Cbus secrecy over pitch days before $500m offer

Cbus sent Jim Chalmers a proposal to exclude stamp duty in fees and costs disclosures four days before its chair Wayne Swan put $500m on the table in support of Labor’s signature housing fund.

Super fund giant Cbus sent Jim Chalmers a proposal to exclude stamp duty in fees and costs disclosures four days before its chair Wayne Swan, who is also ALP national president, put $500m on the table in support of Labor’s signature housing fund.

After almost 18 months invoking “commercial in confidence” to block Freedom of Information applications and a Senate-authorised order for production of documents, the Office of the Australian Information Commissioner instructed the Treasurer to release correspondence between Cbus and his office.

A chain of emails obtained by The Weekend Australian reveals that on November 24, 2022, Cbus sent Dr Chalmers’ staff a “Stamp Duty and Fee Disclosure briefing note for the Treasurer”.

“Please find attached a short briefing note on the impact of including stamp duty in fees and costs disclosure – a potential barrier to institutional investment in Australian Property and Infrastructure, and a proposed solution,” a Cbus staffer said.

“Looking forward to having a more detailed discussion about this with your office post-roundtable. Our [redacted] can set out some compelling real world examples of this problem playing out.”

Cbus was told Dr Chalmers’ superannuation and housing advisers would review the document, which proposed that stamp duty “be excluded from fee and cost reporting entirely” to ensure “consistency between unlisted property investments, listed property investments and other asset classes”.

Cbus staff sent another email on February 6, 2023 with the subject heading: “Stamp Duty and Fee Disclosure – Briefing Note pt 2”: “Please find attached a further briefing note on stamp duty addressing the matters we discussed – frequency, materiality and a tangible example of its inclusion in the RG (Regulatory Guide) 97 disclosure regime.”

The stamp duty emails came days before Cbus’s November 28, 2022 announcement that it would “commit up to half a billion dollars over five years to support the construction of new social and affordable homes through the Housing Australia Future Fund (HAFF)”.

Mr Swan, a former Labor treasurer who is Dr Chalmers’ mentor and former boss, said at the time: “Our commitment to the housing sector is part of our fund’s DNA. We believe that investing through the HAFF will meet the best financial interests of our members, particularly those members requiring a steady stream of income during retirement or as part of a more conservative accumulation product,” Mr Swan said.

The nine-point Cbus briefing note sent in November 2022 questioned the requirement of super funds to include stamp duty in fee and cost reporting with respect to investments in unlisted property. Cbus argued that stamp duty should be excluded to be consistent with listed property assets reporting. The note said: “All fees and costs (including stamp duty) would continue to be taken into account when reporting net investment returns – which is ultimately what matters most to members.

“The requirement to disclose stamp duty as part of fees and costs is emerging as a disincentive to invest in Australian property and certain infrastructure. Anecdotally we are aware that funds have decided against property investments because of concerns about the impact disclosing stamp duty has on their fees and costs template and what it would means for their APRA Fees and Costs Heatmap ranking … Property investment is an opportunity for funds to support the economy and deepen member connection with the super system by giving them a stake in airports, shopping centres, affordable housing developments etc.”

The briefing said if superannuation funds wound back investment in property “it cannot be assumed that other investors e.g., private equity, will step in because big property transactions are typically syndicated, relying on participation by funds”.

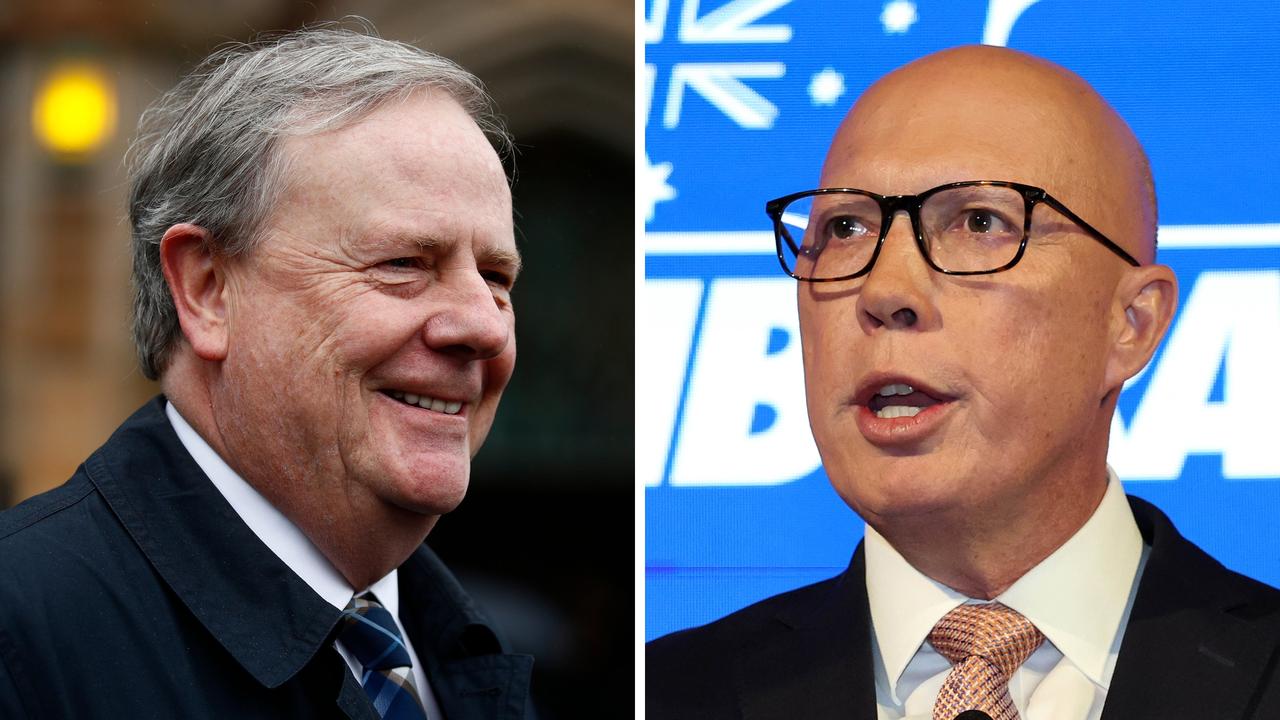

Opposition assistant home ownership spokesman Andrew Bragg, who led the fight for access to the Cbus correspondence, had previously won support in the Senate for an order for production of documents compelling ministers to release requested documents. Under Anthony Albanese, multiple cabinet ministers have invoked “public interest immunity” to reject such orders.

In refusing access to communications with Cbus, Dr Chalmers said: “Disclosure of the documents sought would provide an unfair insight into CBUS’ private opinions and business affairs. CBUS is a large superannuation fund with many members, and disclosure of the information sought would have the potential to damage their commercial affairs.”

Under legislative requirements, the government consulted Cbus upon receiving the FOI request and the super fund objected to releasing the documents. Senior government sources said the changes to disclosure requirements sought by CBUS were a matter for the fund and regulator.

Senator Bragg said super funds wanted to “take over the Australian dream”, rejecting Dr Chalmers’ claims the emails were commercially sensitive.

“For almost 18 months, Jim Chalmers and Cbus have engaged in a cover-up. The documents reveal the deep ambition of super funds to become corporate landlords. Wayne Swan and Cbus want a special deal to conceal fees from members, and Jim Chalmers tried to cover it up,” he said. “There were no commercial secrets, it was just putrid rent-seeking as part of a sick corporate housing agenda. The Australian people want to live in their own house, not a house owned by Cbus.”

A Cbus spokesman said Senator Bragg “well knows that Cbus does not have any build-to-rent investments in Australia, and is not seeking to be a landlord”. He said the stamp duty discussions were “unrelated to the HAFF” and mirrored industry-wide concerns the “current approach negatively biases against unlisted, directly-owned investments”.

“Cbus has not committed any money to HAFF investments, and provided a high-level indication of our potential interest in the HAFF should an attractive product be developed, in line with our risk/return expectations for the relevant asset class.

“Stamp duty costs are not relevant to the HAFF in this regard. Under the model Cbus has been working on with other institutional investors, investors would provide debt, not equity.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout