per cent over that period.

Mr Dutton’s signal was met with immediate hostility from the insurance industry, which described market conditions as “very competitive”.

“The only sustainable way to address insurance affordability is to reduce or remove risks,” said Andrew Hall, chief executive of the Insurance Council of Australia, which represents major providers including Allianz, AAMI, QBE and IAG.

Mr Hall instead pinned responsibility for premium increases on price hikes in building and motor repairs, ballooning reinsurance costs, appreciation in asset values, and the growing frequency and severity of severe weather events.

The industry advocate also apportioned blame to the taxes on insurance products levied by state governments, which, if removed, would reduce premiums by as much as 30 per cent, he claimed.

The parliament’s house economics committee, chaired by Labor MP Daniel Mulino, is examining the rising cost of home insurance as part of broader inquiry into the sector’s response to a series of flooding events in 2022.

The competition watchdog is similarly monitoring pricing behaviours in the industry, including the federal government’s cyclone reinsurance pool, established in 2022 to make insurance more affordable for households and small businesses.

In its latest insurance monitoring report, the Australian Competition and Consumer Commission found while insurers were passing through savings generated by the reinsurance pool, those were being eroded by other cost increases.

Despite the pressure on home premiums, the insurance industry recorded healthy profits last year. In the 12 months to September, Australia’s insurers recorded a combined net profit after tax totalling almost $6bn, according to data released by the Prudential Regulator.

Mr Dutton’s threat to the nation’s major insurance companies comes as elevated living costs continue to strain household budgets, with inflation registering as the most pressing issue among voters in the lead-up to the federal election, likely to be held in April.

In a potential indication of further relief for family budgets should the Coalition win government, Mr Dutton flagged plans to cut income taxes but did not provide a firm commitment to do so, nor any specific details.

“We want to reduce taxes wherever possible, but we’ll be dictated to by how much money is left in the bank,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout