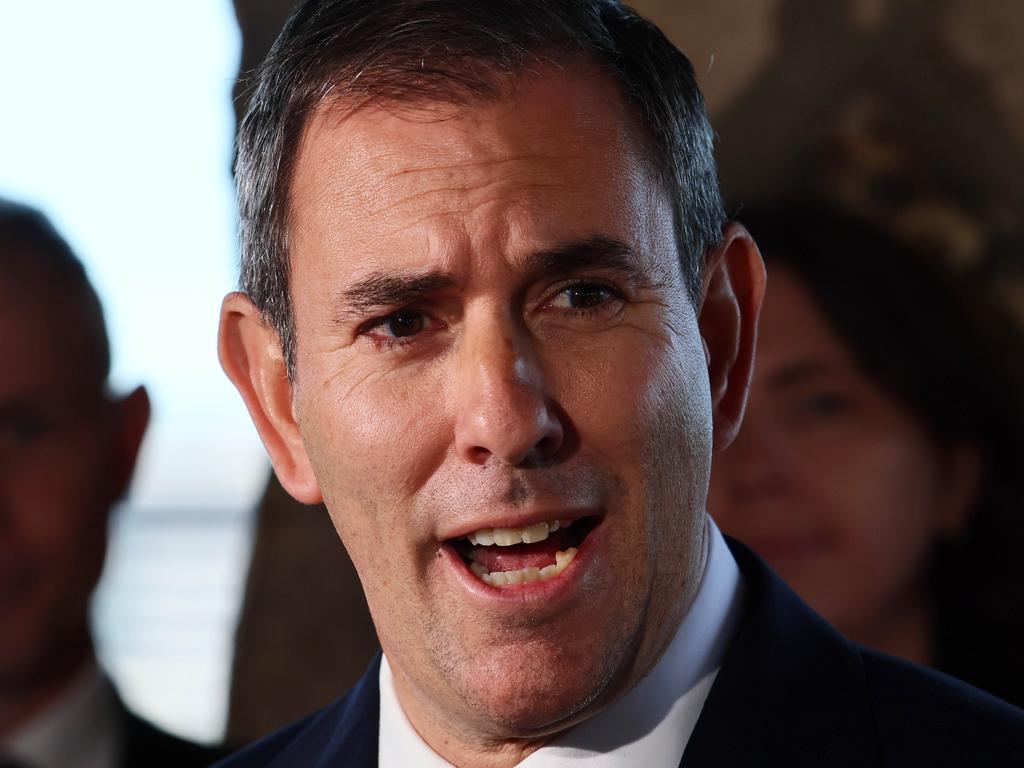

Coalition open to a deal on super tax if Chalmers changes direction: Ted O’Brien

The Coalition has left the door open to striking a deal with Labor on increasing taxes on high-end superannuation balances to help address the structural budget deficit.

The Coalition has left the door open to striking a deal with Labor on increasing taxes on high-value superannuation balances to help address the structural budget deficit, but Jim Chalmers will have to drop the model of taxing unrealised capital gains to have any chance of winning bipartisan support for reform.

Opposition Treasury spokesman Ted O’Brien said the Coalition would be willing to engage with the Treasurer on superannuation tax reform if he raised the white flag on a model that has been widely panned by economists. He said another “red line” for the Coalition was the failure of Labor to index the proposed rate of tax applying for balances worth $3m or above.

The government’s policy would raise taxes on superannuation earnings from 15 per cent to 30 per cent for super balances above $3m, while taxing unrealised capital gains on these accounts.

“We will be constructive, but Jim Chalmers has to be prepared to change his direction on this,” Mr O’Brien told The Australian.

“What is being put forward really does breach a red line in taxing unrealised capital gains.

“But if Jim Chalmers is prepared to be humble for a moment and realise he’s made a mistake and wishes to engage with me, my door is open.”

A deal with the Coalition would bake in reform to increase revenue from superannuation and take the political heat out of the issue, while striking a deal with the Greens would likely see it remain as a contentious issue at the next federal election, due in 2028.

New Greens leader Larissa Waters told The Australian last week the party was supportive of taxing unrealised capital gains, with the minor party opposing the policy in the last parliamentary term only because it wanted the threshold to be lowered to $2m.

In his first major interview since he became Coalition Treasury spokesman, Mr O’Brien said the economic offering Peter Dutton took to the last election was inconsistent with Liberal values.

Mr O’Brien – the architect of the contentious nuclear policy that was successfully weaponised by Labor at the election – said it was a mistake for the Coalition to both oppose income tax cuts and plan to deliver higher deficits than the Albanese government for two years.

“There’s been inconsistency between the values of the party, and the traditional strength of economic management, and the policies we took to the last election,” Mr O’Brien said.

“I think that had a lot to do with why Australians simply did not see a compelling enough case to vote for us.

“I don’t think we had an economic narrative that the Australian people could see their aspirations realised through.

“I think that was a big flaw for us.

“We are at our best when Australians understand that if they work hard, they can achieve anything, because the Coalition is empowering them through economic management.”

With the Coalition lashing the government over high deficits, spending and tax in the last term of government, Mr O’Brien said: “There’s no point in holding a government to account on an issue for which you’re not going to have a very clear, compelling solution”.

In his first speech of the year in January, Mr Dutton vowed to undertake “economic surgery” by cutting spending and rejecting cost-of-living sugar hits that he claimed were putting upward pressure on inflation.

The former Liberal leader and his economic team progressively walked away from this approach as the poll drew closer, mostly backing-in Labor’s spending, refusing to outline a pathway to surplus, rejecting tax reform and outbidding Labor on inflationary cost-of-living handouts.

Former Treasury spokesman Angus Taylor spent the lead-up to budget week campaigning against bracket creep under Labor, despite his own policy increasing the tax burden on working Australians compared to what was being offered by Dr Chalmers.

New opposition finance spokesman James Paterson – a key supporter of Mr Dutton who was a member of the leadership group – said he was among many Coalition MPs who regretted not speaking up more about the policy direction.

“I should have spoken up more, I should’ve pushed back more, I should have contested ideas more,” Senator Paterson told Sky News.

“I think all my colleagues in the parliamentary party have had that conclusion.

“We prized unity over our robustly interrogating policy ideas.”

Mr O’Brien said the Coalition needed to “return to a disciplined approach to fiscal responsibility” while also having an ambitious growth agenda.

“For too long, we haven’t spoken on the importance of deficits and debt and pointed out the intergenerational inequity of the approach that’s being taken,” Mr O’Brien said.

He acknowledged that fiscal repair needed to include conversations about both spending and revenue, vowing to be “pragmatic” and “constructive” if Labor proposed measures that would broaden the tax base and take pressure off workers.

“But I make this point: that there is no better driver of revenue than a more ambitious economic growth agenda,” he said.

“Our objective has to be to always have lower, simpler and fairer taxes.

“That is one of our core traditional strengths, and we need to reclaim that strength as we move forward.”

He said the Coalition’s growth agenda needed to examine reforms to industrial relations, energy, tax and red tape.

“It’s from ensuring that we’ve got lower energy costs, more user-friendly IR policies,” he said.

“(That) we’ve got a tax and investment regime that attracts capital into productive assets, we’ve got a competition policy that allows for small businesses to become big businesses.

“We need to be leveraging our existing strengths while ensuring that we’re not left behind with areas of the new economy (that) are very much technology-driven.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout