Chinese investment slows to a trickle

Capital is being dramatically shifted to developing nations that have signed up to Xi Jingping’s Belt and Road Initiative.

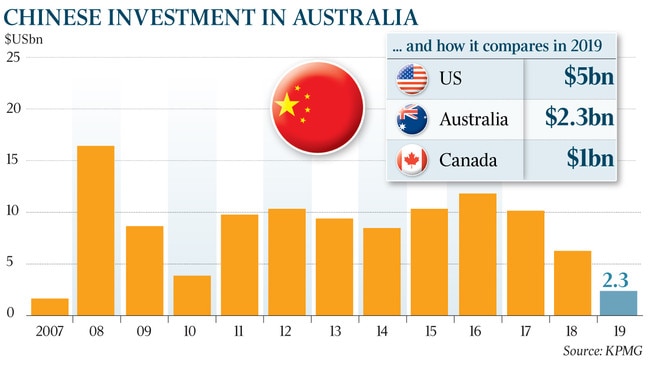

Chinese investment in Australia plummeted by more than 60 per cent last year to $3.4bn, as Beijing shifted capital towards developing nations that have signed up to Xi Jinping’s signature Belt and Road Initiative.

A new report reveals that despite record trade between the two countries, Chinese investment in Australia in 2019 was at its lowest annual level since its 2010 fall from boomtime heights, two years after Chinese minerals and energy sector deals brought in more than $20bn.

The investment dive is part of a broader trend of falling Chinese investment in Western countries such as the US and Canada, as Beijing directs capital flows to reinforce its strategic interests elsewhere in the world.

It came amid stricter Chinese government controls over outward investment, and tougher treatment by Australia’s Foreign Investment Review Board of bids by Chinese companies, particularly state-owned enterprises.

The report by KPMG and the University of Sydney predates last week’s announcement by the Morrison government of a new foreign national security test for all offshore bids for sensitive assets, which could further choke investment flows from Chinese companies.

The report says the most Chinese investment in Australia last year came from a single deal that was 44 per cent of the total — the $1.5bn takeover by China Mengniu Dairy Company of food company Bellamy’s Australia.

The total number of new deals by Chinese investors in Australia almost halved from 74 in 2018 to 42 last year.

Real estate was responsible for two other major deals — $280m to buy a majority stake in the Propertylink Australian Logistics Trust 11 in NSW by the China Merchants Fund, and a $200m residential investment deal by the Hong Kong-listed Aoyuan International to buy Sydney property developer Capital Bluestone.

The fourth-largest deal was the $128m purchase by the China Education Group of education provider the King’s Own Institute.

Two-way trade between Australia and China grew by more than 21 per cent last year to a record $235bn.

KPMG’s partner in charge of Asia and international markets, Doug Ferguson, said there were many reasons behind the fall.

They included the tightening of Chinese regulations on outward direct investment, and “investments by Chinese state-owned enterprises moving away from developed markets and towards Belt and Road Initiative projects and Latin America”.

Mr Ferguson said “negative Chinese perceptions on stricter control regulations by the Australian government and worsening media narratives in both countries” had also contributed to lower levels of investment.

He said there had been a big emphasis by the Chinese government in encouraging Chinese investment in the 120 countries that had signed up to the BRI.

“You can’t deny there has been a change in Chinese outbound direct investment into Belt and Road Initiatives,” he said.

“Some countries which signed up the BRI are receiving a lot of Chinese investment.”

Mr Ferguson said he expected an even sharper reduction in Chinese investment into Australia this year, given the ban on travel from China and the new temporary stricter requirements for all foreign investment proposals, even by private companies, to apply for FIRB approval.

The report shows one of the few areas with an increase in Chinese investment was Latin America, where 18 countries have signed up to the BRI, including Chile, Costa Rica, Cuba and Peru, but excluding major economies such as Brazil, Argentina, Colombia and Mexico.

Mr Ferguson said progressively tighter foreign investment regulations by Australia was also a factor in the reduction in Chinese investment.

The report had shown a continued reduction in deals involving Chinese state-owned companies into Australia, with any investments by state-owned companies needing Foreign Investment Review Board approval.

Deals involving Chinese state- owned companies made up only 24 per cent of deals by number and 16 per cent by value. The fall in China investment in Australia has been evident for the past few years, well ahead of the moves by Josh Frydenberg in March to impose a temporary requirement for all foreign takeover deals to be subject to review by the FIRB.

The report covers completed deals worth more than $US5m, which means it does not cover thousands of smaller property investments in Australia.

New Chinese investment in Australia, which fell 62 per cent in 2019, was just below half of the $US5bn received by the US but more than Canada’s $US1bn. That was a faster fall than experienced by any other Western country, the authors noted.

The report showed that while Chinese investment into Europe and America was down last year, the lowest since 2008, Chinese investment in Latin America had increased.

The report shows there was no investment by Chinese buyers in the healthcare sector in Australia last year despite it being an area of interest for Chinese investors in the years before.

Chinese interests were linked to a 2018 potential offer for Healthscope, the second-largest private hospital operator in Australia. Healthscope was eventually bought by Canadian infrastructure investor Brookfield in a deal worth more than $4bn.

Hong Kong remained the most popular destination for capital from mainland China for real estate, with Chinese investment in property also increasing significantly in Japan, Singapore and Malaysia.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout