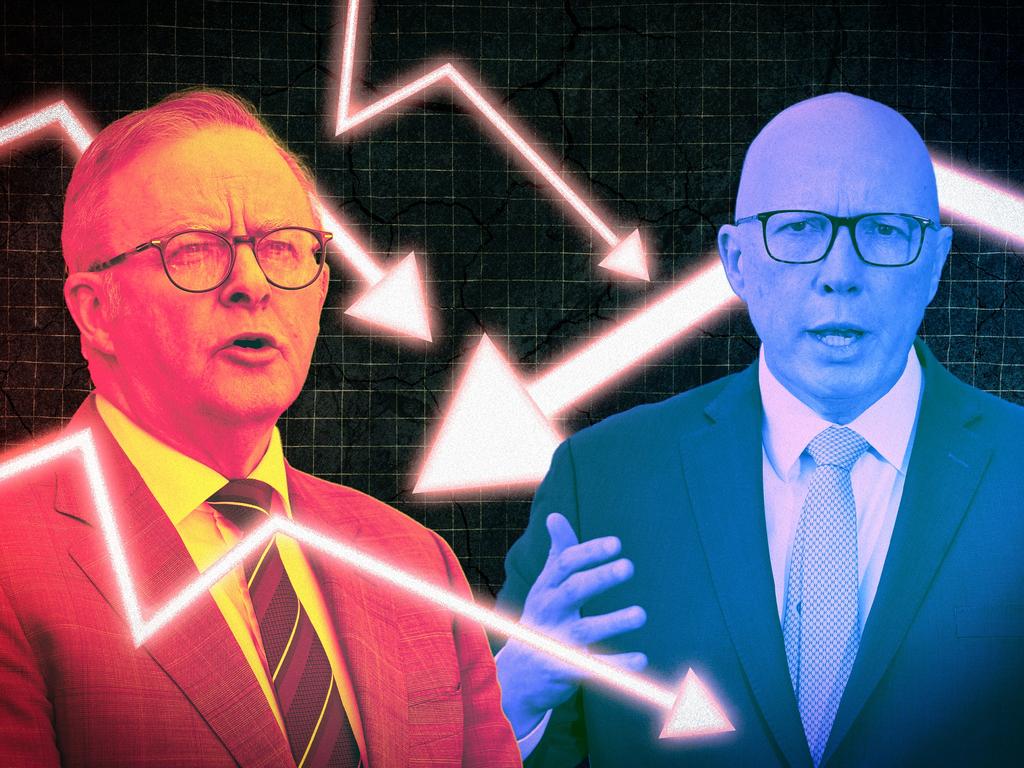

Don’t expect Anthony Albanese to get too much credit for this interest rate cut from angry voters

This is the rate cut that borrowers have been praying for and the Albanese government desperately needed.

It will inject optimism into the Labor campaign and add weight to Chalmers’ economic narrative.

The Prime Minister will be banking on it to take some of the edge off voter anger.

The odds of a late March or early April election have just rocketed up the charts.

There will be a view that this may be about as good as it gets for the government, considering it is the best day it has had since before the voice referendum.

But there is a sting in the tail.

What the central bank didn’t say in its statement, but is contained in the data drop accompanying it, is that the time it is going to take for living standards to return to anything resembling pre-2022 will now take longer than they expected.

Another two years in fact.

June 2031, to be precise.

While the bank is giving with one hand, it appears to be taking away with the other – reducing interest rate pain now but forecasting the broader cost-of-living pain to go on longer than it had predicted only three months ago.

It is a fact that the government would be likely unwilling to acknowledge because it is a factor that is more directly under its control.

Albanese would be crazy-brave to wait around for the central bank to be less generous on April 1, which governor Michele Bullock has strongly suggested it will be.

The decision plays directly into the storyline that Albanese will pursue – that the nation has turned the corner on the cost-of-living crisis and better times are ahead.

However, it is an open question as to whether the several million households with mortgages, having endured 13 rate hikes since 2022, are willing to return the favour as a political dividend to the government.

When the reality for households sinks in, and they discover that it means only about $100 a month less than the $1500 a month more they have been forced to pay on their mortgage since the last election, what is left is a continuation of pain.

It would be bold to assume that voters will be generous in their assessment of the government’s role in delivering this, considering it has been part of the reason why it has taken so long for a rate cut to come.

For this reason, the Treasurer will want to tread carefully in trying to claim too much credit.

Nothing will annoy the punters more than a government gloating.

The politics of pre-election rate cuts – or indeed rate rises – historically haven’t swung elections demonstrably one way or the other.

But in this case, a different dynamic is at play.

Having built up expectations as much as the government did, had the RBA put rates on hold it would have been a political disaster.

But it may be wishful thinking on Labor’s part that a single rate cut following a dozen rises will shift the dynamic too much if at all in its favour.

Chalmers may have to wear the charge from the Coalition that the government had bullied the bank into it.

However, mortgage holders are hardly likely to care – and this would be a churlishly stupid pre-election strategy from the Opposition.

There is a double-edged sword in all of this for Peter Dutton.

Having steered perilously close to barracking against mortgage holders last week, the Opposition Leader joined the chorus of hope this week for a rate cut.

The better political outcome for the Coalition would have been for the RBA to have held on rates.

The better outcome for the voters is the opposite.

While the rate cut may take some wind out of the Coalition’s sails in the short term, it won’t materially affect the political strategy.

From here to polling day, the message will be one of reminding people that it is going to take a lot more than one rate cut to begin to return peoples’ lost standard of living to where it was three years ago.

Once the sugar hit of a rate cut subsides, borrowers are likely to move on and shift their focus to when the next one is coming.

A single rate cut may simply serve to remind them just how much they have lost.

In the end, the central bank’s decision to finally administer a dose of belated pain relief for borrowers on Tuesday may be too little too late, with the explicit warning that it may be some time before more relief is on the way.