Coronavirus: China poses $17bn threat to farmers in trade war

The risk of escalating action by China to restrict our farmers’ access to its massive market would pose a $17bn threat to exports.

The risk of escalating action by China to restrict our farmers’ access to its massive market would pose a “substantial” threat to Australian agricultural exports worth close to $17bn.

Fears of a one-sided “trade war” emerging between Australia and the communist country have heightened this week, after China suspended meat imports from four Australian abattoirs and threatened to slap tariffs of more than 70 per cent on barley as soon as this weekend.

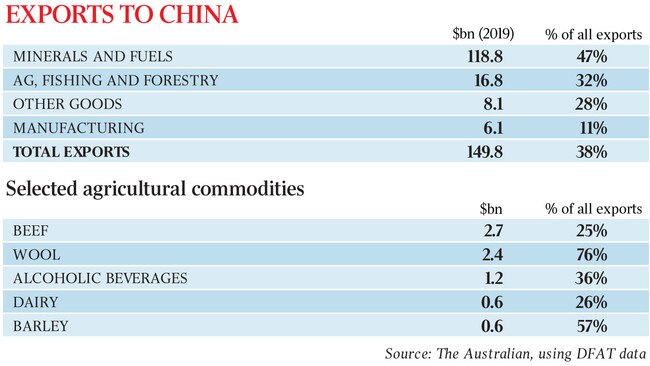

Agricultural, forestry and fishery exporters are particularly reliant on the Chinese market. The sector sent just under a third of all its exports, by value, to China last year — $16.8bn of the $53bn total international sales for the year, according to Department of Foreign Affairs and Trade data.

In comparison, manufactured goods exporters sell less overseas and are also relatively less reliant on our largest trading partner. There were $6.1bn worth of manufactured goods exports to China last year, accounting for only a tenth of that sector’s total.

CBA agricultural commodity strategist Tobin Gorey said the risk of rising Chinese protectionism was “a substantial threat” to the sector and that China was “a big market for beef”.

Australian producers sold $2.7bn worth of beef to China last year, or a quarter of the $10.8bn total export sales for the year, according to the DFAT data.

Barley sales to China were worth a much smaller $600m last year, but that accounted for a much larger share of the $1bn in total barley overseas sales, showing how vulnerable the industry is to adverse Chinese trade rulings.

Wool producers are even more reliant on our largest trading partner: more than three-quarters of the $3.2bn in total exports last year went to that country. A quarter of dairy exports, or $600m, go to the Asian giant, and more than a third of our alcoholic beverages sales, valued at $1.2bn in 2019.

Mr Gorey said the barley tariff and beef regulatory actions remained “isolated” incidents, with the former a long-running trade issue. “There’s definitely no sense there is a campaign on these issues yet,” he said. “That would be a bigger worry if that was the case, and if a third one emerges in short order that might be a larger concern.”

Mr Gorey noted that the generic issue of protectionism was “always there” for agricultural exporters. He pointed to examples such as Indonesia restricting the live cattle trade, or India putting heavy tariffs on pulses, such as beans, lentils, chickpeas and split peas, to protect domestic farmers.

Our mining and energy giants dominate our trade relationship with the world’s second-largest economy — earning just under $120bn last year in exports and accounting for close to half of all goods exports to China.

China’s reliance on Australia to supply these crucial natural resources reduces the likelihood of our biggest export earners falling prey to politically motivated protectionist measures.

More than 60 per cent of Chinese iron ore imports come from Australia, half of LNG imports and 40 per cent of coking coal purchases.

ANZ chief China economist Raymond Yeung said China would struggle to find a ready substitute for these resources. “Loosely speaking, China likes Australian LNG, iron ore and coking coal because of the quality,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout