The Catholic Church has pumped $170m into its insurance company to help cover sex abuse claims amid massive losses and potential capital shortfalls that raise fears of future bailouts.

Dioceses and religious orders across Australia made the payments to shore up Catholic Church Insurance, which recorded a $192m loss last financial year.

CCI’s financial position is so volatile – it lost nearly $250m the previous year – that it has limited its public reporting on future developments in the operations of the consolidated entity, with uncertainty about how much the abuse scandal will eventually cost the insurers and whether more capital will need to be raised.

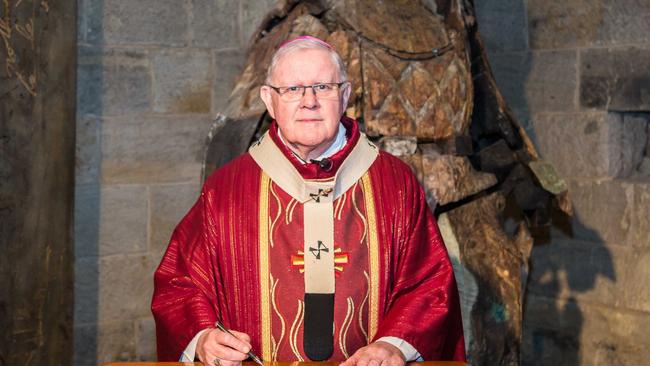

Australian Catholic Bishops Conference president Archbishop Mark Coleridge said 18 CCI shareholders had injected capital into the company to strengthen its ability to compensate victims for abuse carried out by priests, religious and lay people.

“The recent work we have undertaken together means we can assure the Catholic community and wider public that survivors of historical abuse will be treated justly, with no impact on compensation arrangements,” he said.

“The mission of the church can only be carried out if we show, in concrete ways, that we are deeply sorry for the abuse that has occurred and that we want to bring some healing, where that is possible.”

CCI’s latest annual report for 2020-21 will show the abuse issue is bleeding through its accounts, with more than $250m spent last financial year on abuse-related payments and “movements in outstanding claims”.

The decision to seek capital from the 18 church bodies comes as the pandemic has undermined Catholic finances. The church and its many entities in recent years across Australia have been forced into asset sales and parish amalgamations to help chart a sustainable future.

In the CCI annual report, chief executive Robert Scenna described last year as the insurance company’s greatest challenge in its 110 years.

Abuse – described in the report as professional standards claims – is widely known as a financial challenge across most religions in the wake of the child sex abuse royal commission.

“The volume of professional standards claims reveals an increasing trend that requires CCI to conscientiously review its risk exposure … we have taken this step with confidence,” Mr Scenna said. “The heartbreaking history of abuse and harm by members of the church has created deep suffering for victims, families and supporters and the community.”

Hundreds of cases of alleged Catholic abuse were referred to police in the wake of the sex abuse royal commission, with the church dominating total case numbers compared with other religions. However, the $170m capital injection to CCI by the church in Australia is evidence of the bishops’ determination to fund payments and actively deal with the intergenerational fallout of the abuse scandal.

While the church is still considered asset-rich, many of the assets are hard to sell.

Its education, health and social justice entities remain relatively strong, while parish finances are challenged in many traditional areas by falling numbers, exacerbated by pandemic restrictions.

It is possible CCI will require further financial assistance, with its directors deciding against making publicly available projections about expected results of the consolidated entity over future years.

This is because this information, if made public, “is likely to prejudice its interests”, the annual report said.

“That information has therefore not been disclosed in this report,” CCI said.

It argued in its annual report that it retained a strong balance sheet but said the significant increase in reserves for professional standards claims had led to a substantial decrease in its regulatory capital during recent years.

It had taken a series of steps to address concerns about its financial stability and the capital-raising and changes to its investment mix were important parts of the renewal process.

Raising the spectre of potential further church bailouts, it is examining other capital strengthening options to restore levels to within targets.

“In addition to these initiatives, in order to preserve capital in the short term, CCI will not pay a final dividend for the 2021 financial year nor will it pay its annual Catholic entity distribution,” it said.

“Although it is not certain that these efforts will be successful, CCI has determined that the actions it is taking are sufficient and has therefore deemed it appropriate to continue to prepare the financial report on a going concern basis due to its ability to realise its assets and settle its liabilities in the ordinary course of business at the amounts recorded in the financial statements.”

CCI chairwoman Joan Fitzpatrick said the company’s core business as an insurer, asset and risk manager for policyholders would continue for the settlement of abuse claims. “We share the commitment of the bishops and leaders of religious institutes in finding and pursuing just responses to abuse claims that come forward,” she said.