Coronavirus: Tax bonus eases pain of lockdown

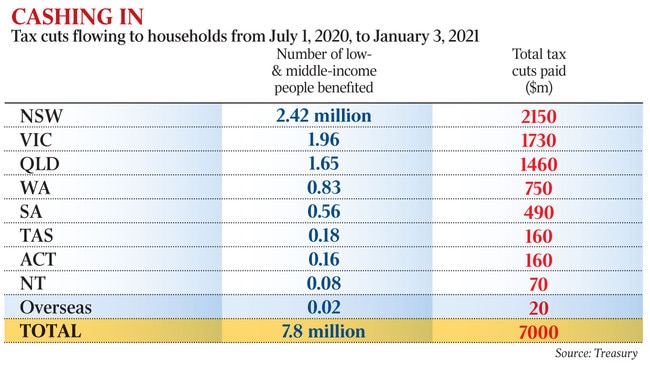

Tax cuts and low income concessions have put $7bn in the pockets of nearly eight million Australians in the past six months.

Tax cuts and low income concessions have put $7bn in the pockets of nearly eight million Australians in the past six months, underpinning a boom in household spending that has partially offset the impact of COVID-19 closures.

Unpublished data from the Australian Taxation Office shows about $1.1bn has flowed to taxpayers as part of the federal government’s stage II tax cuts between July 1 and January 3.

Another $5.9bn has been paid under the Low and Middle Income Tax Offset that flowed to 7.8 million people at the same time.

The tax cuts could partially explain strong retail spending in the second half of the year, despite the impact of COVID-19 restrictions.

Economists say, however, that the strength of the recovery will depend on how quickly restrictions can be eased as Queensland, NSW and Victoria battle COVID infections.

The Queensland government will say on Monday whether it will ease a lockdown imposed on Brisbane after a case of the UK variant of the coronavirus was discovered in the community.

National cabinet declared Brisbane a COVID hotspot in the wake of the infection but no further cases have been found.

The Australian understands another day of zero community transmissions will see the lockdown relaxed but it is likely social distancing measures will remain in force until authorities can be certain the UK strain has not escaped into the community.

The NSW government lifted a lockdown on the northern section of Sydney’s northern beaches at the weekend and appears to have contained a cluster at Berala in city’s west. Three cases of community transmission were reported in NSW on Sunday.

Significant border restrictions remain in force on travel from Queensland and NSW, which economists predict could cost the economy more than $3bn in lost trade over the January holidays.

Josh Frydenberg says the tax cuts have put more money in workers’ pockets. “As part of our economic recovery plan, the Morrison government has delivered $7bn in tax cuts to Australians in the second half of 2020, meaning they have more money in their pockets over this well-earned summer break,’’ he said.

The Treasurer said the 2020-21 budget personal income tax cuts, coupled with the government’s loss carry-back and immediate expensing incentives for business would create about 100,000 jobs by the end of 2021-22.

AMP Capital chief economist Shane Oliver said he was “nervous” but still expected the national economic recovery would remain on track despite outbreaks over recent weeks. He said, however, this view was “critically dependent on the Brisbane lockdown coming to an end on Monday night”.

Mr Oliver estimated that a two-month lockdown of Brisbane could result in 50-60,000 workers being laid off, stood down or having their hours reduced to zero.

“I feel nervous about things, but I also have a degree of comfort that we are now three weeks into the outbreak in Sydney and there hasn’t been an explosion in cases,” he said.

An Australian Retailers Association spokesman said overall, retail had “quite a successful period’’ over the Christmas-New Year period. “For Sydney obviously with the COVID outbreak on the northern beaches, foot traffic was down in the city. We did, however, see it really pick up in suburban areas such as Parramatta, as people seemed to be more keen on shopping in their local area.

“We saw more people shopping online, as was expected, and so there was a massive spike there.

“November was a really great month because we had Black Friday and Cyber Monday … a record-breaking month in terms of online sales and that has sort of provided some good momentum heading into the pre- and post-Christmas sales.”

As a result of the government’s tax cuts, more than 11.5 million people are expected to receive an income boost.

Low and middle income earners will receive tax relief of up to $2745 for singles and $5490 for dual-income families compared with tax bills in 2017-18.

Treasury estimates the tax cuts, announced in the October budget, will boost GDP by about $3.5bn in 2020-21 and $9bn in 2021-22 and will create an extra 50,000 jobs by the end of 2021-22.

Growth rebounded in the September quarter by 3.3 per cent after falling 7 per cent in the June quarter, driven in part by a 7.9 per cent increase in household consumption, the largest on record.

Economists believe the spending continued in the lead-up to Christmas. Citi predicts November retail sales statistics to be released on Monday will show a 7 per cent rise in consumer spending.

A breakdown of ATO tax cut figures estimates that between July 1 and January 3, NSW residents received $340m in tax cuts from the bringing forward of the stage II reductions and 2.42 million NSW residents received $1.81bn from LMITO. Victorian residents received $260m in stage II tax cuts and 1.96 million residents received $1.47bn from LMITO. Queensland residents received $210m from the tax cuts and 1.65 million received $1.25bn from LMITO. Western Australian residents received $130m in tax cuts and 830,000 received $620m from LMITO. South Australian residents received $60m in tax cuts and 560,000 received $430m from LMITO.

Tasmanian residents received $20m in tax cuts and 180,000 received $140m from LMITO.

A Citi note to clients last week said high savings rates because of lockdowns and an increase in disposable income thanks to fiscal stimulus meant that consumers began spending in the fourth quarter of 2020 as restrictions eased.

Ahead of the release of the November retail sales numbers, Citi said: “We expect the final report will confirm that household goods retailing rose sharply, with significant increases in other discretionary spending items.’’

ANZ last week said it anticipated spending in December had been stronger than in November.

“This is an encouraging end to 2020 for total ANZ-observed spending, especially considering the mid-December COVID-19 cluster in Sydney’s northern beaches and the subsequent uncertainty and restrictions,’’ ANZ economist Adelaide Timbrell said.