Coronavirus: Federal fiscal rescue streets ahead of states

The federal government has committed two to three times more in stimulus spending as a percentage of revenue than the states.

The federal government has committed two to three times more in COVID-19 stimulus spending as a percentage of revenue than the states, with Josh Frydenberg pushing the premiers to “do more” to shoulder the burden.

The Morrison government has said the $45bn in emergency economic assistance from the states and territories is equal to just over 2 per cent of their combined economic output. The Treasurer on Saturday compared this with the $314bn in support pledged by the commonwealth — equivalent to about 16 per cent of GDP. Mr Frydenberg said when it came to supporting their economies, “the states can do more, the states need to do more”.

But ANZ senior economist Cherelle Murphy said it was unfair to compare spending in absolute terms due to the different revenue-raising capacities between the levels of government.

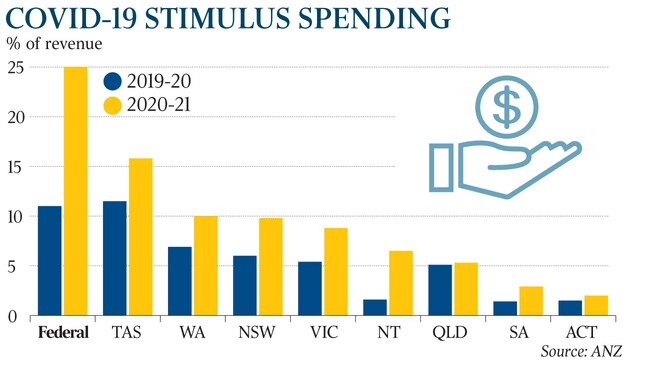

Expressing COVID-19 spending as a proportion of government income painted a more accurate picture of the fiscal weight taken on by the states and the commonwealth, Ms Murphy said.

Her analysis showed that while the states lagged well behind the commonwealth, they were carrying more of the burden than the federal government claimed.

The ANZ research revealed that about $190bn in federal support policies were worth 18 per cent of combined commonwealth revenue across 2019-20 and 2020-21 (Treasury has said these years account for almost all of the COVID-19 fiscal measures).

The states and territories have committed nearly $40bn over the two financial years, or 7 per cent of combined revenues, the ANZ analysis showed. Pandemic support measures accounted for 11 per cent of total commonwealth income in 2019-20, and 25 per cent of 2020-21. This compared to 6 per cent and 9.8 per cent in NSW for the two financial years, respectively, and 5.4 per cent and 8.8 per cent in Victoria. Western Australia and Tasmania have committed the most, at 10pc and 15.8pc of 2020-21 revenue, respectively, figures showed.

Most of Mr Frydenberg’s state and territory counterparts defended their level of spending, with one saying the commonwealth’s tax-raising powers gave it greater room to spend.

Victorian Treasurer Tim Pallas defended his state’s COVID measures, which ANZ put at $103bn over two financial years. Victoria will also be sharing costs for paid pandemic leave.

“Now more than ever, it’s essential we work together in our efforts to get on top of this global pandemic,” Mr Pallas said.

NSW Treasurer Dominic Perrottet said state governments would ultimately have to increase their fiscal support measures. “COVID-19 is a long-term challenge and we have continued to increase support over the past six months. We know more will be needed,” he said.

Queensland Treasurer Cameron Dick said he would wait to discuss future borrowing with Mr Frydenberg directly. “I look forward to hearing from Josh Frydenberg about what additional level of borrowings he thinks each state should undertake,” he said.

West Australian Treasurer Ben Wyatt said: “The commonwealth fiscal capacity is significantly higher than the states, largely due to significant revenues gained through federal taxes.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout