‘Class-action overhaul key’ if victims to keep the lion’s share

The booming class-actions industry needs an overhaul to ensure litigation funders cannot take an exorbitant cut of legal payouts.

The booming class-actions industry needs an overhaul to ensure litigation funders cannot take an exorbitant cut of payouts to victims of negligence and bad company behaviour.

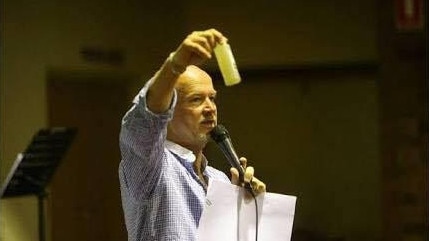

This is the view of NSW resident Rob Roseworne who lives on a property contaminated by toxic firefighting chemicals that have leached from a defence base in Williamtown, near Newcastle.

Mr Roseworne is bitterly disappointed that more than 40 per cent of a $212.5m settlement meant to compensate hundreds of victims is set to disappear on fees and commissions.

His concerns come amid fears the economic misery wrought by COVID-19 in Australia is being targeted by global litigation funding firms intent on backing lawsuits against business and government. The concerns have caused a spotlight to be shone on the massive profits being reaped by global funders that back class actions in Australia.

Mr Roseworne said he hoped an inquiry expected to be set up this week by the Morrison government into the booming class actions industry would shine a light on the way “the little people” were “being churned up and spat out”.

“It’s stopped being our case a long time ago and it’s just business,” Mr Roseworne said.

Lawyers will reap about $30m from the actions brought by communities impacted by the toxic firefighting foam, while the litigation funder has estimated its profit will be $51.5m from the case.

All three class actions were backed by global funding giant Omni Bridgeway.

Litigation funders invest in lawsuits by paying upfront legal fees in exchange for a cut of the settlement money.

The Australian reported this week that Omni Bridgeway had made returns on its investment capital of more than 300 per cent on two Australian-linked funds — a result that was about 90 times better than its US fund.

Its funding applications for legal cases such as class actions had soared almost 18 per cent compared with last year.

Business groups have urged the government to temporarily suspend new class actions until the COVID-19 crisis is over.

Mr Roseworne said he believed a new licensing system was needed to ensure litigation funders acted in the best interests of clients and remained at arm’s length from proceedings.

He said he felt under immense pressure to agree to a settlement when he had not yet been told how it would be divided between hundreds of claimants.

However, not everyone shares Mr Roseworne’s concerns about the settlement.

The Weekend Australian can reveal that the steering committee of the Williamtown class action wrote to the judge handling the case on Thursday urging him to approve the proposed settlement.

The letter said the community needed to move on and that the “significant settlement” was fair, hard fought and in its interests and “preferable to pursuing litigation over a number of years that will cause ongoing uncertainty and mental anguish for the people of Williamtown”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout