Chinese trade tensions cost $5.5bn in lost exports

New research showing the multi-billion hit to export earnings from Chinese trade aggression comes as the threat of further sanctions looms.

Trade tensions with China have cost Australian exporters $5.5bn in lost sales over the six months to January, despite early evidence that barley, rock lobster, coal and cotton producers had found alternative markets for $500m worth of their wares.

The Morrison government’s decision on Wednesday to veto an infrastructure deal between the Asian powerhouse and the Victorian state government has sparked threats of further trade retaliation from Chinese officials.

Research by Commonwealth Bank shows the imposition of bans and extra taxes on Australian goods into China have triggered $5.5bn in lost exports over the six months to January.

The fall in coal exports to China was equivalent to more than $5bn alone over that period, a drop of nearly 80 per cent.

CBA senior economist Belinda Allen said coalminers ramped up exports to other markets, particularly to India, Japan and Korea, but at lower prices than they were getting from Chinese customers.

Australian exporters subject to Chinese trade aggression in 2020 have seized the opportunity to diversify to new markets in some of the fastest-growing economies in the world, providing a $500m cushion to the hit from souring relations with our largest economic partner.

Despite China imposing tariffs of 80.5 per cent on Australian barley exports in May 2020, total sales over the six months to January jumped 13 per cent versus the previous six months, thanks to a surge in exports to Saudi Arabia, alongside a lift in sales to Thailand, Vietnam and Kuwait.

It was a similar story for other targeted goods, such as crustaceans (including rock lobsters) and cotton, with total exports climbing in both between the two half-year periods.

Ms Allen cautioned that Chinese sanctions on these goods had come into effect only in November and the impact may prove larger as later figures emerge.

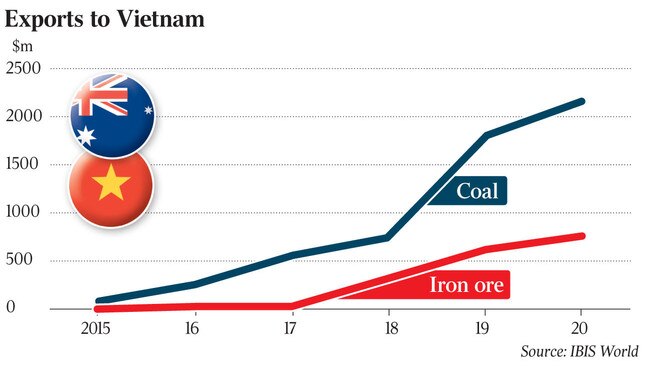

Vietnam has become an increasingly important trading partner. Coal exports there have grown at an average annual rate of close to 90 per cent over the past five years, from under $100m to over $2bn in 2020, according to IBISWorld.

Iron ore exports over the same period have gone from zero to about $750m, while the Southeast Asian economy is now our largest overseas market for grapes, at 7 per cent of sales.

India’s appetite for Australian coal has soared. Australia typically provides about 4 per cent of India’s thermal coal needs but that lifted to about 20 per cent in January and February, on IBISWorld figures. Its analysts also identified Indonesia and Mexico as fertile ground for export penetration.

The booming iron ore price, which this week reached a record high in Australian dollar terms of over $230 a tonne, has eclipsed the damage wrought by Chinese trade aggression in 2020.

Data from the Department of Foreign Affairs and Trade shows total merchandise exports to China fell by only 2 per cent to $146.3bn in 2020, despite the pandemic and global recession.

Exports earnings from the key steelmaking commodity jumped by nearly 20 per cent over the six months to January, the CBA analysis showed.

Josh Frydenberg on Thursday said he was “confident” the country’s biggest export earner, iron ore, would not be targeted in new sanctions, a view supported by commodity analysts.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout