Double-whammy tax hit for exclusive club

Voters in the most exclusive suburbs face a “double-whammy” tax clampdown under a Labor government.

Voters living in Australia’s most exclusive suburbs face a “double-whammy” tax clampdown under a Labor government, with Bill Shorten’s plan to cap deductions for managing tax affairs at $3000 aimed at the same people most vulnerable to his franking credit ban.

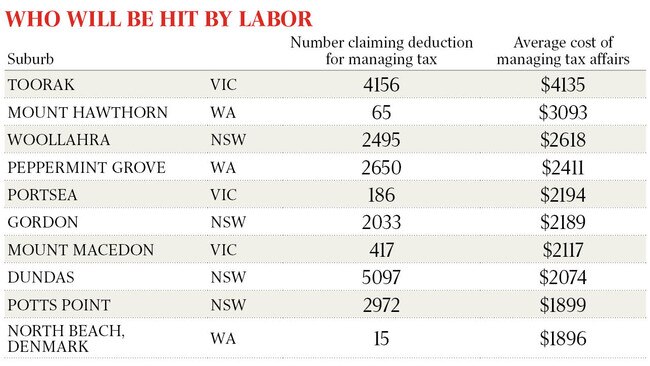

While the latest tax statistics do not reveal the extent to which specific individuals are claiming deductions above Labor’s proposed limit for managing their tax affairs, they show the postcodes with the highest average deductions for the cost of accountants, advice and tax planning, pointing to the suburbs most likely to be impacted by the proposal.

Accountants and the Coalition have attacked the opposition’s policy as a “handbrake” on small businesses that offer tax advice and have warned it could prevent average Australians from seeking help when managing the tax implications of a divorce or the death of a family member.

An analysis of new Australian Taxation Office statistics by The Australian shows residents in upmarket Toorak in Melbourne’s east claim an average $4135 for managing their tax affairs, putting voters in Kelly O’Dwyer’s vacated seat of Higgins squarely in the sights of Labor’s clampdown.

That is more than 10 times the national average deduction of just under $400 a taxpayer.

Among the top 30 postcodes with the highest deductions for managing tax affairs are Woollahra in Sydney’s east claiming an average $2600, while voters in Perth’s riverside Peppermint Grove are lowering their tax bill by an average $2400. In Portsea, on the Mornington Peninsula, the average deduction is $2200, closely followed by residents in another Victorian getaway town, Mount Macedon, where the average claim is $2100.

The list of top postcodes also reveals a significant overlap between high rates of deductions for managing tax affairs with postcodes where residents are collecting the highest rates of franking credit income from both directly and indirectly held investments, as revealed in The Weekend Australian. Other postcodes that register on both tables include the suburbs of Bellevue Hill, Mosman, Double Bay and Northbridge in Sydney, Sorrento in Victoria, City Beach and Applecross in Perth and St Lucia in Brisbane.

Josh Frydenberg said the policy would “hurt all Australians” and especially “small businesses and farmers” in their time of need.

“This is yet another ill-conceived tax from Bill Shorten that will put the cost of important advice for many Australians out of reach at a time when they need it most,” the Treasurer said.

Opposition Treasury spokesman Chris Bowen said only 1 per cent of Australians would be affected by the cap and that the data “reiterates that it’s higher-income earners who benefit most” from deducting the cost of managing their tax affairs.

“This often comes as a double whammy for low and middle-income earners, because it’s those claiming the bigger tax accountant costs who are accessing tax loopholes that cost the taxpayers billions of dollars in revenue,” Mr Bowen said.

Labor estimates that its shake-up will raise $1.8 billion over a decade.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout