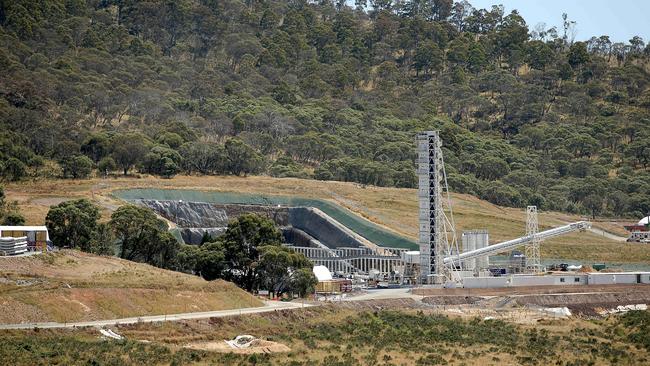

Snowy 2.0’s tunnelling machine Florence is bogged — can the project get back on track?

Malcolm Turnbull’s pet mega-project — fast-tracked and over-hyped in the wake of 2016 power blackouts — is key to our clean-energy future and keeping the lights on. It’s not going well.

Snowy 2.0’s star tunnelling machine Florence is bogged in Kosciuszko’s soft earth and the diva’s delay is turning heads to the troubled mega-project’s future and industry’s capacity to deliver.

About 100,000 workers, including migrants from 30 countries, built the original Snowy Mountains Scheme over 25 years; an engineering wonder powering a nation, changing its face and altering its ecosystem.

Today’s $5.9bn pumped hydro expansion, fast-tracked and over-hyped in the wake of South Australia’s 2016 power blackouts, is plainly more modest.

Yet this infrastructure octopus is a key to our clean-energy future, its tentacles reaching into industry capacity, skills, finance, environmental protection and, not least, keeping the lights on.

Snowy 2.0 is a story that could spill in several ways, or maybe not flow at all. Industry players warn a lack of expertise in tunnelling, as well as cost blow outs and delays, could compromise the National Energy Market as it transitions from fossil fuels to renewables to meet the Albanese government’s emission reduction targets.

They want Snowy 2.0 to be subject to frequent reviews in line with performance guidelines from Infrastructure Australia.

The project’s cost has tripled from initial estimates, a key contractor was put into voluntary administration, payment disputes have flared up, Snowy Hydro was warned of a potential credit downgrade and its chief executive abruptly exited last August.

Drilling of the link between the Tantangara and Talbingo reservoirs, which requires 27-km of tunnels, has been stalled for months; subsidence above the Florence borer, which sits 50m-70m below ground, indicates part of the tunnel has collapsed.

Former IA chief of policy and research Peter Colacino told The Weekend Australian the sector is under immense strain and “every project should be reviewed during delivery to ensure it is efficient.”

“There is no doubt the market conditions over the past few years, from supply chain constraints, to skills shortages, record levels of work and Covid border closures, have all contributed to Snowy 2.0’s position,” Mr Colacino said.

“Snowy is a technically challenging project but it is also being delivered at a time of unprecedented activity in the sector. These external factors heighten the risk for the project and therefore warrant attention.”

Snowy Hydro chief executive Dennis Barnes, who began this month, told a Senate hearing last week delays will push project completion out to the end of 2027.

Mr Barnes said it would take two years, when the first third of a vast underground cavern is excavated, to tell whether the project would face further delay. It was not clear when Florence would jolt out of “pause” mode.

Announced in March 2017 by then prime minister Malcolm Turnbull, Snowy 2.0 was not on IA’s priority list; nor was its business case assessed by the agency.

After buying out the NSW and Victoria’s stakes in Snowy Hydro for $6bn the following year, Canberra provided the green light in early 2019 and a $1.38bn equity injection to the project that will add 2000 megawatts to the grid.

An early review by the Australian National Audit Office last year gave Snowy 2.0 a clean bill of governance health.

The latest IA road map, backed by state and territory treasuries and infrastructure bodies, recommended continuous reviews across a project’s life to improve productivity and innovation.

The surge in demand for skills and materials has been overwhelming, with some firms going to the wall, including Clough, the former partner of Webuild in the Future Generation joint venture that is building Snowy 2.0.

An IA market capacity report in December said labour demand would reach a peak of 442,000 this year, “more than double the projected available supply”

Australian Constructors Association chief executive Jon Davies said “the nation cannot afford for the construction industry to continue its current course”.

“It’s a costly game for everyone,” Mr Davies said, adding the federal government should provide leadership for collaboration, rather than being a “passive buyer on infrastructure”.

Critics of Snowy 2.0 have called for the project to be scrapped and an independent review.

According to former energy company executive Ted Woodley, who has opposed it from the start, Snowy 2.0 is “the wrong project in the wrong place,”

Mr Woodley this week laid out a series of concerns, including a spiralling bill which could reach $20bn when all associated costs, such as transmission lines, are included, as well as “the enormous environmental damage to Kosciuszko National Park”.

“Clean, green, renewable, that’s a bit of a sham. It is simply a battery that recycles power very inefficiently,” he said.

“Snowy 2.0 requires electricity to pump the water uphill. Even if the upper dam was full and Snowy 2.0 was able to generate for seven days it would take weeks to recharge.”

The Weekend Australian spoke to officials and senior figures from the previous and current government, with some saying Snowy 2.0 was “too big to fail”.

“That doesn’t mean we succumb to the sunk cost fallacy,” said one former Coalition adviser.

“But it’s a critical part of the energy transition and we should be able to overcome the geological issues. After all, we built the Snowy, and we are a nation that can solve problems.”

Mr Colacino, now a partner at infrastructure consultancy Avista Strategy, described Snowy 2.0 as an “expensive asset”, but unique in that it helps energy reliability and reduces carbon.

“It’s a low-efficiency battery but a big one,” he said.

“The ANAO provided a narrow review of aspects of Snowy 2.0’s governance but projects of this scale need to be examined regularly to make sure that they are being delivered efficiently and effectively for taxpayers.”

On Tuesday, the Australian Energy Market Operator issued an extraordinary update to its outlook for supply and demand in the system, warning of power gaps in NSW from 2025 and all states from 2027.

AEMO called for urgent investment in firming generation, such as pumped hydro, gas and long-duration batteries.

Yet the operator noted Snowy 2.0 delays “do not have a material impact on forecast reliability outcomes due to transmission limitations within NSW”.

Last year Energy Minister Chris Bowen said Snowy Hydro’s performance was below par.

A spokesman for Mr Bowen said there have been no requests for more capital for Snowy 2.0.

“The Government continues to work closely with Snowy Hydro to get its critical projects delivered,” he said.

A Snowy Hydro spokesman said the company “applies an attitude of best practice, including continuous learning, to all our projects”.

“Snowy Hydro also provides ongoing transparency regarding the project’s timeline and budgetary expectations,” she said.

In December, ratings agency S & P Global warned of a potential downgrade to the company’s BBB+ credit rating over potential for further cost blowouts to Snowy 2.0 expansion and its Kurri Kurri gas plant in the Hunter Valley, and “volatile” energy markets.

Its annual underlying profit after tax fell 30 per cent last year to $189m, with Snowy Hydro, the nation’s fourth-largest energy retailer, blaming extreme winter that led to price caps and suspension of the electricity market.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout